0 0

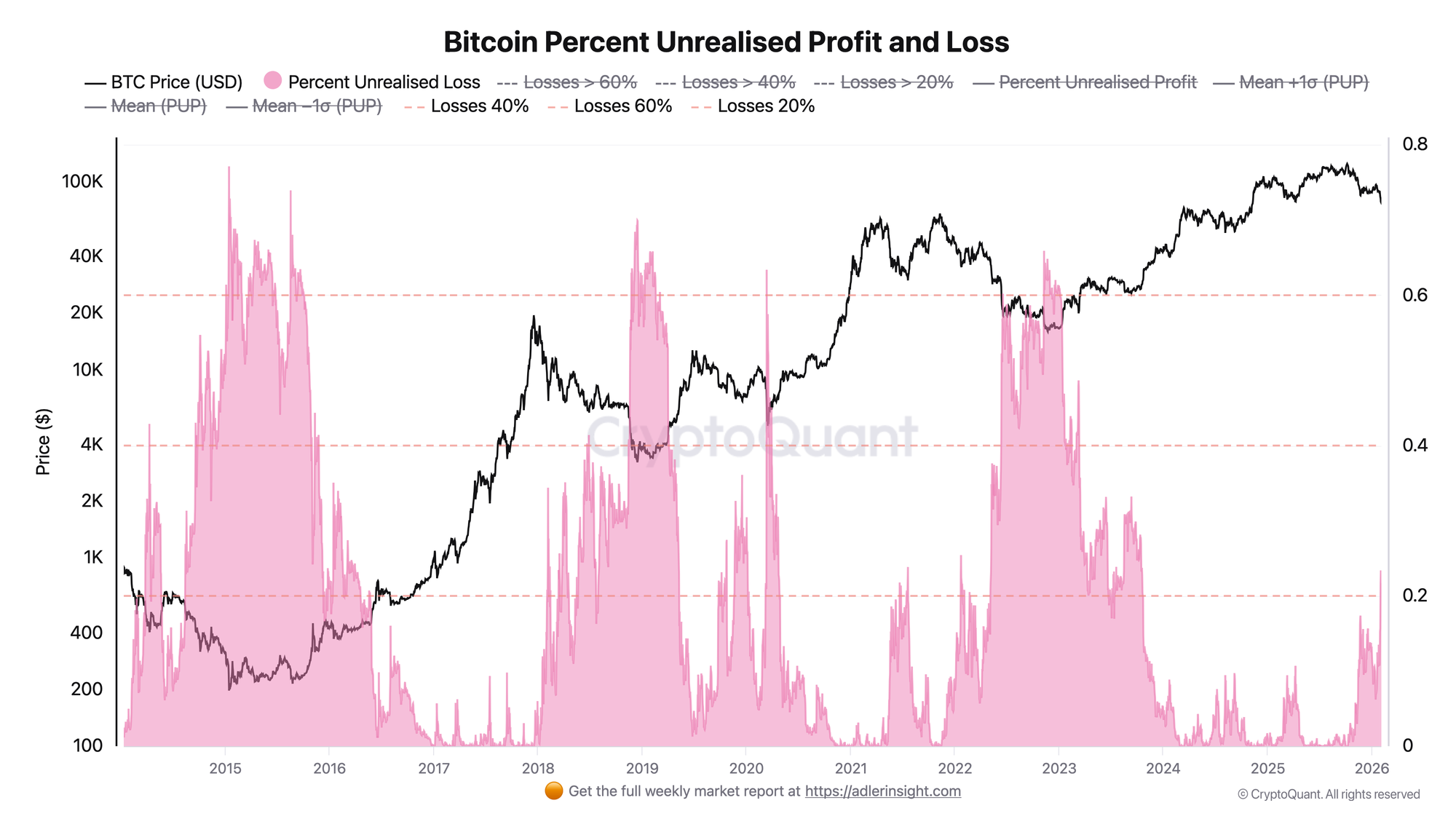

BEARISH 📉 : Bitcoin Faces Growing Unrealized Losses, No Capitulation Yet

Bitcoin struggles to regain the $80,000 level amid ongoing selling pressure and market uncertainty. Attempts to rebound lack strong follow-through, indicating a potential structural shift rather than a short-term correction.

- Bitcoin entered a bear cycle in October 2025 after peaking at $125,000.

- Unrealised losses have increased from 7% to 22% as prices fell from $95,000 to near $78,000.

