7 0

Bitcoin Consolidates at $100K Amid Rising Binance Inflows

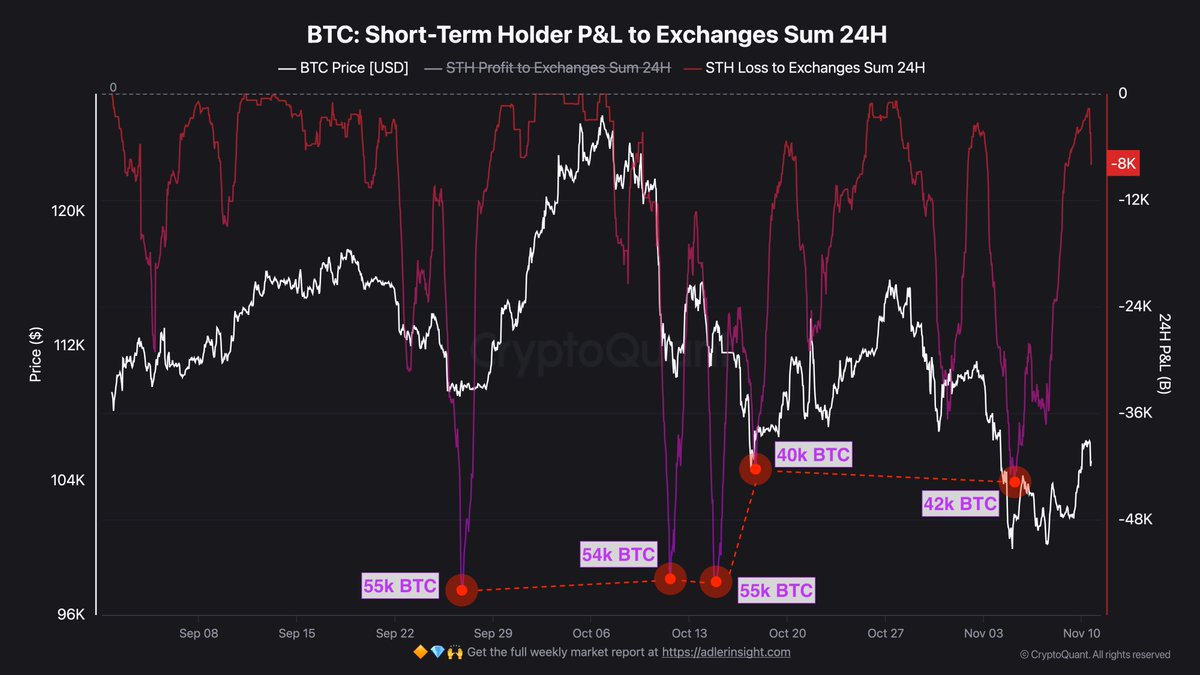

Bitcoin is currently in a consolidation phase, maintaining levels above $100,000 but facing resistance around $105,000. Despite previous volatility, on-chain data indicates active profit-taking as investors reduce exposure towards the end of the cycle.

- Market Dynamics: Increased Bitcoin inflows to Binance are noted, averaging 7,500 BTC daily in October, the highest since the March correction.

- Investor Behavior: Short-term holders are contributing to selling pressure, often reacting quickly to market fluctuations and sentiment changes.

- Structural Reset: Market is experiencing a balance between distribution and accumulation, suggesting a structural reset rather than a capitulation.

- Historical Patterns: Current behavior aligns with late-stage corrections where speculative capital exits, and long-term investors absorb supply.

- Weekly Chart Analysis: Bitcoin consolidates between $102,000 and $107,000, supported by the 50-week moving average, showing resilience at the $100K level.

- Long-term Trend: The broader trend remains bullish with upward sloping 100-week and 200-week moving averages.

- Potential Scenarios: A move above $110K could lead to recovery towards $117K–$120K, while a weekly close below $100K might trigger a decline toward $92K–$95K.