0 0

BEARISH 📉 : Bitcoin risks 40% decline as price dips below $80,000

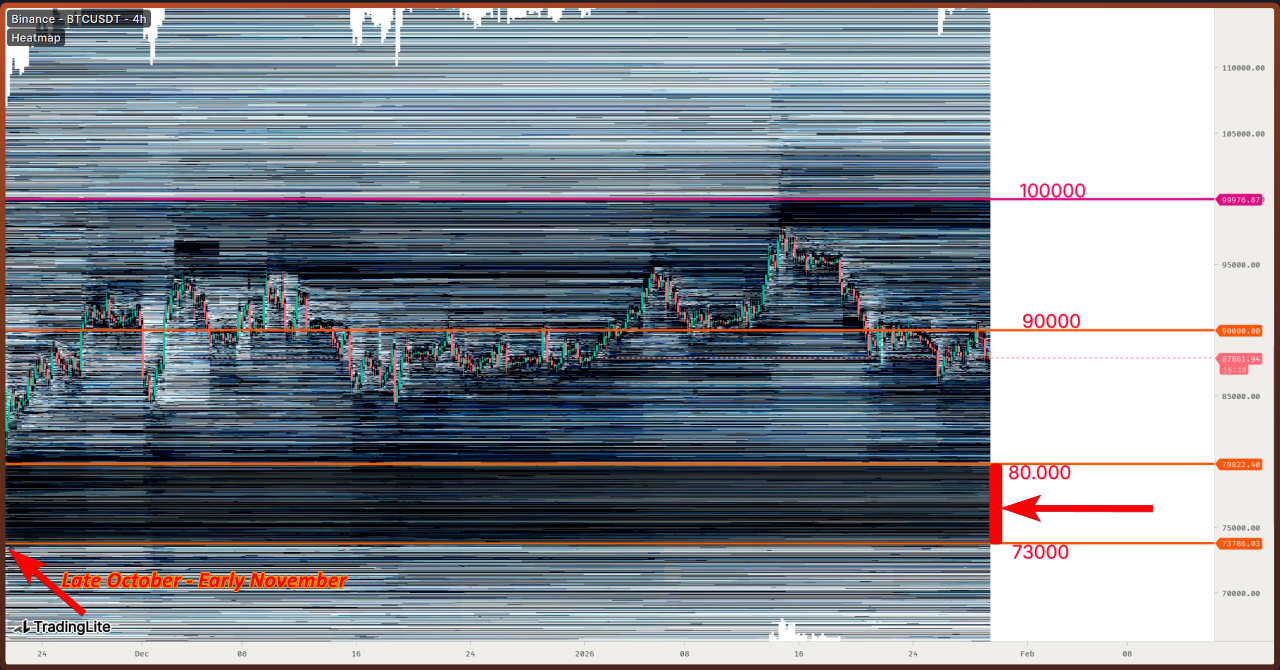

Bitcoin's bearish trend continues as prices fall below the critical $80,000 mark on January 31, leading to a wave of market liquidations.

Key Observations:

- A pseudonymous analyst, CryptoMe, identifies an "air pocket" in the price range of $73,000 - $80,000, suggesting potential downside risk.

- Liquidity levels on Binance show concentrated limit buy orders between $73,000 and $80,000, indicating this zone might act as a price magnet if bearish momentum persists.

- The Unspent Transaction Output (UTXO) price histogram reveals sparse activity in the $73,000 - $80,000 range, signaling a lack of established cost basis which could lead to further declines.

- The Spot ETF Investor Average Cost is at $79,000. Bitcoin's current trajectory suggests a possible decline to $73,000, marking a 40% devaluation from the all-time high.

As of now, Bitcoin trades at $78,558, reflecting a 6.5% increase over the last 24 hours. Total trading volume has risen by 37.15%, reaching $74.67 billion.