0 0

BEARISH 📉 : Crypto funds face unprecedented three-month outflow streak

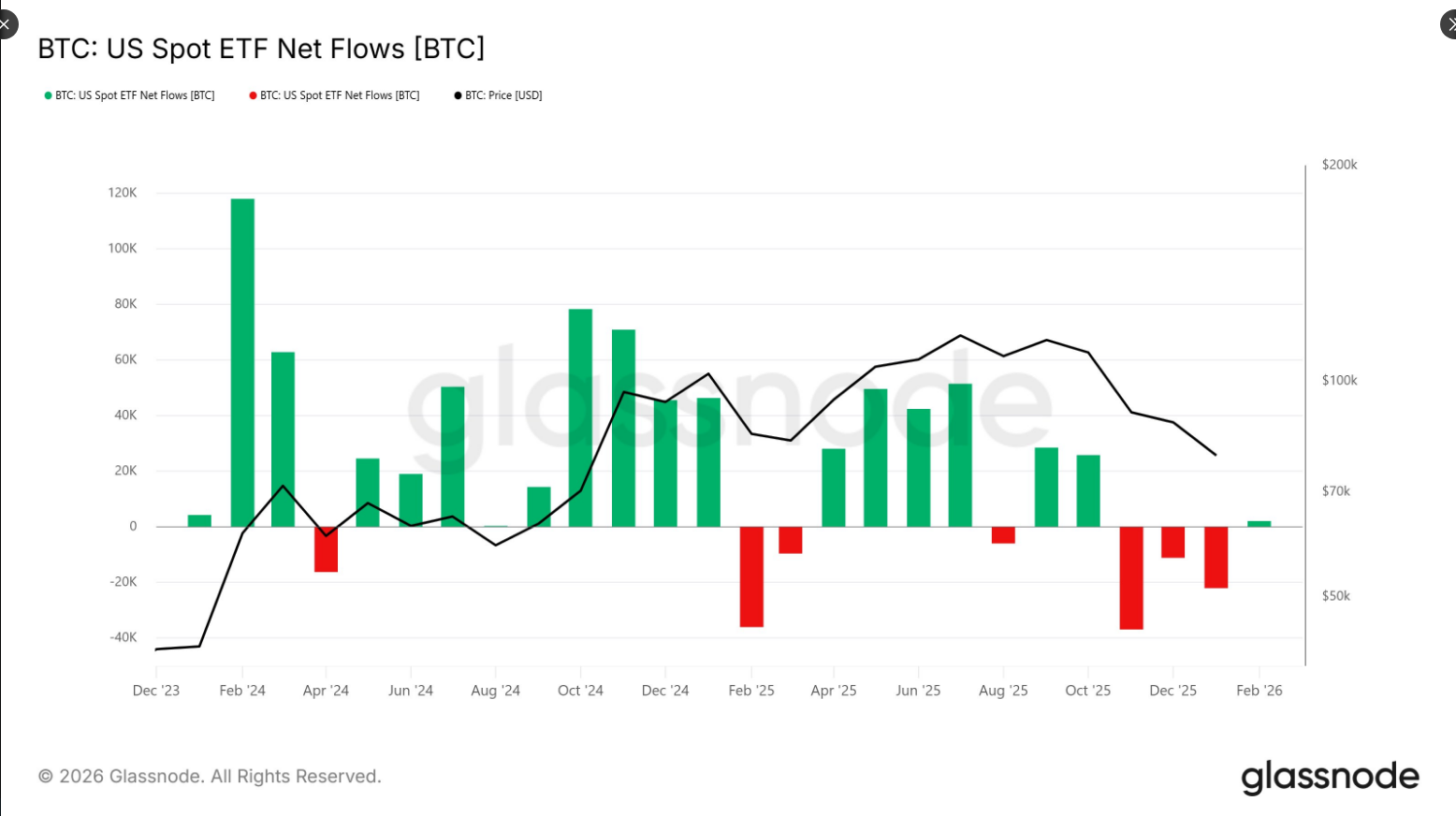

An on-chain analytics account, Rand, has reported that crypto funds have experienced three consecutive months of outflows for the first time.

Historic Outflows

- The current streak marks a departure from previous patterns of sporadic withdrawals and inflows.

- Both retail and institutional flows are affected.

- US spot Bitcoin ETFs have seen significant reductions in inflows, reversing some earlier gains.

ETF Investors' Stance

- Despite paper losses, many ETF holders remain invested.

- Analysts like James Seyffart and Jim Bianco highlight that while positions are underwater, holders are not selling en masse.

- The market is experiencing a slow retreat rather than a full-scale selloff.

Price Movement Impact

- Bitcoin’s price drop over 30 days has pushed ETF positions into losses.

- Some investors face losses around 40%, with steeper short-term swings.

- Despite recent outflows, net positions in ETFs remain substantial.

Long-Term Perspective

- Since 2022, Bitcoin's growth has outpaced several traditional assets.

- Current outflows are viewed differently: as either a temporary pause or a warning sign.

Future Outlook

- The three-month outflow signals widespread caution, affecting products once considered stable.

- Market conditions remain uncertain, with potential for either recovery or continued outflows.

Featured image from Unsplash, chart from TradingView