14 9

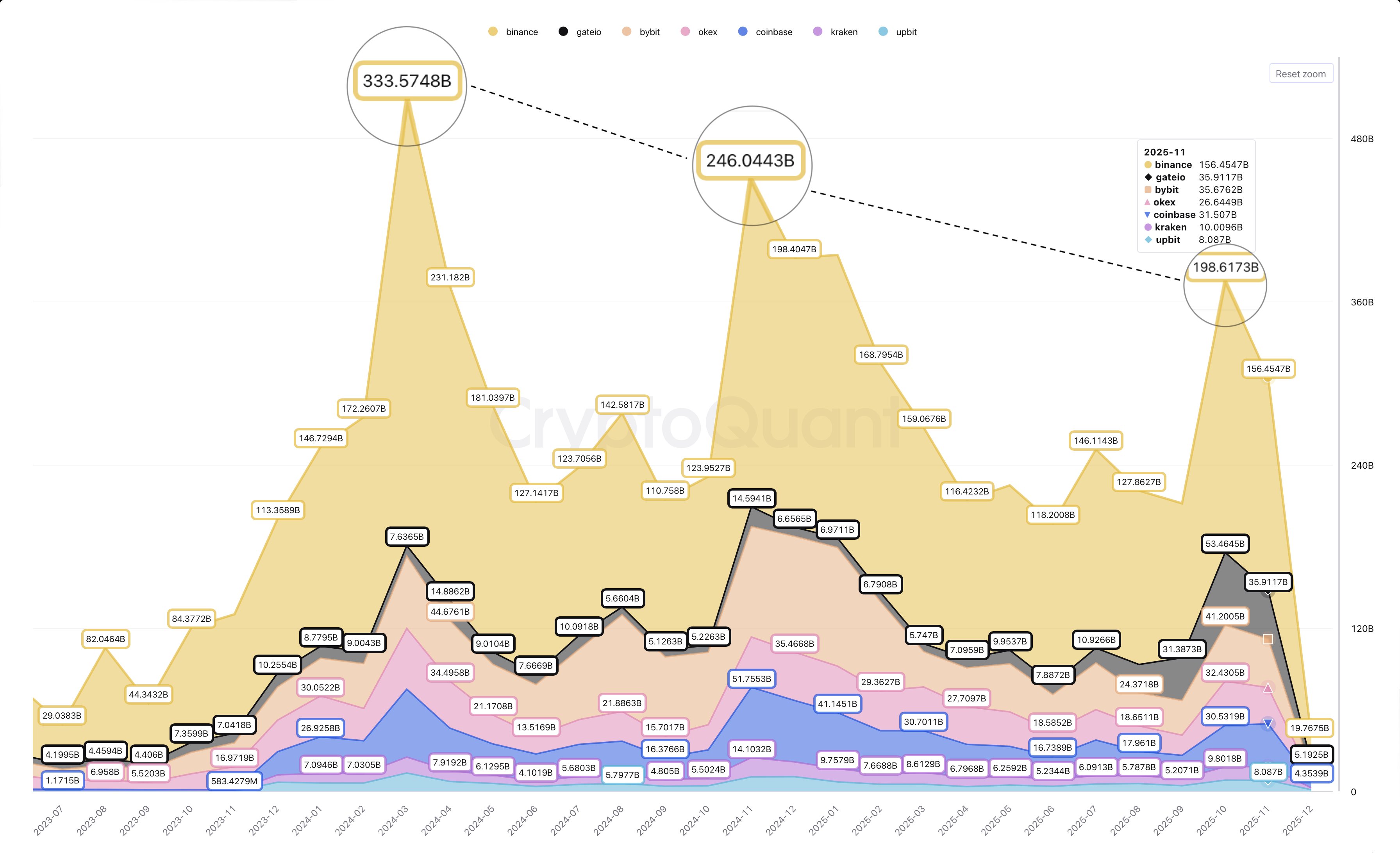

Bitcoin Spot Trading Volume Drops 21% on Binance in November

Bitcoin's (BTC) price correction is accompanied by notable decreases in spot trading volume, raising concerns among investors.

Binance Reports $40B Drop in BTC Spot Trading Volume

- Spot trading volume indicates the total amount of Bitcoin bought and sold for immediate delivery within a time frame.

- In November, Bitcoin's spot trading volume saw a significant decline, partly due to its 17.5% price devaluation.

- Binance experienced a 21% decrease in spot volume from $198 billion in October to $156 billion in November.

- Other exchanges also reported declines: ByBit (-13.5%), Gate.io (-33%), OKX (-18%).

- The ongoing drop in spot trading volume indicates reduced market interest, weaker demand, and increased vulnerability to price swings.

- This trend creates a bearish loop, affecting price growth and market confidence.

Decline in Spot Trading Volume Peaks

- The market shows a consistent regression in spot trading volume peaks. Binance peaked at $333.57 billion in March 2024, falling to $246.04 billion in November 2024, and $198.6 billion last October.

- The spot-to-futures volume ratio is now at 0.23, with futures activity surpassing 75% of overall trading.

- Investors are shifting focus to the futures market, likely due to increased uncertainty and short-term volatility.

Currently, Bitcoin trades at $89,300, marking a 0.21% decrease over the past day.