1 0

BEARISH 📉 : Bitcoin sees significant inflows as short-term holders capitulate

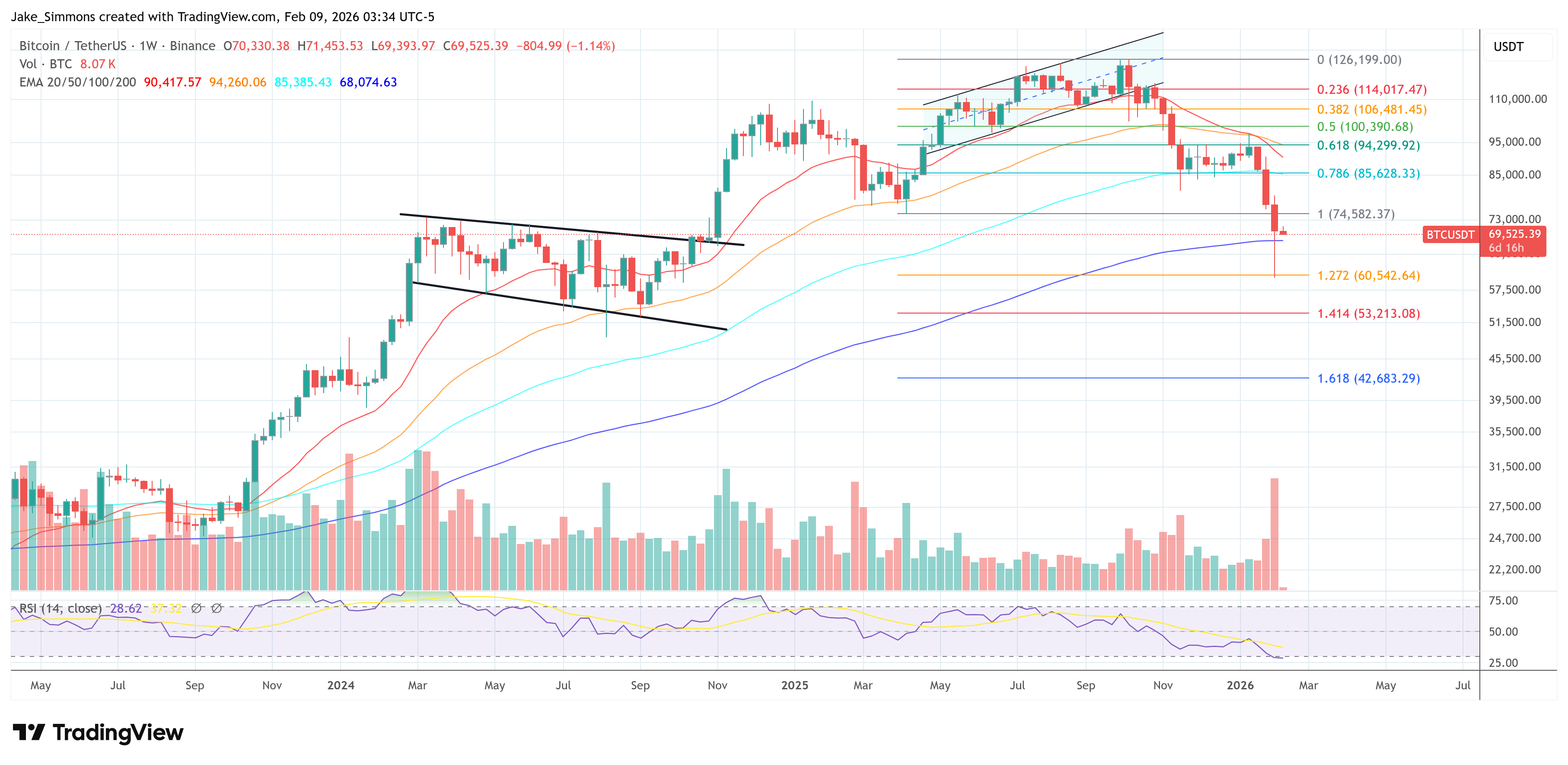

Bitcoin's recent drop to $60,000 on Feb. 6 caused a significant increase in exchange inflows, indicating a capitulation event as short-term holders and small "shrimp" wallets led the selloff.

- The market saw a sharp drawdown exceeding 50% from its last all-time high.

- Binance recorded over 100,000 BTC inflows from short-term holders in one day, surpassing previous corrections.

