3 0

BEARISH 📉 : Strategy Faces Stock Decline Amid Rising Short Interest

Michael Saylor, co-founder of Strategy (formerly MicroStrategy), reaffirmed the company's commitment to its Bitcoin strategy despite financial risk concerns.

Key Points

- Strategy plans to continuously purchase Bitcoin every quarter, unaffected by price fluctuations or market skepticism.

- Saylor is confident in managing the company’s debt through refinancing, even if Bitcoin experiences a severe downturn.

- Strategy holds over $8 billion in total debt, primarily from convertible notes used for Bitcoin purchases.

- The company has no intention of selling its Bitcoin holdings to stabilize its finances.

- Short interest in Strategy's stock rose by about 40% since September 2025, with approximately 10% of the public float sold short.

- Strategy's shares have decreased around 70%, trading at $134.

- Despite stock pressures, Strategy remains the largest corporate holder of Bitcoin, with 714,644 BTC valued at about $49 billion.

- The company maintains enough liquidity to cover obligations, with cash reserves for approximately two and a half years of dividend payments.

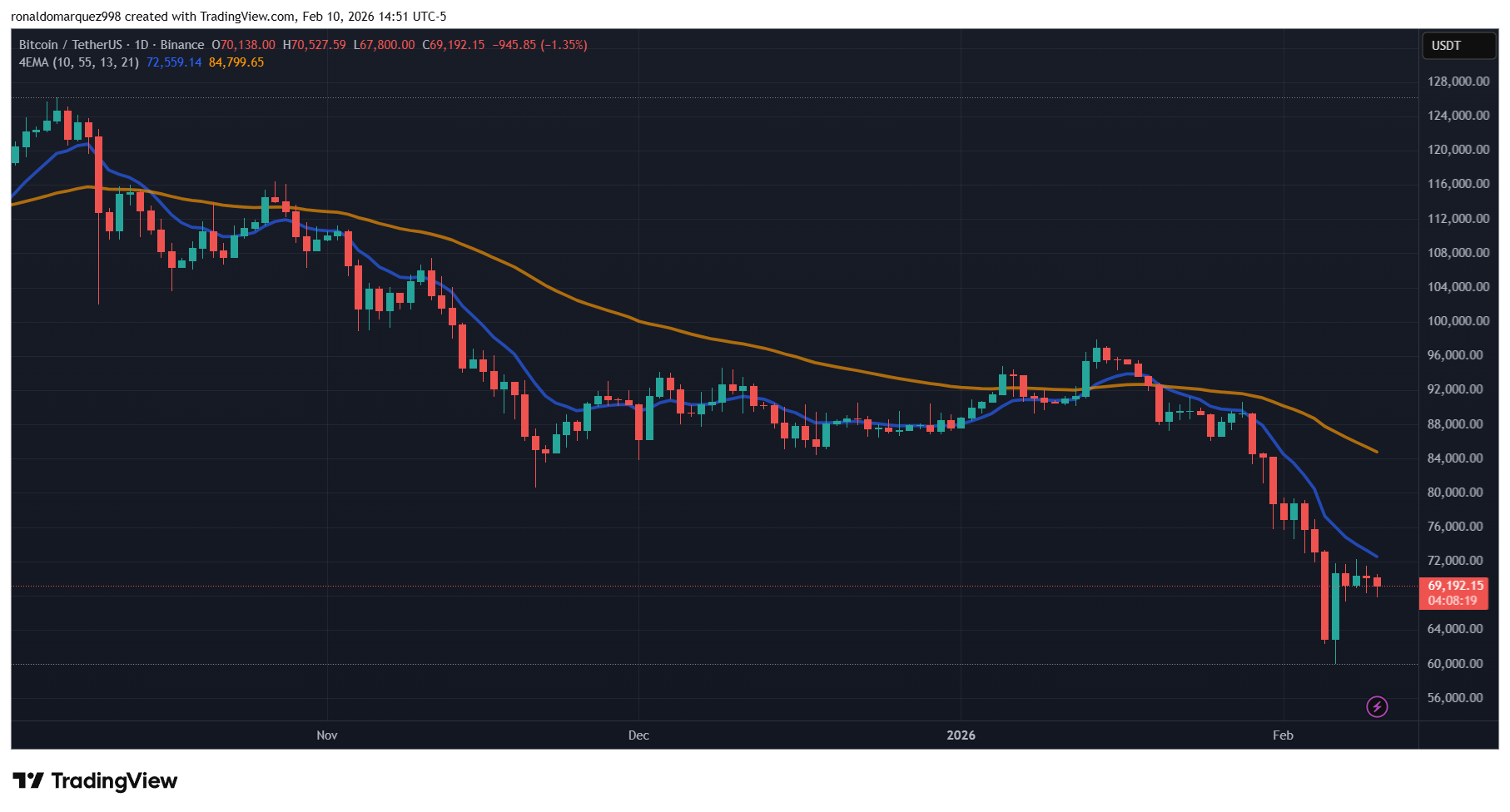

Bitcoin is currently trading at around $69,192, down nearly 8% over the past week and 3% in the last 24 hours.