5 0

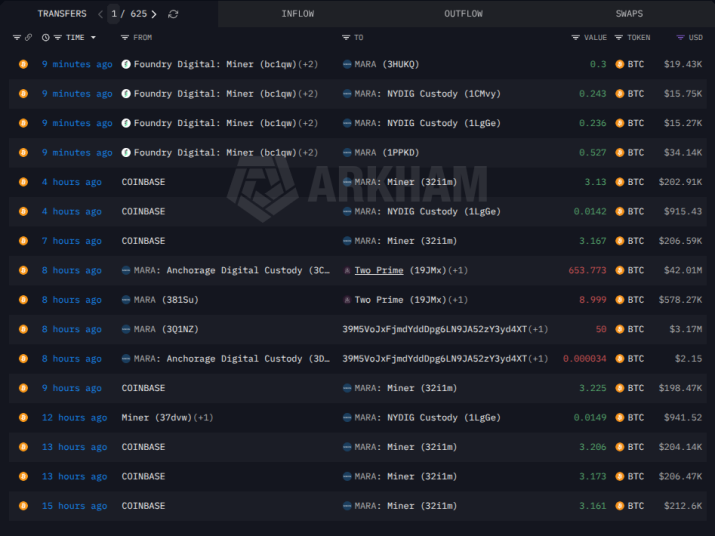

BEARISH 📉 : Bitcoin Miner MARA Moves $87M to Exchanges, Signaling Sell Pressure

- Marathon Digital Holdings transferred $87M in Bitcoin to exchanges, possibly indicating sell pressure or treasury rebalancing.

- This move has raised debates on whether it signifies miner capitulation or standard financial management. Such actions often suggest potential supply-side pressure on Bitcoin's price.

- Market liquidity is shifting from large-cap assets to high-volatility tokens.

- Maxi Doge ($MAXI) aims to attract traders interested in high-risk, high-reward environments.

- The project promotes a 'Leverage King' culture with trading competitions to engage retail traders who prefer volatility over stability.

- Whale accumulation of $MAXI is evident, with significant investments suggesting interest in the project's APY staking model.

- This divergence indicates that while some entities are hedging with Bitcoin, others are pursuing aggressive opportunities in smaller tokens like Maxi Doge.

Note: The content is informational and not financial advice. Cryptocurrency investments involve high risk.