- From Feb. 4 to Feb. 6, nearly 241,000 BTC were moved to exchanges, adding to selling pressure.

- Coinbase also saw a spike of 27,000 BTC inflows, indicating institutional involvement, not just retail panic.

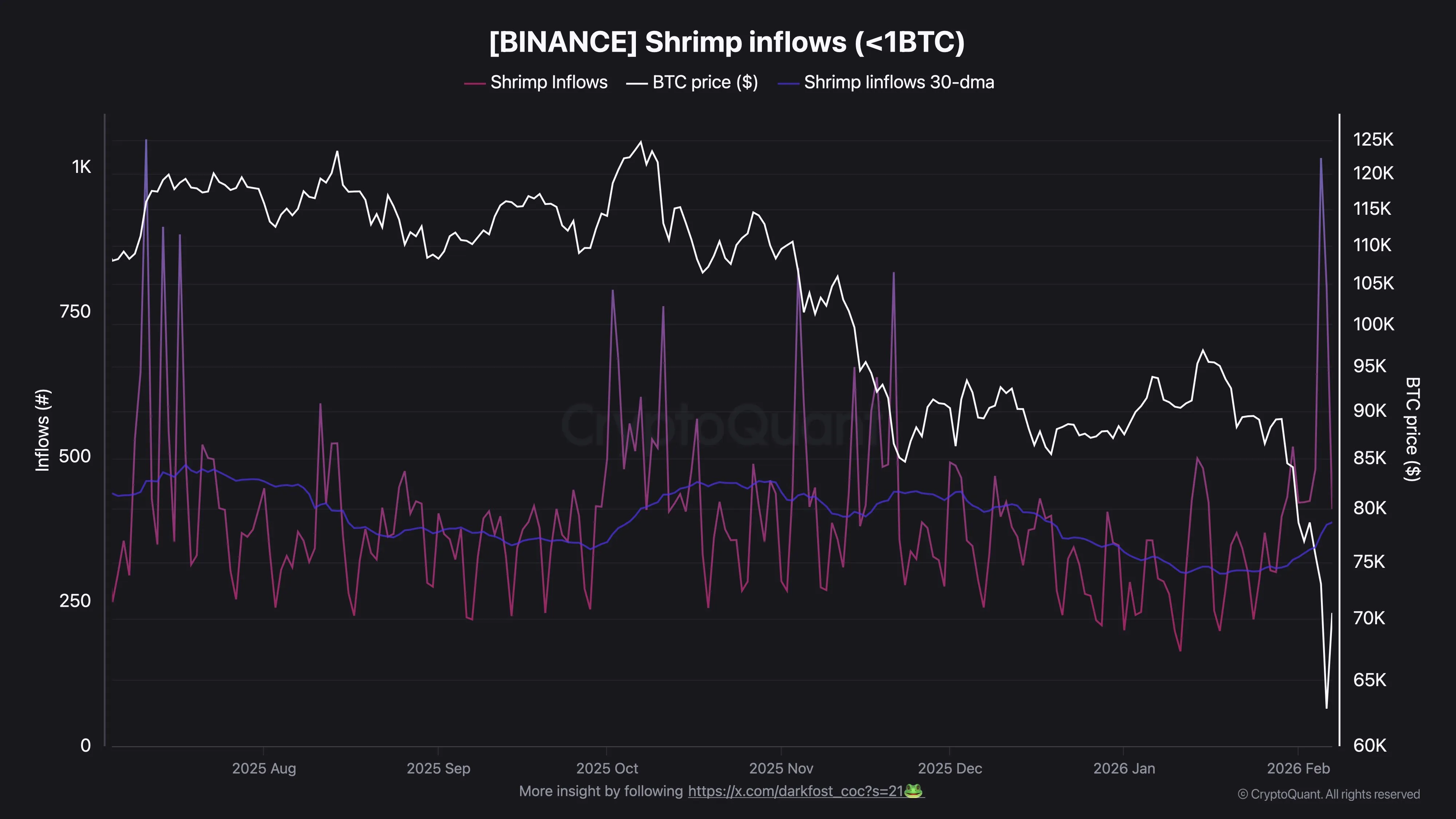

Retail participation, particularly from wallets under 1 BTC, increased significantly during the price drop.

