Bitcoin Expected to Reach $800K in Five to Ten Years

Bitcoin's short-term price action remains bullish, influenced by US President Donald Trump’s support for cryptocurrency. Analysts are considering Bitcoin's potential performance over the next five to ten years.

Mike Novogratz of Galaxy Digital predicts that Bitcoin could reach $800,000 within this timeframe, using gold's market value as a benchmark. In a Bloomberg Television interview, he stated that Bitcoin's upward trend will continue, aligning its market cap with gold's estimated $16 trillion.

Bitcoin To Match Gold’s Market Cap: Analysts

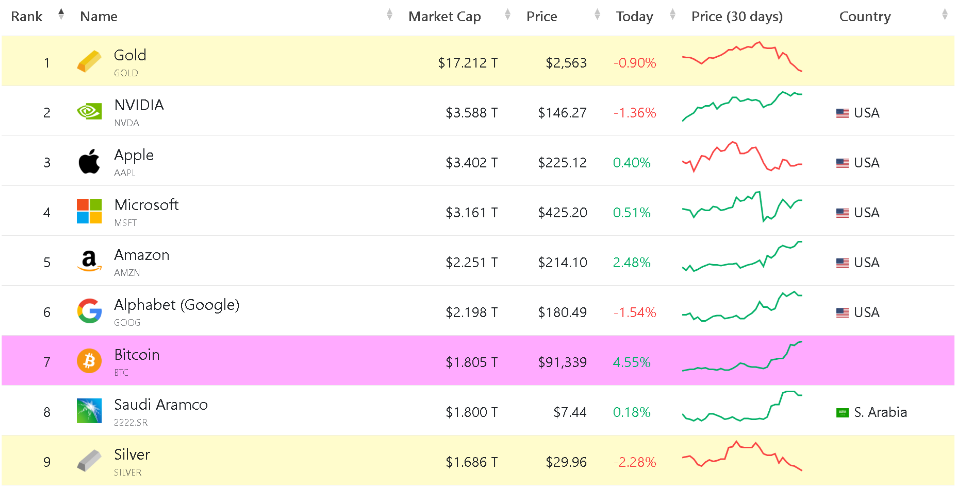

Trump’s election is seen as a catalyst for Bitcoin’s recent price movement. Bitcoin has surpassed silver and currently exceeds Saudi Aramco in market valuation at $1.79 trillion. This raises questions about whether Bitcoin can rival gold's market cap.

According to Novogratz, a shift in interest from new consumers and traders favors Bitcoin, which is viewed as a digital store of value. Other analysts, including Howard Lutnick and Anthony Scaramucci, also use gold as a benchmark, suggesting that Bitcoin may soon exceed gold’s market capitalization.

Bitcoin To Trade In $500k Level If It Becomes Part Of US Reserve

Novogratz forecasts that Bitcoin could reach $500,000 if the US government incorporates it into its Treasury. This prediction is based on current bullish trends and favorable policies for crypto.

If the US acquires up to 1 million BTC, demand from other governments may increase. Trump's backing of Bitcoin and cryptocurrencies contributes to this bullish sentiment.

Novogratz Not Confident On Government’s Decision To Add BTC As Reserve Asset

Despite his $500,000 target, Novogratz expresses skepticism regarding the US Treasury adopting Bitcoin as a reserve asset. He believes there is a significant chance that the proposal may not pass the Senate, despite approval from the House.

Novogratz maintains a bullish outlook on Bitcoin and advises the US government to increase its investments in digital assets. He argues that the government does not need to back the USD with additional assets. During the Bloomberg interview, he reiterated his substantial investment in Bitcoin and expressed optimism about the potential approval of the reserve bill.

Featured image from Pexels, chart from TradingView