Bernstein Predicts Bitcoin Price Could Reach $200,000 by 2025

As the U.S. election approached, crypto analysts provided insights into Bitcoin's future. Analysts from Wall Street predict volatile BTC prices post-election, influenced by the outcome.

Price Predictions Based on Election Outcome

Gautam Chhugani of the Bernstein Group forecasts that Bitcoin could rise to $80,000 or $90,000 if Donald Trump wins, while a victory for Kamala Harris may see prices decline to $50,000. Bernstein maintains a bullish short-term outlook, projecting Bitcoin to reach $200,000 by 2025, driven by increasing demand for spot BTC ETFs and rising U.S. debt levels.

Bernstein Adjusts BTC Price Predictions: $50K Under Harris, $80-90K With Trump

Bernstein analysts have adjusted their Bitcoin price estimates based on the potential outcomes of the upcoming U.S. election. If Harris wins, they foresee Bitcoin dropping to around $50,000, while a… pic.twitter.com/Z1zJ21aJ48

— The Wolf Of All Streets (@scottmelker) November 4, 2024

Long-Term Outlook for Bitcoin

Bernstein analysts expect Bitcoin to reach $200,000 by the end of next year, regardless of election results. Chhugani emphasized that the election outcome would not alter the long-term prospects for Bitcoin. Factors contributing to this bullish stance include rising interest in BTC ETFs and increasing national debt.

Chhugani previously targeted a $100,000 price for Bitcoin but revised it following market trends.

Market Volatility Ahead of Elections

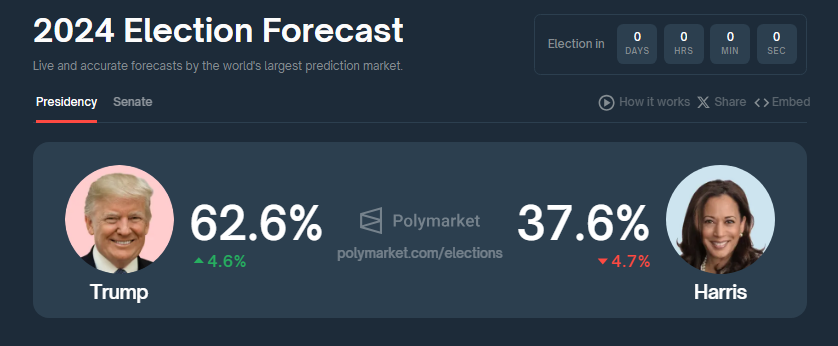

The election battle between Trump and Harris has garnered significant attention, with betting markets like Polymarket showing Trump as the favorite at 63%, compared to Harris at 38%. Bernstein analysts anticipate short-term price fluctuations for Bitcoin regardless of the election outcome, predicting a potential increase to $90,000 with a Trump win.

Currently, Bitcoin trades between $68,000 and $69,000 due to profit-taking and weak ETF inflows, though analysts believe an end-of-year rally is still possible.

Impact on Other Digital Assets

The U.S. elections also affect other digital assets. A Harris presidency may benefit Ether due to increased regulations limiting competition such as Solana. Conversely, Chhugani suggests moderate SEC policies could positively influence Bitcoin and other cryptocurrencies.

This election cycle places cryptocurrency and blockchain issues at the forefront of political discussions, with both candidates expressing their views on crypto, notably Trump advocating more crypto-friendly policies. Harris initially hesitated to propose policies but changed her approach during the campaign.

Featured image from Invezz, chart from TradingView