5 0

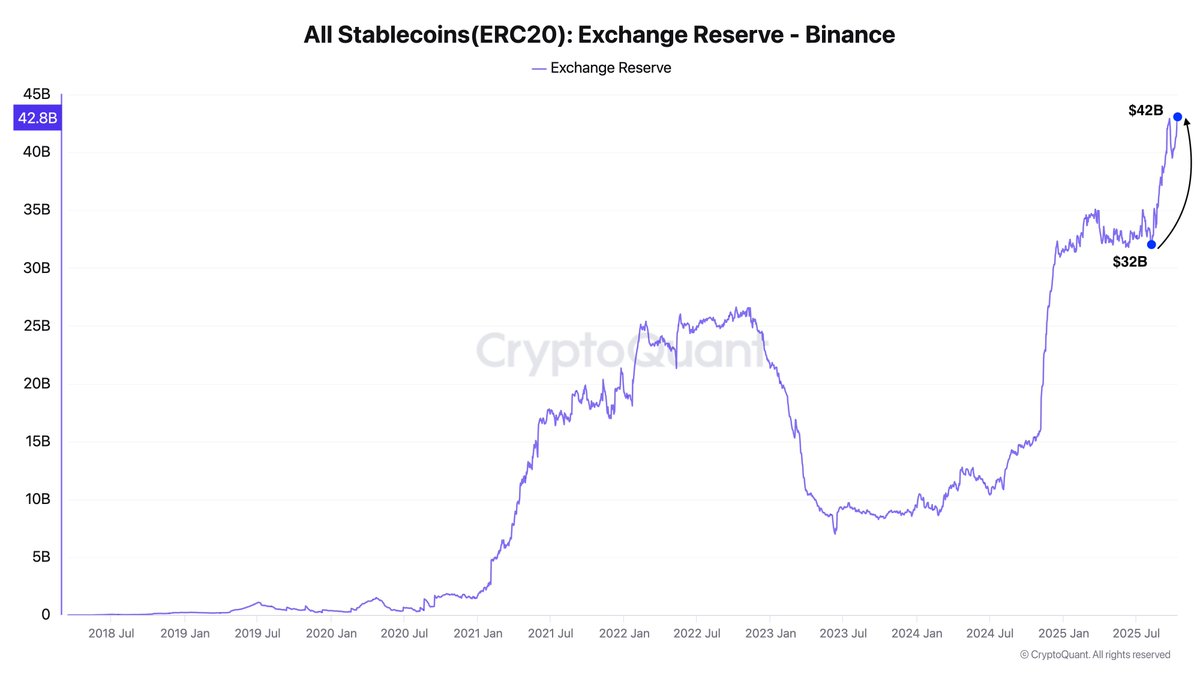

Binance Stablecoin Reserves Hit Record $42B, Signaling Liquidity Influx

The stablecoin market is a crucial indicator for crypto recovery following a significant crash. Bitcoin's recent plunge to $103,000 caused panic, with altcoins losing over 80% of their value. However, on-chain data suggests optimism as ERC-20 stablecoin supply on Binance grows, indicating liquidity rebuilding.

- ERC-20 stablecoin reserves on Binance increased by $10 billion from August, reaching a record $42 billion.

- This rise signifies renewed liquidity inflows and potential for market rebound.

- Stablecoin balances often precede buying pressure, hinting at capital readiness for re-entry.

Stablecoin dominance spiked above 9% during the market volatility, reflecting traders' shift to liquidity. It has since cooled to around 8.15%, suggesting a transition to a reaccumulation phase.

- Current stablecoin dominance remains above its 50-day and 200-day moving averages.

- This setup indicates strong capital positioning and potential market uptrends.

Overall, growing stablecoin reserves and dominance suggest strategic capital deployment, setting the stage for possible market recovery.