5 1

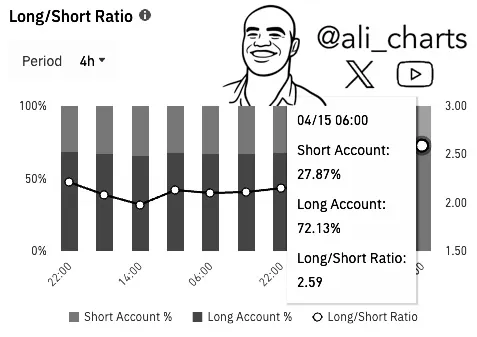

Binance Futures Data Shows 72.13% of Dogecoin Traders Are Long

Recent data from Binance shows a bullish sentiment among Dogecoin traders, with 72.13% of users holding long positions and only 27.87% short. This significant majority suggests expectations for a price increase.

Key Insights on Dogecoin Price

- A high long/short ratio indicates optimism about Dogecoin's momentum.

- Such sentiment could lead to increased buying pressure and higher prices.

- However, a one-sided market may trigger forced liquidations if prices drop suddenly.

- Current trader positions reflect confidence but come with risks of volatility.

- Market conditions, including Bitcoin's performance and external news, can quickly alter this outlook.

As of now, Dogecoin is trading below its multi-year trendline after facing resistance at the $0.167 Fibonacci level. A potential drop towards $0.14 could occur if it closes below the trendline, while the next resistance levels are around $0.18.