2 0

BEARISH 📉 : Bitcoin Hits Second-Largest One-Day Loss at $67,000

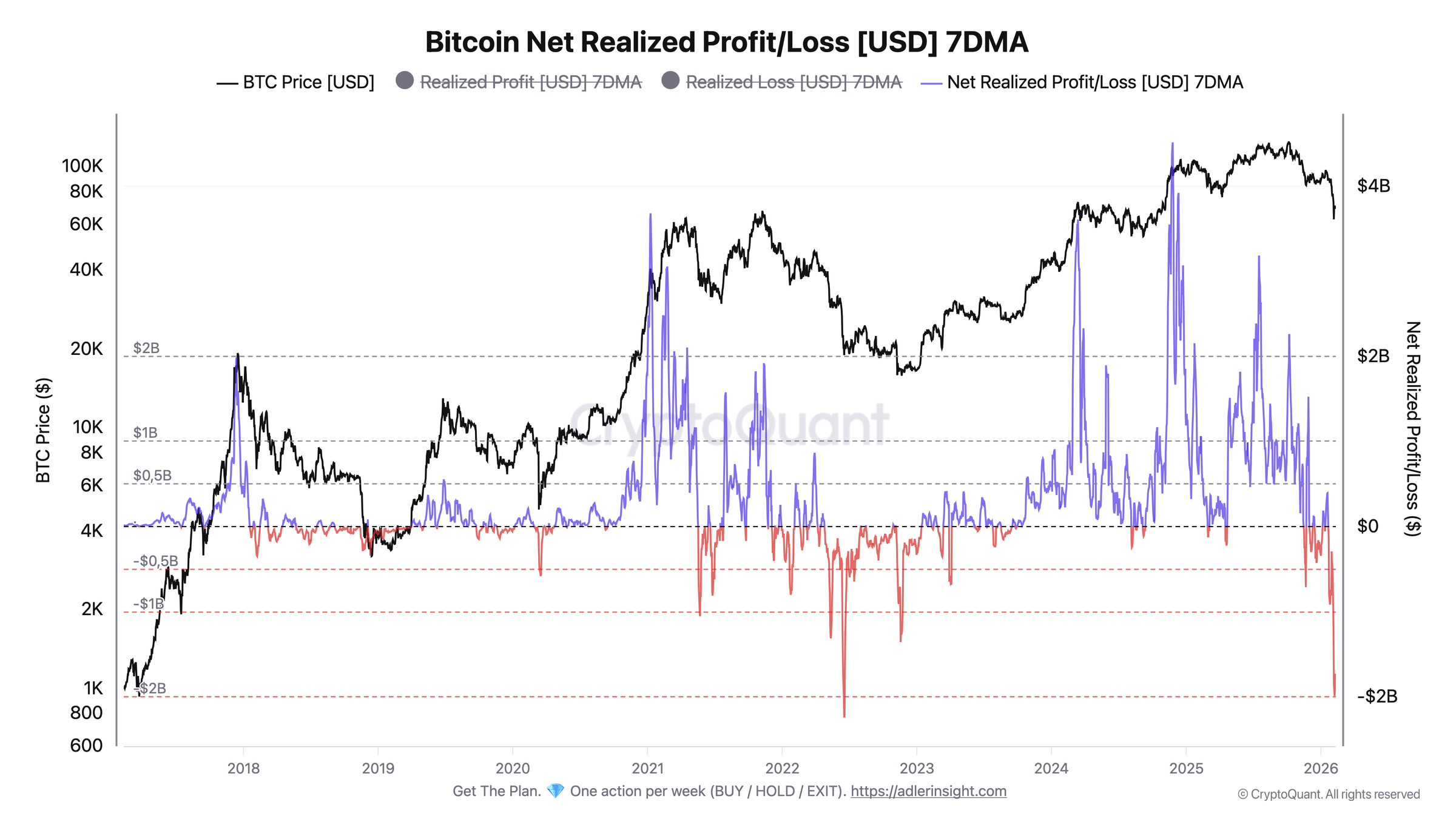

Bitcoin is experiencing significant on-chain losses, similar to those observed during the Luna/UST meltdown. However, the current losses occur at higher price levels.

- The Net Realized Profit/Loss has dropped significantly, reaching -$1.99 billion on Feb. 7 and slightly improving to -$1.73 billion by Feb. 10. This is one of the largest loss-dominant periods recorded.

- The persistence of these losses over five days indicates sustained seller pressure, resembling capitulation behavior rather than a one-time event.

- Realized losses peaked at $2.3 billion on Feb. 7 and remained high. A single-day loss of $6.05 billion was reported on Feb. 5, marking the second-largest one-day loss in Bitcoin's history.

