1 0

BEARISH 📉 : Bitcoin struggles as short-term holders face deep losses

Bitcoin is encountering challenges in maintaining the $70,000 level due to persistent selling pressure affecting market sentiment. Recent price actions indicate a fragile structure, with buyers unable to reclaim higher resistance zones. Analysts are warning of elevated downside risks as short-term investors face losses.

- The Bitcoin Short-Term Holders SOPR indicator reveals many short-term holders are realizing losses, sitting about 25% below their average acquisition cost.

- SOPR has fallen to 0.949, indicating coins are being sold at a loss, often due to forced liquidations or reactive selling.

- Prolonged SOPR weakness could signal seller exhaustion, but a move above 1.0 is needed to confirm a market regime shift.

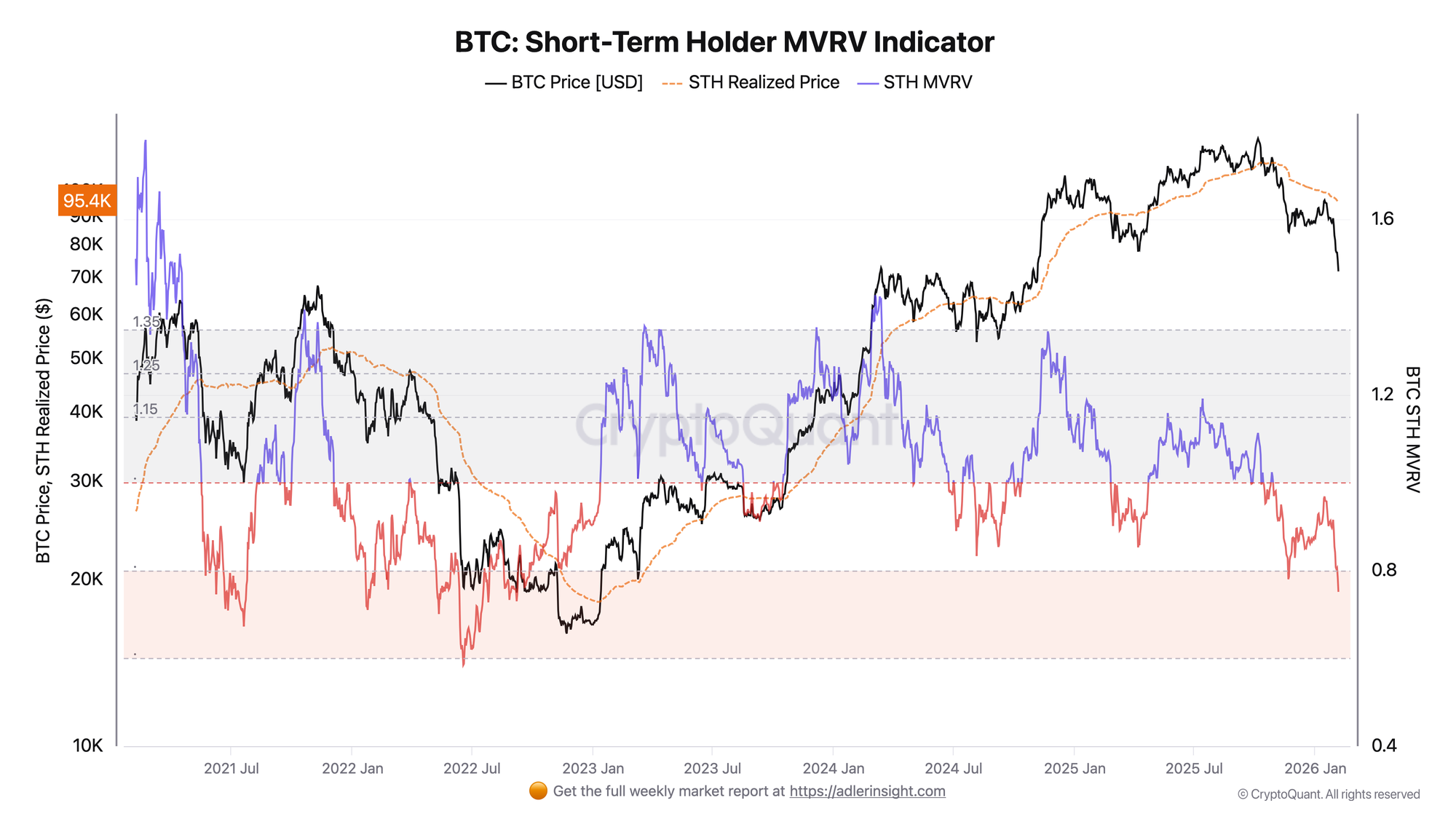

Short-Term Holder MVRV Indicates Deep Unrealized Losses

- The Bitcoin Short-Term Holder MVRV metric shows holders are, on average, at a loss, with the current reading sharply dropping to around 0.752.

- This cohort’s realized price is near $95,400, while Bitcoin trades close to $71,700, leaving them about 25% underwater.

- MVRV readings below 0.8 have historically coincided with accumulation phases or local market bottoms, but require confirmation through price stabilization and SOPR recovery above 1.0.

Bitcoin Breaks Key Weekly Support

- Bitcoin's price broke below the $75K support, reflecting strong downside momentum towards $70K, below the 50-week moving average.

- The 100-week moving average, now resistance, is slightly above $80K; the 200-week average trends upward near $55K–$60K, marking deeper macro support.

- Volume expansion suggests active distribution, with potential for consolidation if Bitcoin holds above the $68K–$70K range, or risk of deeper retracement if not.