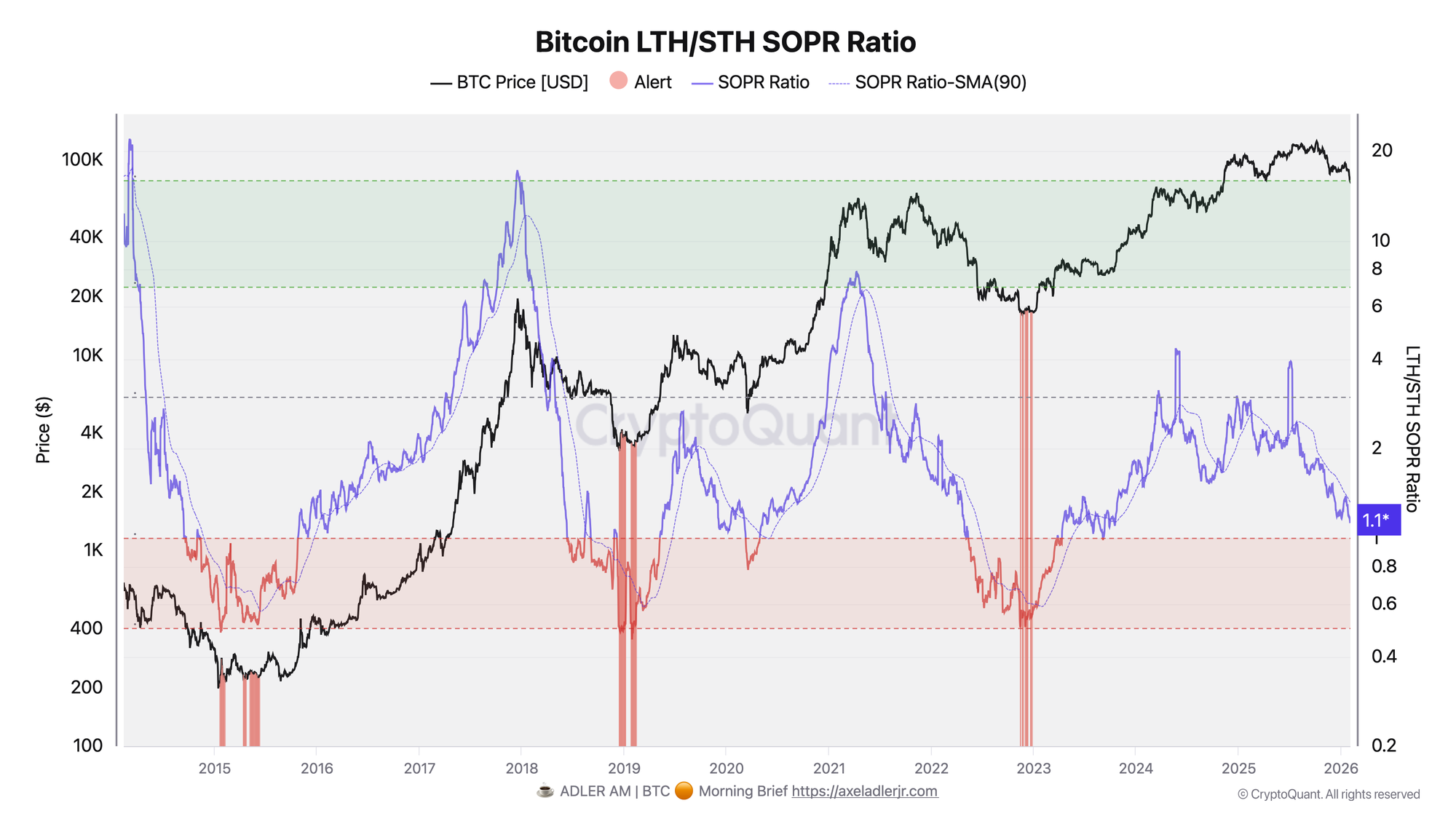

- The LTH/STH SOPR Ratio has dropped around 40% from its peak, reflecting compressed profitability among long-term holders.

This suggests Bitcoin is experiencing mid-cycle stress without full capitulation, as seen in past bear markets.

Profit Compression Without Capitulation Signals

- The LTH/STH SOPR Ratio provides insights into loss absorption between long-term and short-term holders.

- The ratio has fallen to around 1.13 from a peak of 1.85, indicating reduced profitability but still above the critical 1.0 threshold.

- A drop below 1.0 would signal capitulation, while recovery toward 1.3–1.4 would show renewed confidence.

Bitcoin Stabilizes After Sharp Sell-Off

- 12-hour chart shows Bitcoin under structural pressure despite stabilization attempts around $78,000.

- BTC remains below key moving averages, confirming a broader bearish trend.

- Resistance is now evident in the $88,000–$90,000 region, capping upside efforts.

- Sustained bid absorption or higher-timeframe demand is not yet apparent.

Downside risks persist unless BTC reclaims and holds above the $82,000–$85,000 area.