4 0

BEARISH 📉 : Bitcoin Supply in Loss Rises, Signaling Potential Bear Market

Recent on-chain data indicates a shift in the Bitcoin Supply in Loss indicator, which historically signals the onset of bearish market phases.

Key Points

- The 365-day SMA of Bitcoin Supply in Loss has started rising again.

- This metric measures the percentage of BTC supply held at a net unrealized loss.

- A rising trend in this indicator historically marks early bear markets, spreading losses from short-term to long-term holders.

- The recent low of this indicator occurred as BTC reached an all-time high of over $126,000.

- While the current increase is not yet significant compared to past levels, it shows a solidifying change in direction.

- Past cycles show a high value in this indicator often aligns with cycle bottoms.

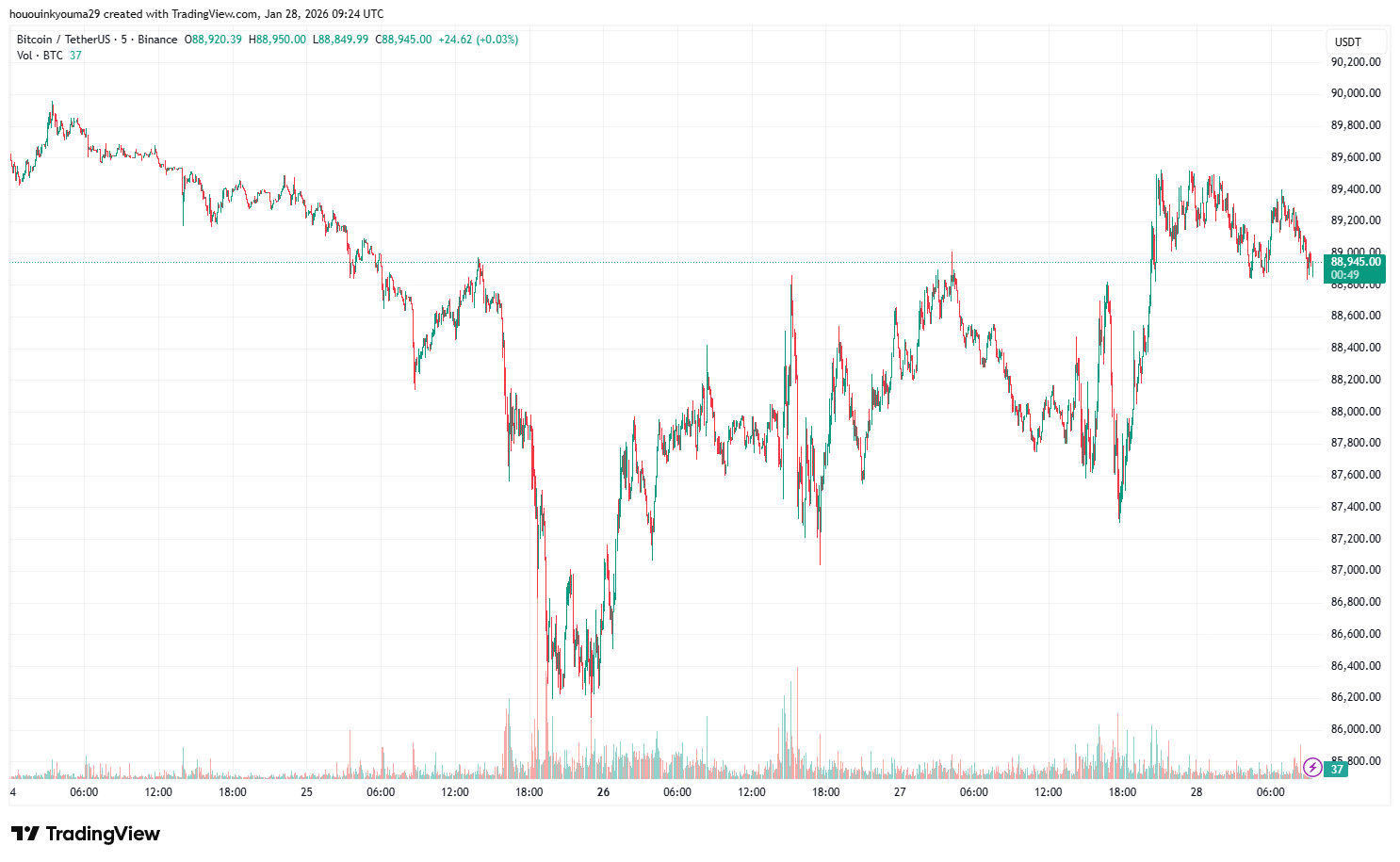

At present, Bitcoin trades around $89,000, reflecting a 1% increase over the last 24 hours.