Despite the scale of these losses, they differ from past systemic crashes. Previously, similar loss regimes occurred with Bitcoin around $19,000, while current losses are being realized around $67,000 after a pullback from $125,000.

- A key reversal would be indicated by Net Realized Profit/Loss moving above zero for several weeks, signaling a shift to profit dominance.

- A decline in Realized Loss below $1 billion would suggest a reduction in forced selling pressure.

Adler warns that if price weakness continues and loss volumes increase, it could lead to deeper market capitulation. Currently, Bitcoin's losses are substantial but do not signify structural damage akin to the Luna crash.

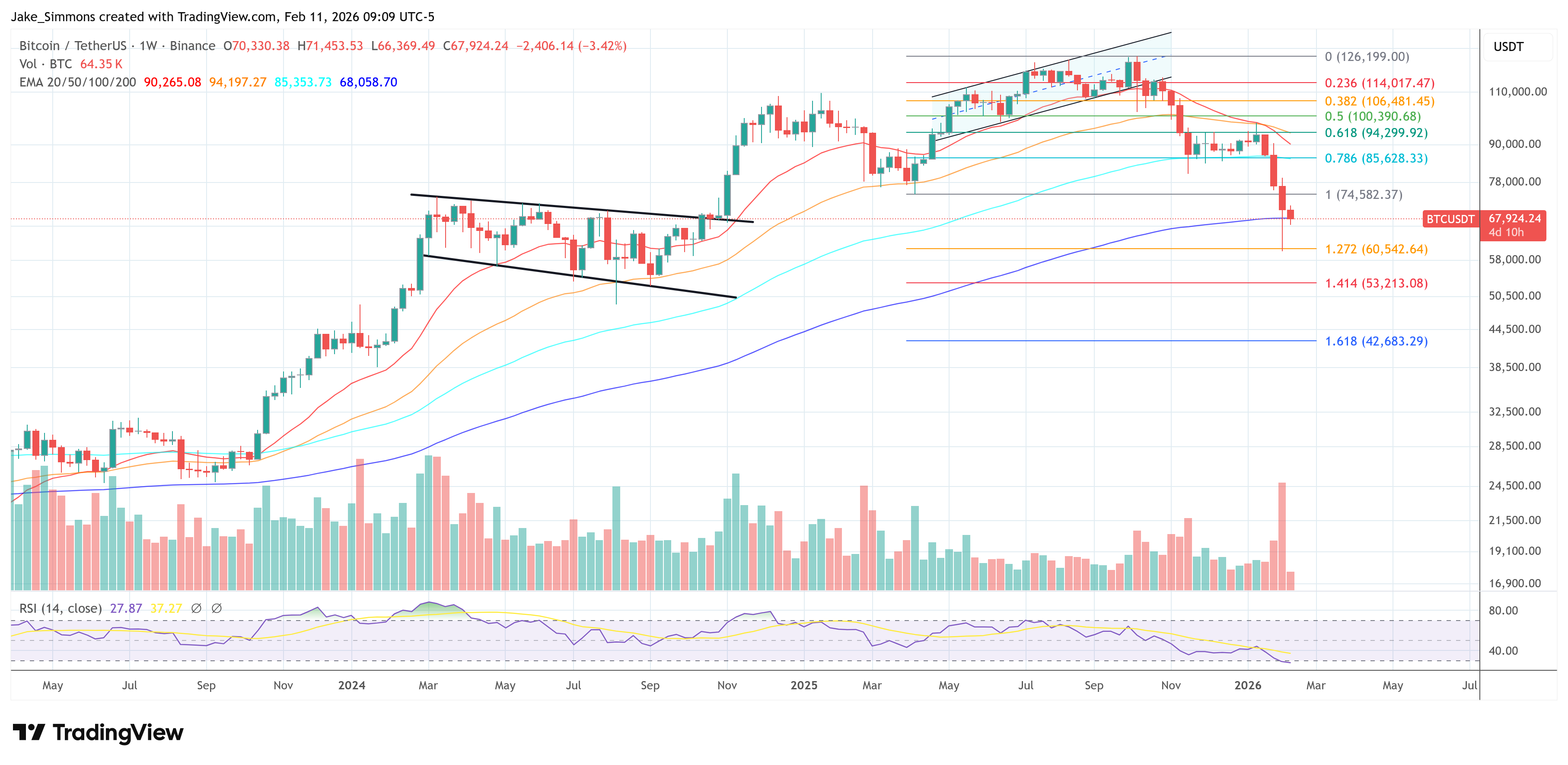

At press time, BTC traded at $67,924.