1 0

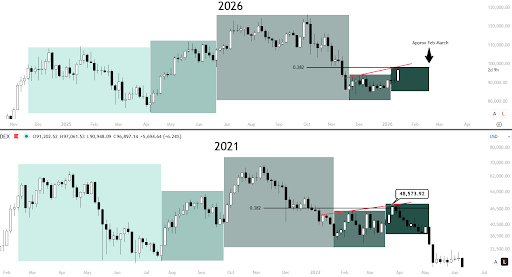

Bitcoin Mirrors 2021 Fractal, Suggesting Possible Rally to $100,000

Bitcoin may be replaying a market pattern that previously led to significant rallies. A trader has identified a fractal similar to the one before the 2021 bull run, suggesting current cycles align with historical structures observed over the past decade.

Key Observations

- The trader highlights structural symmetry in Bitcoin's cycle compared to 2021, showing price movements within a distribution range and retracing to the 0.382 Fibonacci level.

- This pattern follows prior four-year cycles consistently, allowing predictions of all-time highs and lows based on historical data.

- Bitcoin's behavior is being evaluated through a recurring pattern that has existed for over 12 years.

$100,000 as a Psychological Ceiling

- $100,000 is seen as a psychological resistance point, similar to the $50,000 level in 2021, which Bitcoin struggled to surpass.

- Diagonal trendlines suggest structural limits on upward momentum, with potential temporary stalls around $98,000–$99,000.

- Data indicates median short-term buyer cost basis between $95,000 and $100,000, likely leading to profit-taking and selling pressure.

- A sustained move above $104,000–$105,000 would challenge the current fractal pattern and require a reassessment of the trend.