1 0

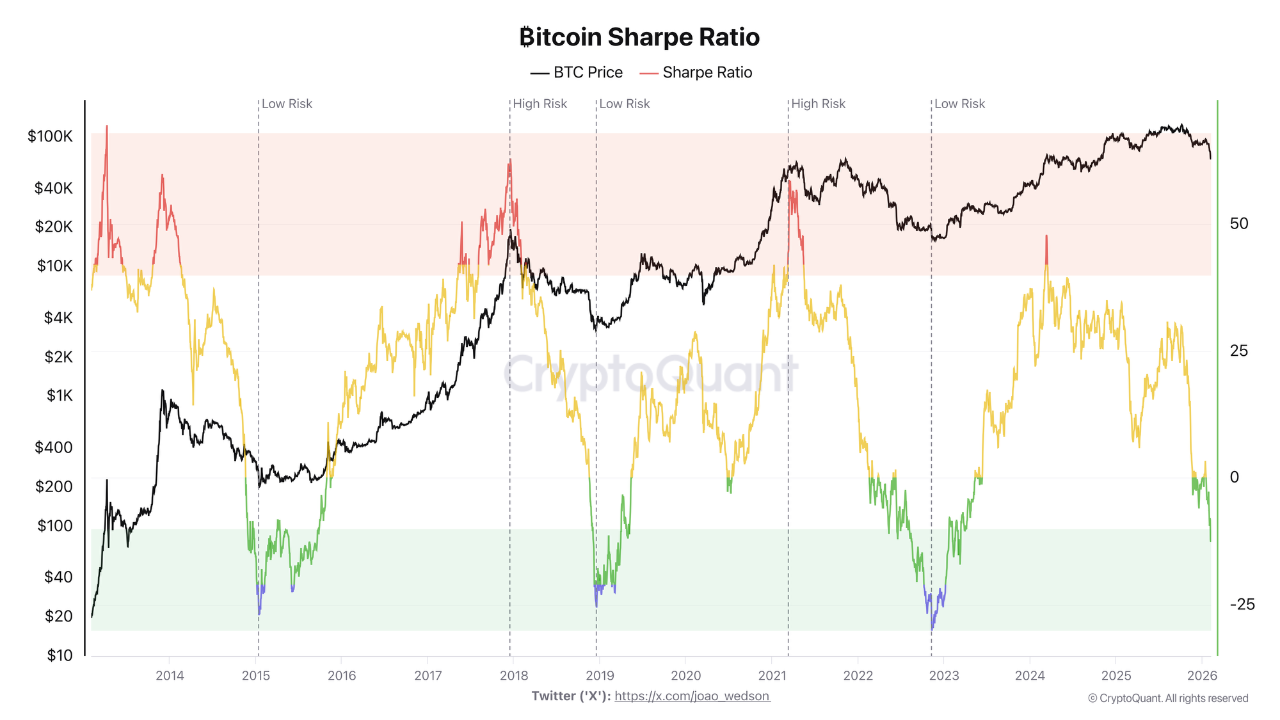

BEARISH 📉 : Bitcoin Sharpe Ratio signals ongoing high-risk bear market phase

Bitcoin has seen a decline from its all-time-high of $126,000 in October last year to $60,000, marking a 52% drop. A potential rebound is being observed, but it may be a short-term recovery. Recent analysis indicates that this movement might be driven by significant metrics.

Insights from the Bitcoin Sharpe Ratio

- The Bitcoin Sharpe Ratio, a risk-adjusted performance metric, is now in a zone associated with the ends of bear markets.

- A low Sharpe Ratio suggests high risk for poor returns, often seen during deep bear markets or capitulation phases.

- The current low ratio implies Bitcoin's performance remains unattractive for risk-takers, potentially indicating a nearing market turnaround.

Approaches for Investors

- Investors could gradually increase exposure as the Sharpe Ratio moves towards lower risk zones.

- Alternatively, waiting for clear improvements in the Sharpe Ratio can serve as a confirmation strategy.

The bear phase may last several more months despite signals from the Sharpe Ratio, with Bitcoin currently valued at $69,064, reflecting a 1.71% loss over the past day.