Bitcoin Approaches $11.8 Billion Options Expiry on December 27, 2024

Bitcoin (#BTC) is nearing a significant deadline with the expiration of $11.8 billion in Bitcoin options on December 27, 2024, which may lead to increased market volatility. This expiration includes both call and put options that could impact Bitcoin's price in late 2024.

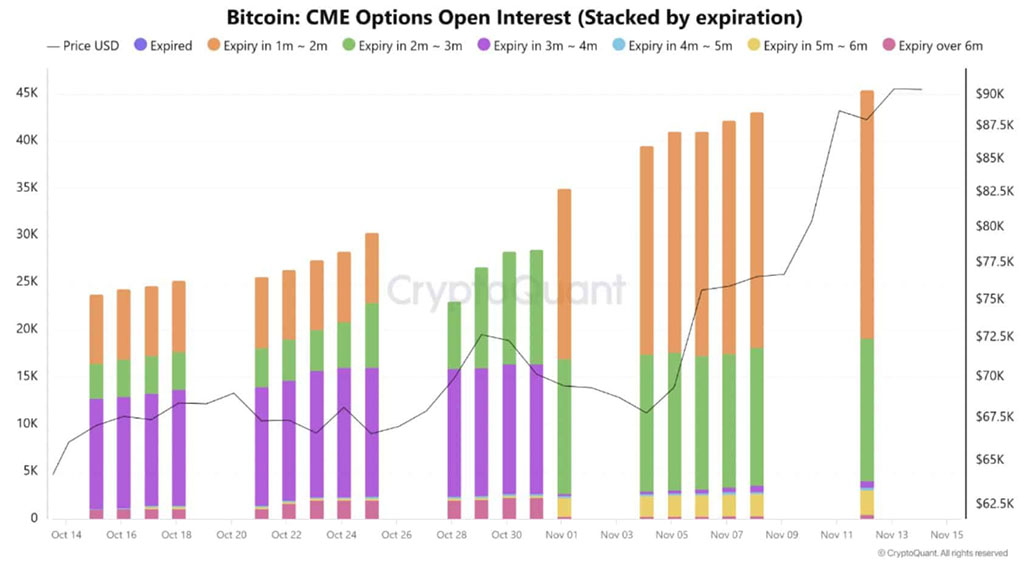

Source: CryptoQuant

Following the 2024 US elections, bullish sentiment around Bitcoin has risen. Some analysts predict a price increase to $100,000, driven by higher capital inflows and a market dominance exceeding 60%. However, this goal faces challenges due to the upcoming expiration of substantial options contracts.

The cryptocurrency's appeal is reflected in the options market, where open interest has reached an all-time high of $50 billion. The optimism surrounding Bitcoin's future performance is contingent on its behavior in the weeks leading up to the expiration of the $11.8 billion in options.

Bitcoin Price Hovers Above $90K

Bitcoin's price, currently just above $90K, indicates a balance between bullish and bearish dynamics. Recent price corrections suggest that upward momentum may be faltering. The options market will significantly influence Bitcoin's short-term price direction.

Among the $11.8 billion in expiring options, approximately 70% are call options, according to Coinglass data. Investor optimism about reaching the $100K mark could lead to substantial selling pressure if this target is achieved, as many traders would exercise their call options to secure profits.

Nevertheless, the expiration might also trigger a short-term pullback. Traders closing call option positions may increase market sales. If put options outnumber calls, market sentiment could shift, increasing downward pressure on prices.

Deribit Leads the Charge in Bitcoin Options Market

The Bitcoin options market is highly concentrated, with Deribit holding a 74% market share, while CME and Binance each account for around 10.3%. This concentration emphasizes Deribit's role as the primary platform for Bitcoin price movement speculation.

The situation for Bitcoin options is precarious. While strong bullish sentiment leads many traders to expect a breakout above $100,000, the expiration of options contracts could create self-fulfilling selling pressure if prices fail to remain above this threshold. The behavior of these contracts will be critical for Bitcoin's ability to maintain or exceed this value.