- On Feb. 5, shrimp inflows to Binance exceeded 1,000 BTC in a single day, compared to a monthly average of 365 BTC.

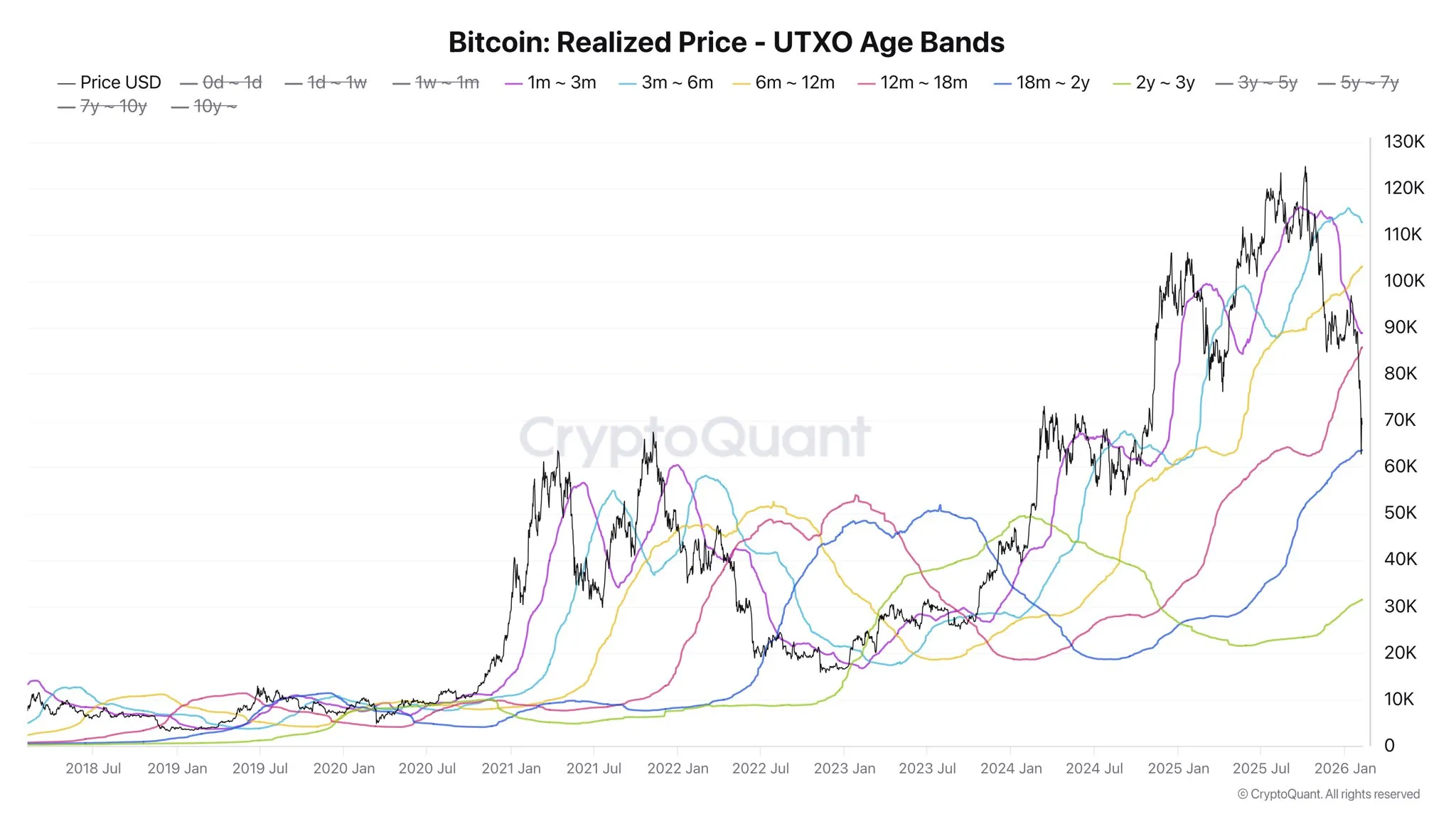

- Long-term holders with cost bases of $103,188 and $85,849 are under pressure as prices test their levels.

Darkfost suggests the market needs time to absorb this oversold condition, despite Bitcoin rebounding to around $71,000 after briefly falling below $60,000.

At press time, Bitcoin was trading at $69,525.

The main concern remains whether this marks a low or is just a pause in ongoing volatility.