3 0

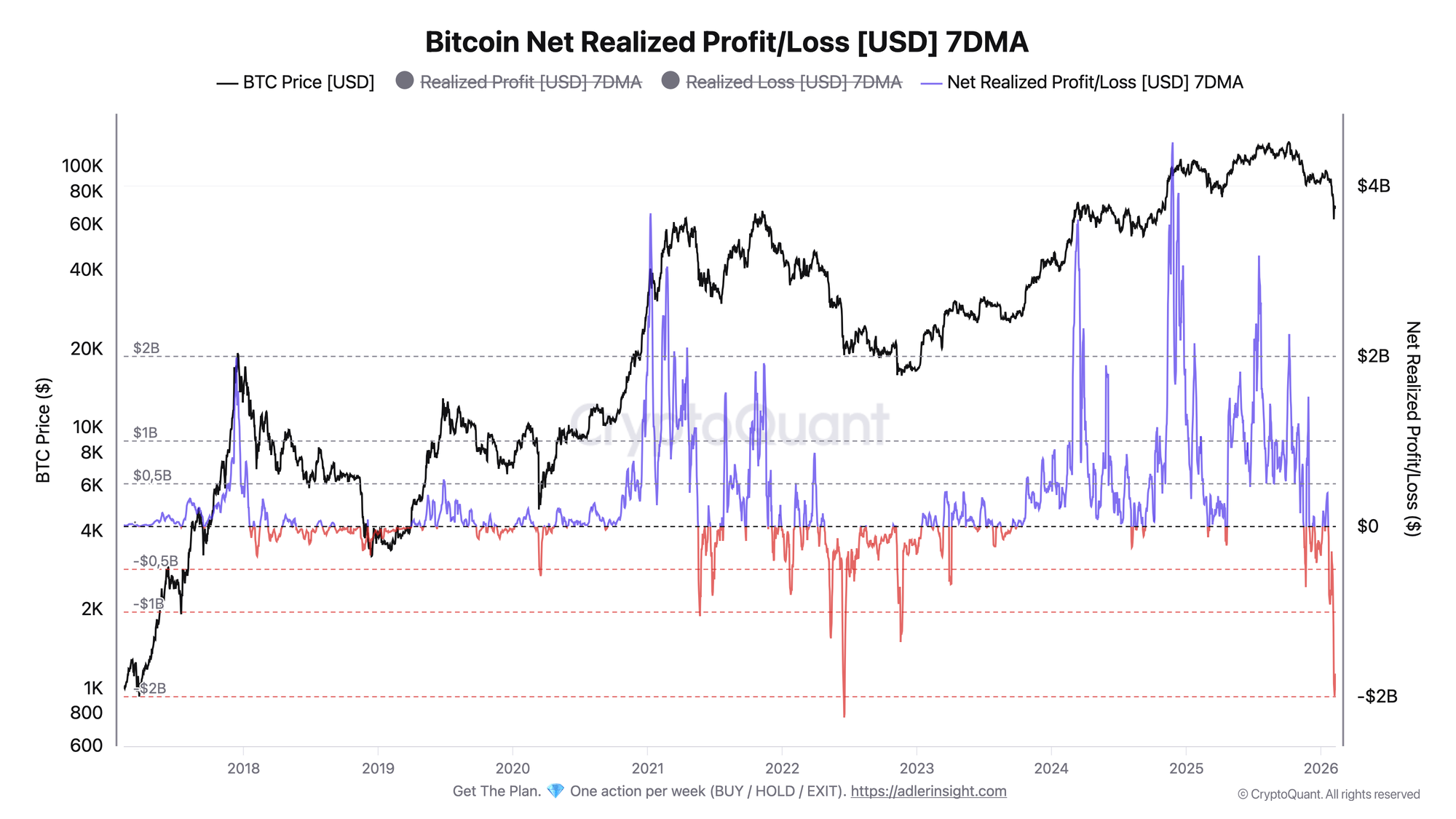

BEARISH 📉 : Bitcoin faces selling pressure, realized losses near Luna crash levels

Bitcoin has experienced renewed selling pressure after it failed to maintain the crucial $70,000 level. This shift has moved the market into a defensive phase with increased volatility and uncertain liquidity conditions.

- The price action is now focused on the mid-$60,000 range, which is critical for determining whether this is a deeper correction or just another consolidation phase.

- On-chain data indicates realized losses have surged to levels similar to the June 2022 Luna and UST crash, suggesting stress and capitulation among investors.

- Despite the losses, Bitcoin's current trading around $67,000 changes the interpretation of these signals from systemic collapse to a potential flush-out of late-cycle buyers.

Realized Losses Signal Capitulation

- Analyst Axel Adler reports a sharp drop in Bitcoin’s Net Realized Profit/Loss 7-day moving average to -$1.99 billion, indicating large-scale loss-taking.

- This metric remains one of the deepest negative readings, showing persistent seller pressure and investor capitulation.

- Realized losses reached approximately $2.3 billion on a 7-day basis, suggesting a cyclical purge rather than market failure.

Bearish Momentum Continues

- Bitcoin's daily chart shows sustained downside pressure as it trades in the mid-$60,000 range following a significant decline.

- The pattern of lower highs and sell-offs indicates weakening bullish momentum.

- Bitcoin is below key moving averages, now acting as resistance, reinforcing the dominance of sellers in the short term.

- The $60,000–$62,000 range is a critical support area; holding it could stabilize sentiment, while a break might lead to deeper retracements.