3 0

BEARISH 📉 : Strategy’s Discount to NAV Hurts Bitcoin Buying, Boosts $HYPER

Key Developments in Bitcoin Investment:

- Strategy (MSTR) has historically served as a high-beta proxy for Bitcoin, trading at a significant premium over its Net Asset Value (NAV). This premium, known as the 'Saylor Premium,' is now occasionally flipping into a discount.

- The MSTR premium was crucial for their strategy of issuing equity offerings to acquire Bitcoin. Trading below NAV makes this approach less effective and potentially dilutive.

- This shift affects one of the major buyers of Bitcoin, redirecting investment focus towards protocol-level innovations that provide yield without traditional market friction.

Source: Saylor Tracker

New Opportunities with Bitcoin Hyper ($HYPER)

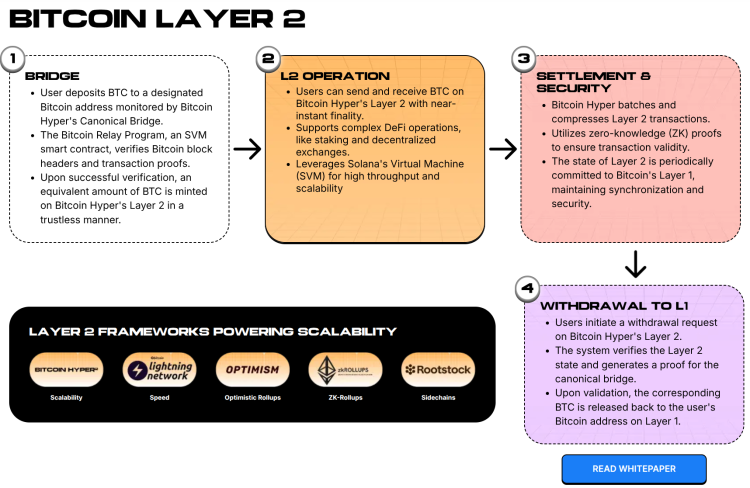

- Bitcoin Hyper introduces Layer 2 infrastructure using the Solana Virtual Machine (SVM) to address Bitcoin's transaction speed and programmability issues.

- This setup aims to expand Bitcoin's utility beyond being a store of value by enabling DeFi applications directly on top of Bitcoin liquidity.

Source: Bitcoin Hyper

Market Trends and Investor Movements

- Whales are increasingly investing in Bitcoin Hyper, with transactions reaching up to $500K, indicating strong confidence before the mainnet launch.

- The presale has already raised over $31M, with tokens priced at $0.013675. The protocol offers a substantial APY of 38% through direct staking models.

- This represents a shift from reliance on stock market dynamics to on-chain staking, aligning more closely with DeFi standards.

Source: X