11 2

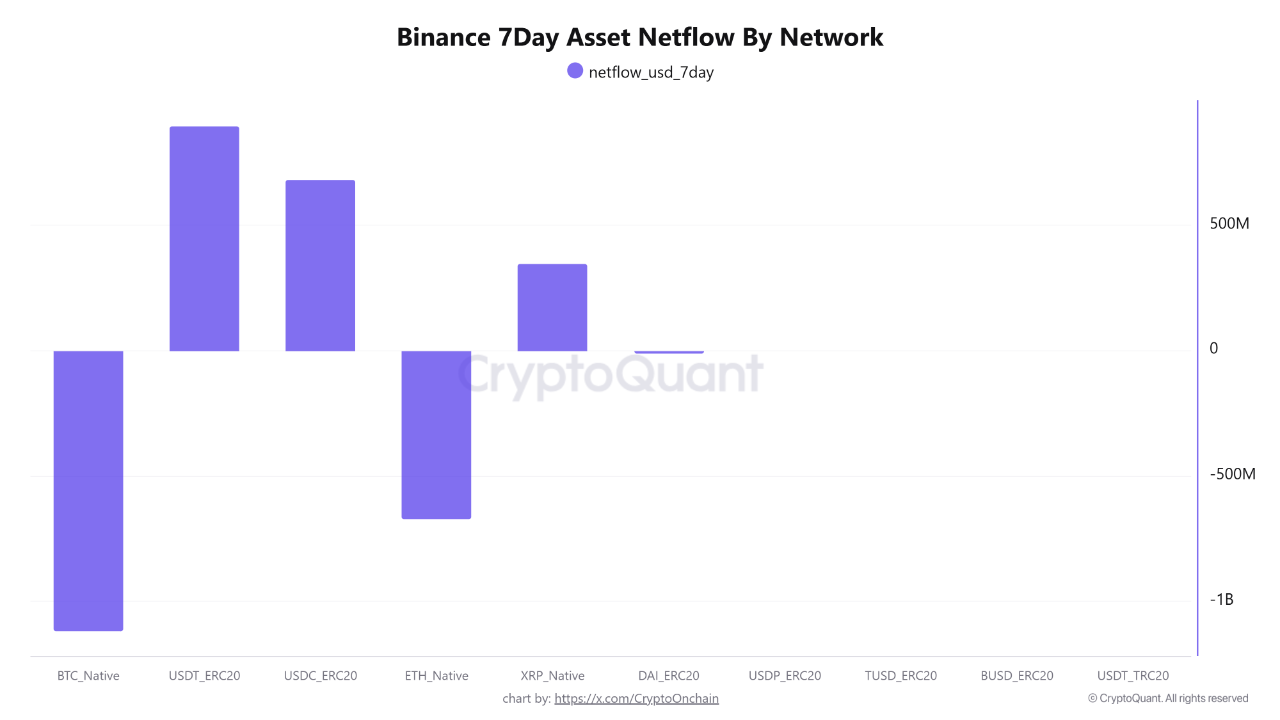

Binance Records $1.77B BTC/ETH Outflows Amid $1.58B Stablecoin Inflows

Recent on-chain analysis indicates significant accumulation patterns for Bitcoin and Ethereum on Binance, potentially signaling upcoming bullish momentum.

Binance Asset Movement Overview

- $1.77 billion in Bitcoin and Ethereum outflows from Binance were observed.

- Specifically, $1.1 billion in Bitcoin and $670 million in Ethereum were withdrawn.

- This trend suggests a 'HODL' sentiment, as investors move assets to private wallets, reducing sell-side pressure.

- Simultaneously, Binance saw $1.58 billion in stablecoin inflows, with $900 million in USDT and $680 million in USDC.

- This activity often indicates increased buying power by 'smart money,' ready to absorb sell pressure.

Implications of Accumulation Amid Market Conditions

- The divergence between BTC/ETH outflows and stablecoin inflows is a historical precursor to price recoveries.

- Despite prevailing market fear, major participants are seen "buying the dip," potentially setting a strong price bottom.

- Current valuations show Bitcoin at $96,133 (down 1.33%) and Ethereum at $3,153 (down 1.53%).