6 0

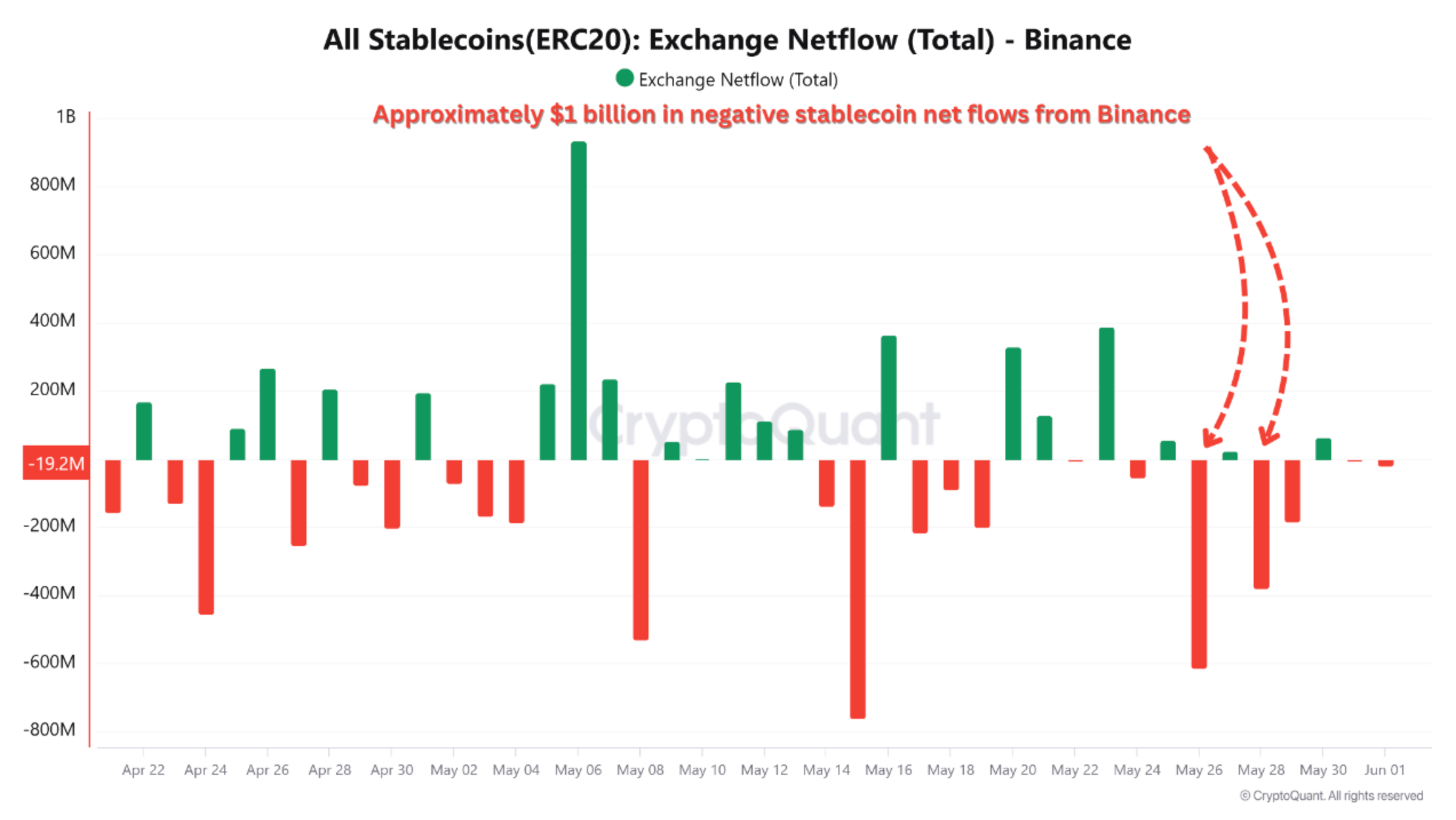

Bitcoin Sees $1 Billion Stablecoin Outflow as Long-Term Holders Withdraw

Bitcoin (BTC) is experiencing a retreat from its recent all-time high of $111,814 and is currently trading in the mid-$100,000 range. On-chain data indicates a potential waning momentum for the cryptocurrency.

Indicators of Potential Correction

- Stablecoin outflows from Binance exceed $1 billion, suggesting reduced risk appetite among traders.

- Long-term holder (LTH) participation has declined significantly, with net position realized cap dropping from $28 billion to $2 billion.

- Larger holders (1,000 to 10,000 BTC) are selling their positions, while smaller holders (100 to 1,000 BTC) are accumulating.

These factors may lead to a loss of market momentum, risking a dip below the $100,000 level.

Contrasting Signals

- Despite signs of correction, other on-chain metrics suggest Bitcoin could still reach new all-time highs.

- The Net Realized Profit/Loss (NRPL) metric shows current profit-taking levels are lower than prior cycle peaks.

- Increased outflows from centralized exchanges, including a recent withdrawal of 7,883 BTC from Coinbase, indicate potential institutional interest.

As of now, BTC is trading at $103,854, reflecting a minor decline of 0.2% over the past 24 hours.