4 0

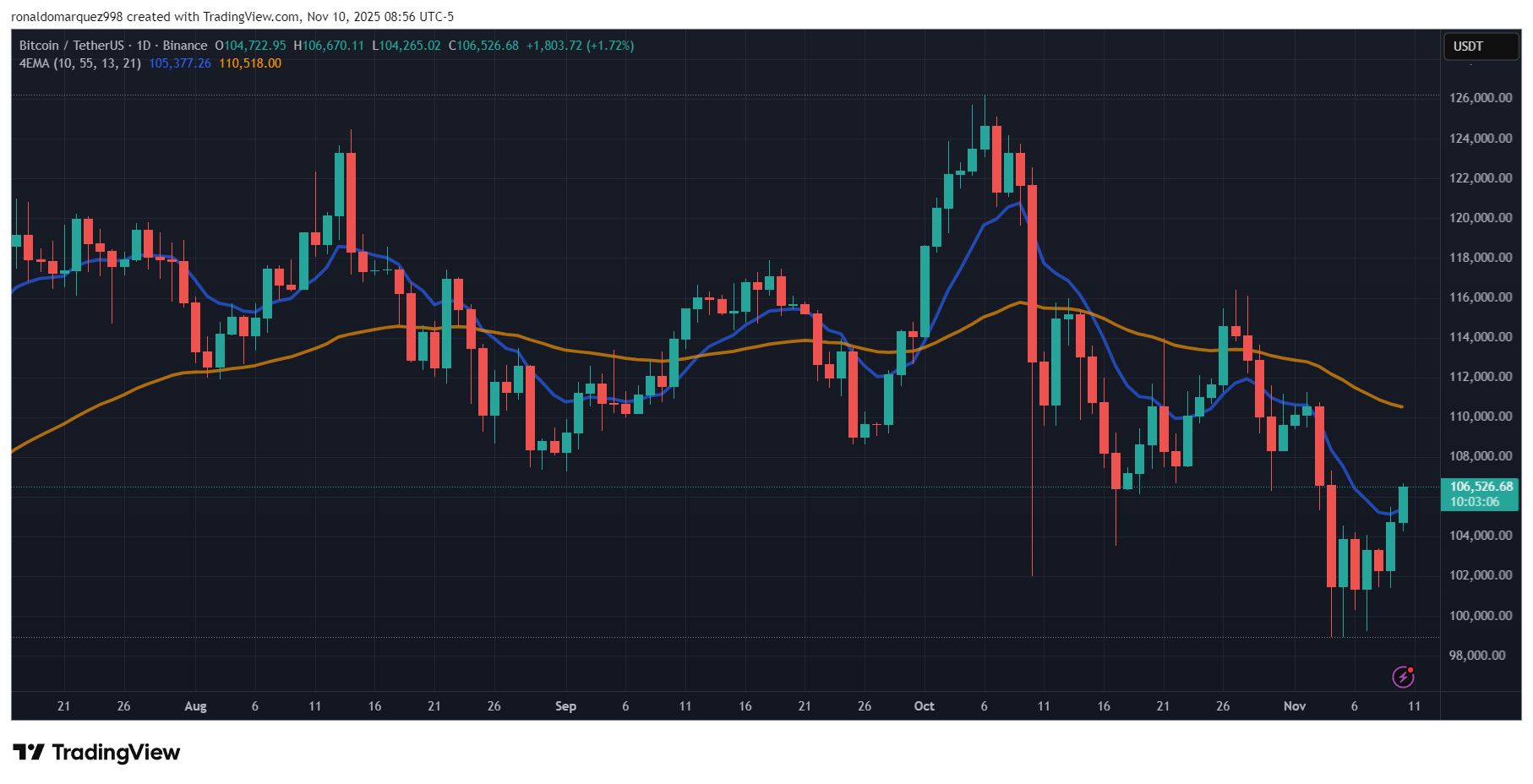

– Bitcoin trades 20% below all-time high, analysts see rally similarities – Reclaimed EMA, RSI support, and MACD suggest potential upward trend – Current structure mirrors past major breakouts since 2023 – Bitcoin price at $106,520, with a nearly 2% recovery in 24 hours

Bitcoin is trading nearly 20% below its all-time highs. Analysts see similarities with the 2023 rally, suggesting potential for future gains.

Positive Signals

- The Bull Theory analysts note Bitcoin closed a weekly candle above the 50-day EMA, a sign historically linked to major uptrends.

- This EMA level has been tested in past years, leading to upward trends after brief dips.

- Bitcoin maintains its position within a multi-year RSI support zone, indicating a possible end of a corrective phase and onset of expansion.

- The MACD indicator is near its historical reversal zone, suggesting exhaustion of selling pressure.

Potential For Future Gains

- Bitcoin has retraced nearly 20% from its peak of $126,000, aligning with average correction sizes since the cycle started.

- The market structure mirrors setups before major breakouts since 2023, implying a reset rather than a breakdown.

- Analysts predict sideways consolidation before another expansion phase, similar to post-April 2025 behavior.

- Potential price targets range between $160,000 and $180,000 by Q1 2026, favoring continuation over collapse.

Currently, Bitcoin is trading at $106,520, showing a nearly 2% recovery in the last 24 hours according to CoinGecko data.