6 0

Bitcoin Records $716 Million Net Outflows Amid Market Liquidity Shift

The liquidity surge supporting Bitcoin is diminishing as net outflows increase, indicating a change in market dynamics with selling pressure surpassing buying interest.

Market Movements and Insights

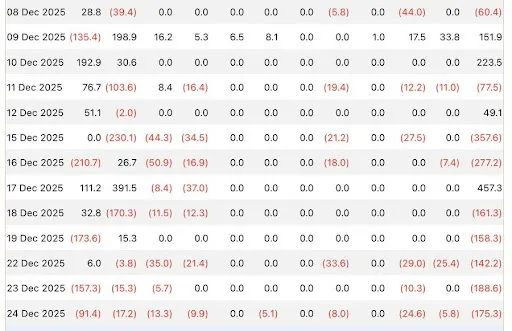

- Since December 8th, Bitcoin has seen approximately $716 million in net outflows.

- Current momentum-driven capital is shifting to gold and metals, but this may be temporary.

- WealthManager notes that lower BTC prices could present significant opportunities.

Analyst Cipher2X emphasizes accumulating Bitcoin now due to its ability to build foundations even when conditions are not ideal. On-chain data shows long-term holders increasingly locking up supply, reinforcing BTC’s role as a hedge against policy risk.

Bitcoin's Volatility and Market Maturity

- Implied volatility on BTC options shows a downward trend, indicating market maturity and institutionalization, according to Daan Crypto Trades.

- Days of consecutive 10%+ price movements are less frequent, suggesting increased stability.