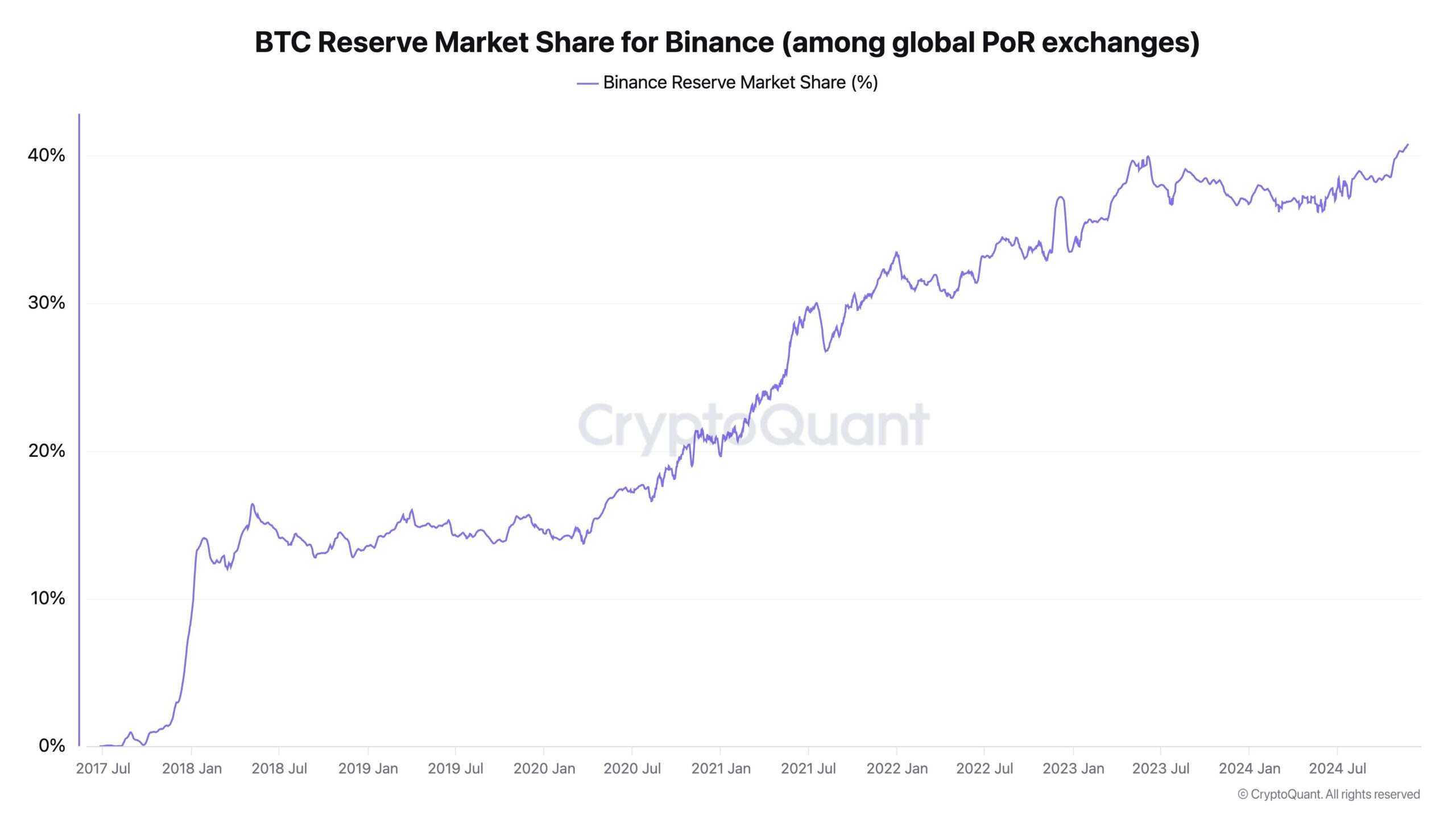

Binance Captures 40% of Bitcoin Reserve Market and Reaches $155 Billion AUM

Crypto exchange Binance has achieved a new all-time high market share in the Bitcoin reserve market, despite facing skepticism and doubt over the past two years. CryptoQuant CEO Ki Young Ju noted that this milestone reinforces Binance's dominance within the expanding crypto ecosystem.

This achievement indicates Binance's consistent growth, with its market share increasing annually. Young Ju emphasized that any disruption to Binance's operations could significantly affect the overall crypto market, potentially leading to prolonged recovery periods.

-

Courtesy: CryptoQuant

This development coincides with Bitcoin's price nearing the $100,000 milestone for the first time.

Binance Hits $155 Billion Milestone in AUM

Binance recorded asset inflows exceeding $8.73 billion in November, contributing to total assets under management reaching $155 billion. This increase follows a significant uptick in the crypto market, influenced by political events earlier this month.

The surge reflects strong demand from both institutional and retail investors seeking returns amid economic uncertainty. Binance's performance results from strategic initiatives that position it as a comprehensive cryptocurrency platform, offering services such as staking solutions and institutional asset management.

Binance founder Changpeng Zhao stated, “We continue to invest in products that meet a growing demand for more flexible and secure crypto solutions.”

Bitcoin Price Action Ahead

After a dip to $97,500, Bitcoin's price has rebounded as it approaches the $100,000 mark. Whale activity has increased, with major players accumulating during dips.

The SuperTrend indicator flipped bullish on the #Bitcoin $BTC hourly chart, as prices break through a resistance trendline as well as the RSI.

Today could be the day! $100,000 pic.twitter.com/TQqrJujFWs

— Ali (@ali_charts) November 25, 2024

Analyst Ali Martinez indicated that Bitcoin (BTC) may soon reach $100,000, citing a bullish SuperTrend indicator on the hourly chart, which shows prices breaking through resistance and a strengthening Relative Strength Index (RSI).