0 0

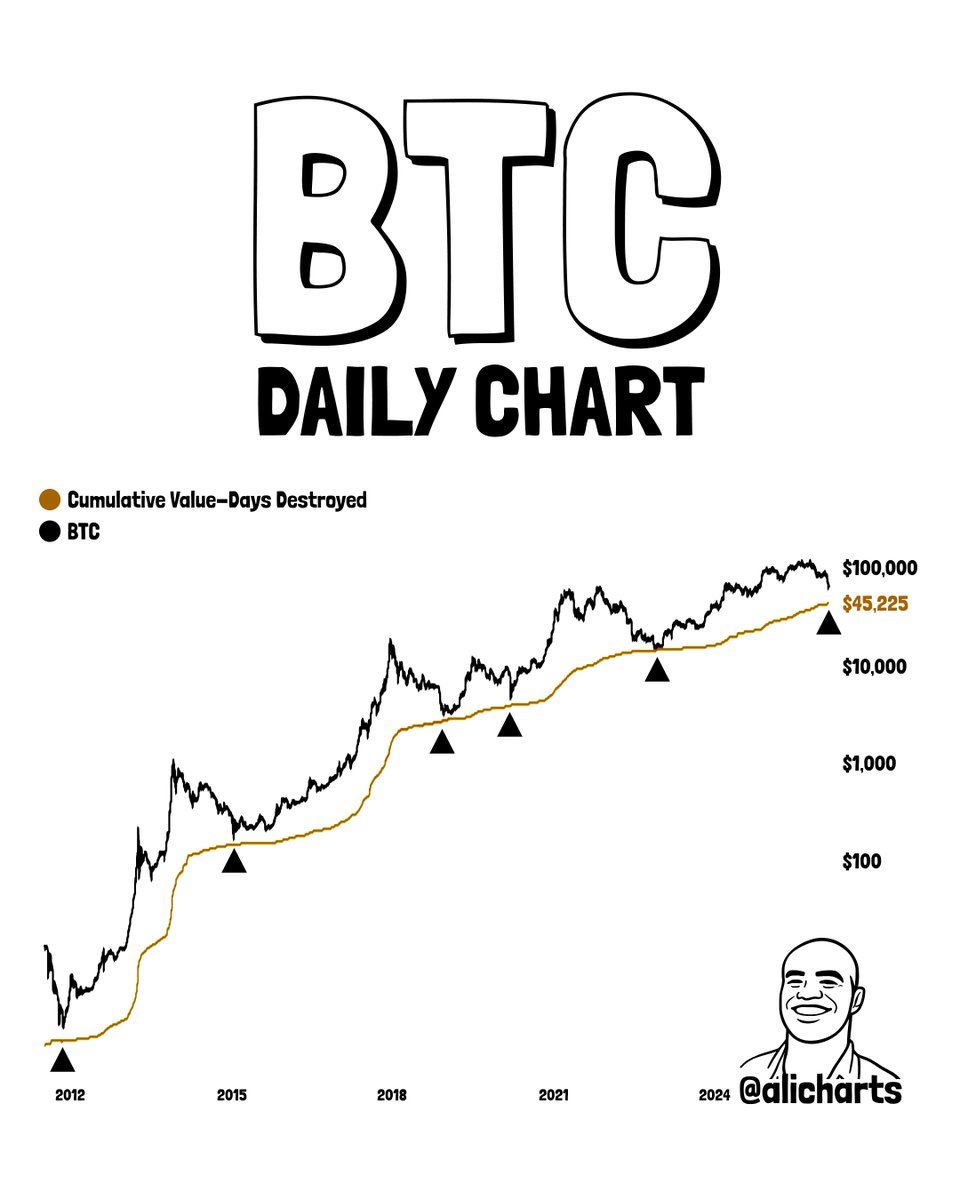

BEARISH 📉 : Bitcoin risks further decline as CVDD highlights $45K support

The Bitcoin price is navigating a fragile phase, alternating between recovery attempts and macroeconomic uncertainties. The market is transitioning from euphoric expansion but has not yet reached full capitulation.

- Price movements reflect a struggle between long-term holders and short-term speculators.

- On-chain data suggests potential further declines for Bitcoin.

CVDD: A Key Indicator for Cycle Lows

- Ali Martinez highlighted that the Cumulative Value – Days Destroyed (CVDD) is a respected indicator for detecting Bitcoin's structural lows since 2012.

- CVDD currently stands at $45,225, serving as a potential support level.

- The metric combines Coin Days Destroyed to predict market bottoms based on long-term holder behavior.

Bitcoin's Potential Safety Net

- Historically, CVDD has acted as a price floor during significant downturns, including the 2015, 2018, and 2022 bear markets.

- Trading above CVDD indicates a healthier market position.

- A move towards CVDD may signal deeper corrections, while strength above it suggests structural integrity in the broader cycle.

Currently, Bitcoin is valued around $70,000, marking a nearly 2% increase recently.