1 0

BEARISH 📉 : Bitcoin slides to 2026 lows with market under broader pressure

The recent decline in Bitcoin prices has reached levels not seen this year, briefly trading near the low $75,000 area. This drop is part of a broader pressure on risk assets, not exclusive to cryptocurrency.

Bids Cluster Below $73k

- Order books show buy interest between $71,500 and $64,000.

- Liquidations have intensified the downturn, with forced closures of leveraged positions causing sharp declines.

Market Analysis

- Joe Burnett from Strive notes that the current price action aligns with historical patterns of rapid adoption and price discovery.

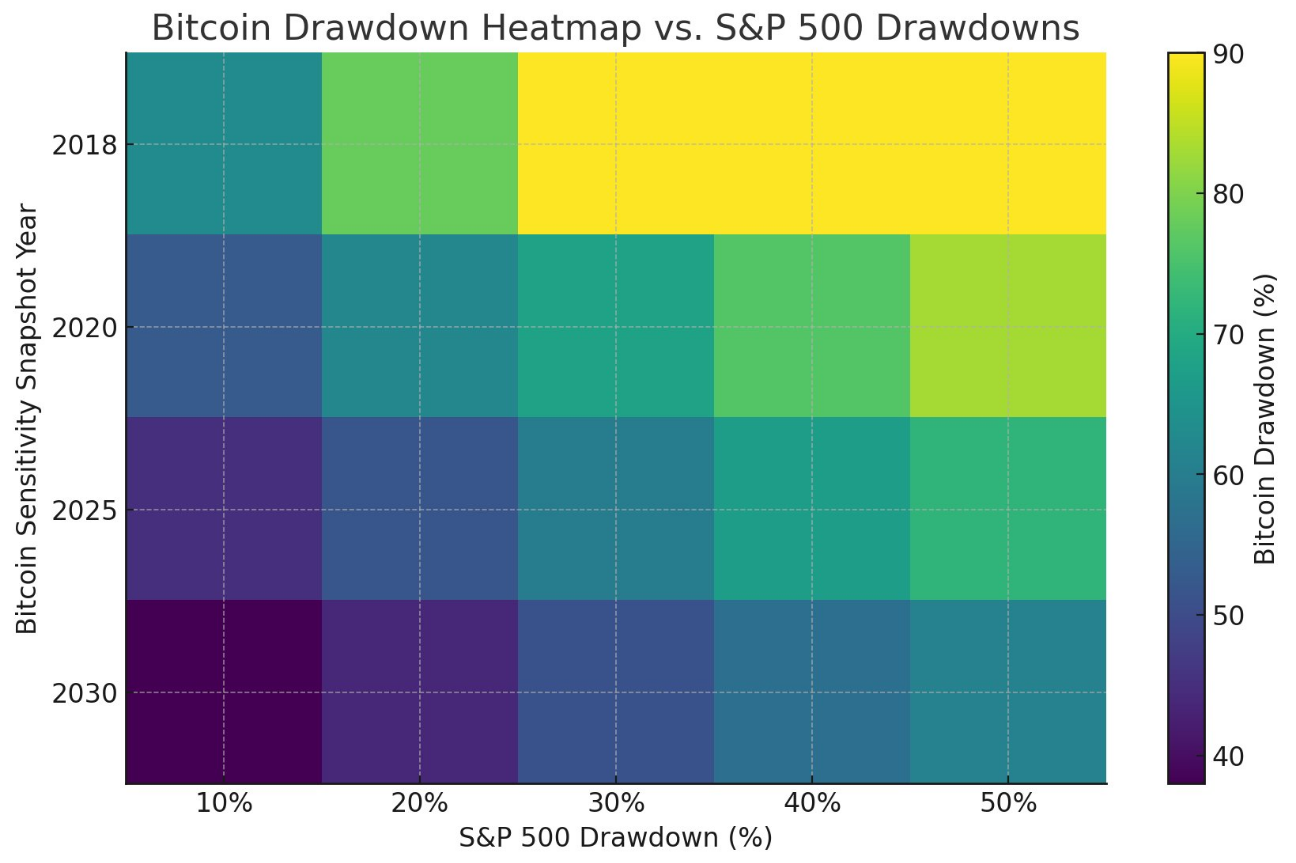

- Volatility like a 45% drawdown is within historical norms for Bitcoin.

Factors Influencing the Drop

- The decline in US tech stocks, especially those connected to AI infrastructure, has impacted risk appetite.

- Major tech companies like NVIDIA and Microsoft have contributed to market caution due to earnings concerns and high-cost AI projects.

- Retail and institutional dip-buying has been observed, indicating some confidence in recovery.

This volatility is part of a broader market pattern rather than an isolated event, suggesting that while challenging, it fits into Bitcoin's historical price movements.