Bitcoin Must Achieve 10x Growth to Surpass Gold’s Market Value

Bitcoin’s value is primarily defined by its accountability. The total number of mined bitcoins is known, along with the addresses holding them and their duration of inactivity.

However, estimates indicate that around 20% of all BTC, approximately 3.7 million BTC valued at $318 billion, may be permanently lost due to inaccessible private keys.

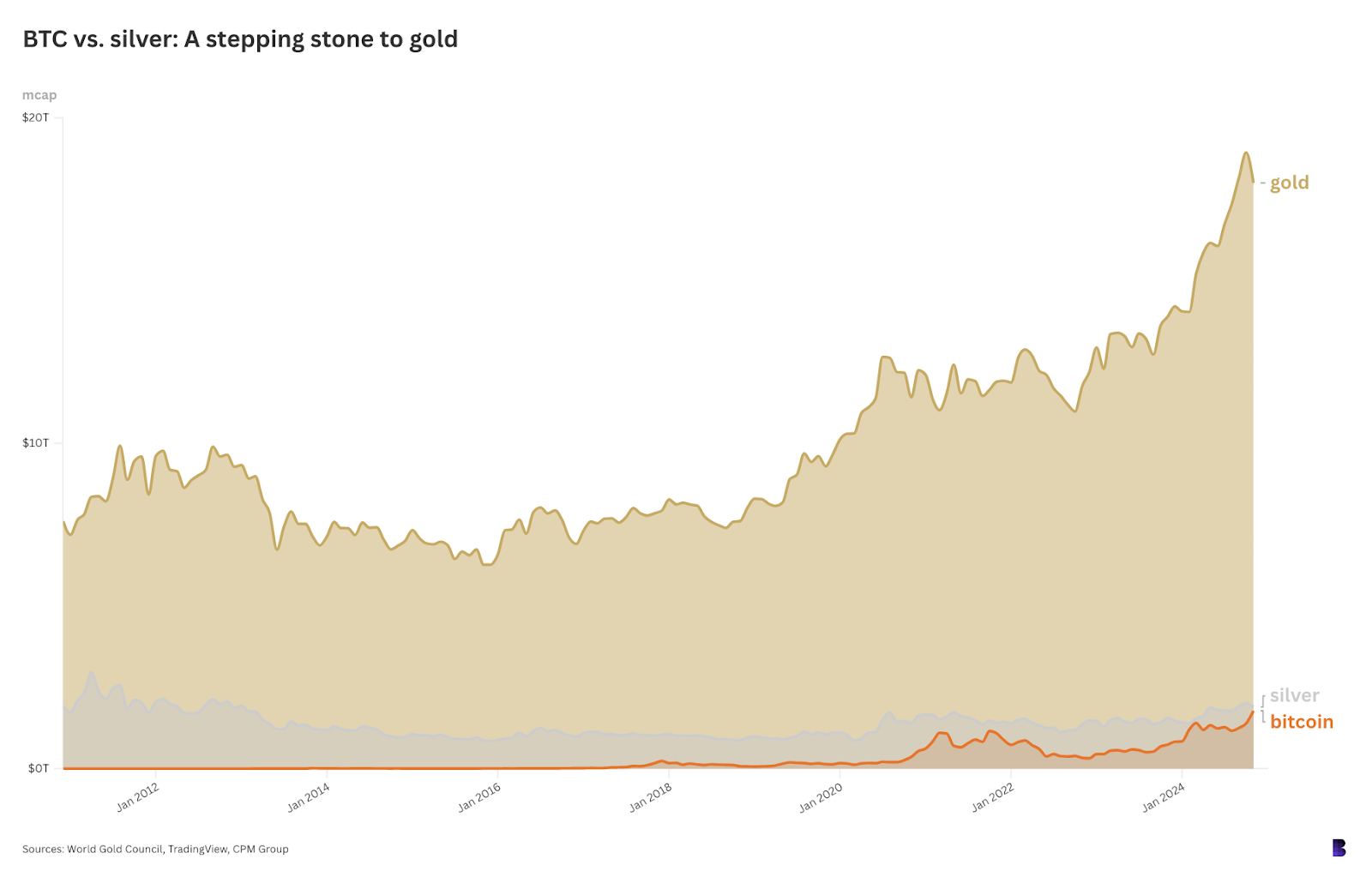

In contrast, the World Gold Council reports that as of last year, 212,582 tonnes of gold have been mined historically, with 45% in jewelry, 22% in bars and coins, and 17% held by central banks. This results in a total mined gold value of about $18 trillion, but the amount available for sale remains uncertain.

For silver, InfiniteMarketCap cites 1.751 million metric tonnes mined, equating to a market cap of nearly $1.9 trillion, which exceeds Bitcoin's current valuation of $1.8 trillion. However, the actual supply of silver is unclear, with some estimates suggesting a market presence of only $108 billion when excluding industrial and jewelry use.

To surpass silver, Bitcoin would need to reach $96,000; to exceed gold, it would require a price of $910,000.