1 0

BULLISH 📈 : Binance PoR Boosts Market Confidence as $MAXI Gains Traction

Key Highlights:

- Binance's Proof-of-Reserves (PoR) confirms a 1:1 asset backing, instilling market confidence and encouraging a shift from stablecoins to high-volatility assets.

- The market is transitioning from wealth preservation to wealth creation, with increased interest in projects like Maxi Doge ($MAXI).

- Maxi Doge ($MAXI) has raised over $4.5M by combining viral culture with trading utility, appealing to those interested in high-leverage trading.

Binance's Role in Market Dynamics

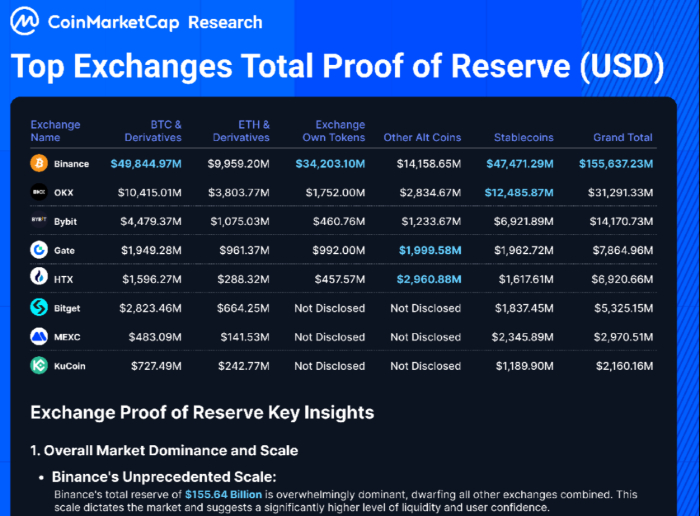

- CoinMarketCap's research reaffirms Binance as the leading exchange in terms of PoR, holding user assets at a ratio exceeding 1:1.

- This on-chain verification plays a crucial role in establishing market confidence post-2022 incidents.

- A robust infrastructure layer leads to a 'risk-on' rotation, with traders moving liquidity into high-beta assets.

Maxi Doge ($MAXI) Insights

- Positioned as a meme token with tangible utility, $MAXI aims to integrate holder-only trading competitions with leaderboard rewards.

- The project's tokenomics include a 'Maxi Fund' treasury and staking protocol offering a dynamic APY (currently 68%).

- Smart contracts have undergone audits confirming no mint functions, blacklist capabilities, and verified contract integrity.

- A structured roadmap focuses on listing Maxi Doge on both DEXs and CEXs to provide liquidity for its community.

Note: This article provides factual information and should not be considered financial advice. Conduct your own research before investing.