3 0

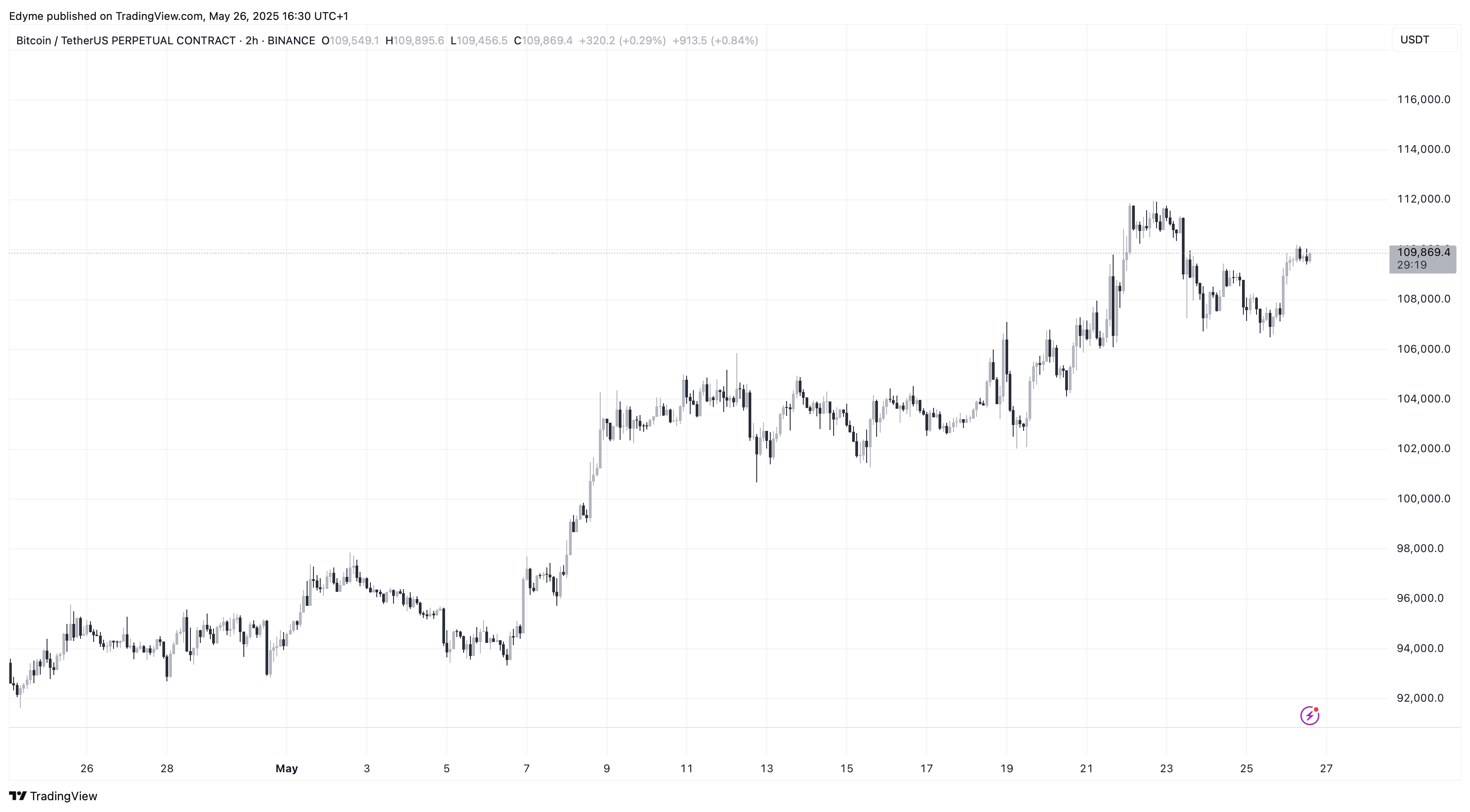

Bitcoin Remains Above $109K as Long-Term Holders Increase Accumulation

Bitcoin is currently trading at $109,874, reflecting a 2.3% daily increase after a modest correction from its recent all-time high above $111,000. Despite market volatility, there is ongoing bullish sentiment among traders.

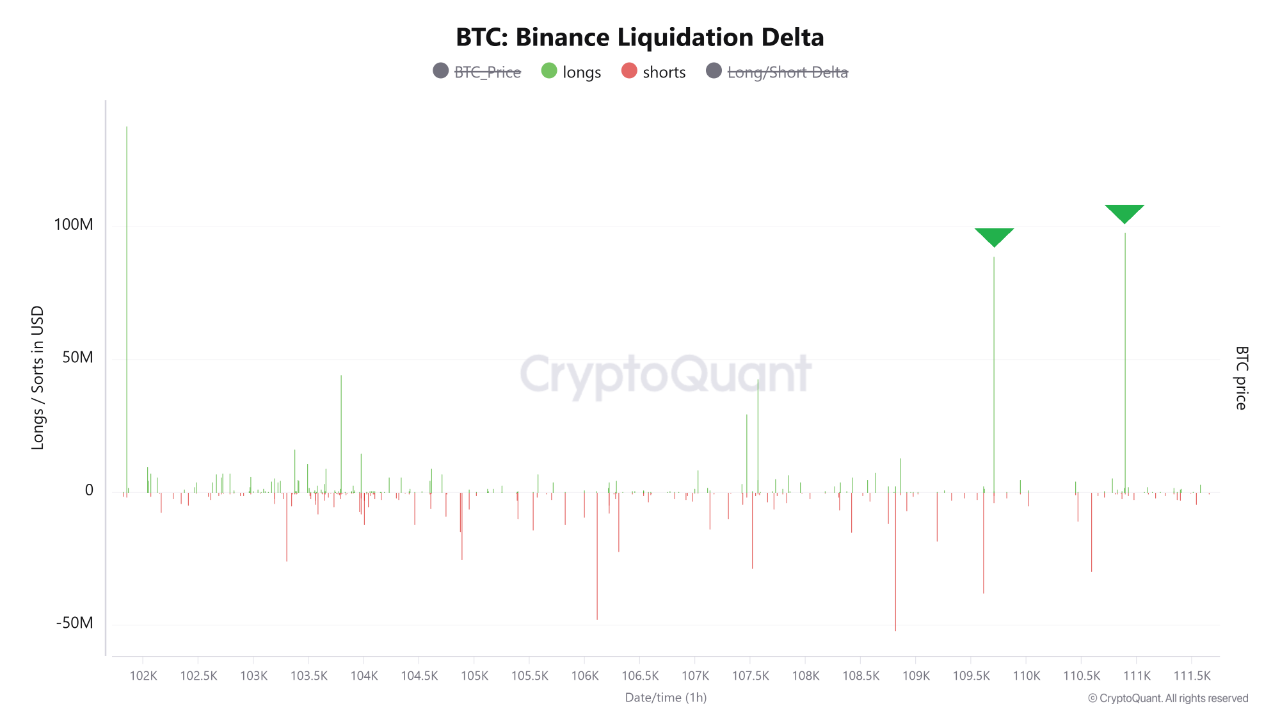

High Leverage Triggers Liquidations

- Over-leveraged traders faced significant liquidations during the price drop below $111,000.

- The first wave of liquidations near $110,900 resulted in over $97 million lost in long positions.

- A second wave occurred around $109,000, wiping out an additional $88 million.

- Cascading margin calls intensified sell pressure during these corrections.

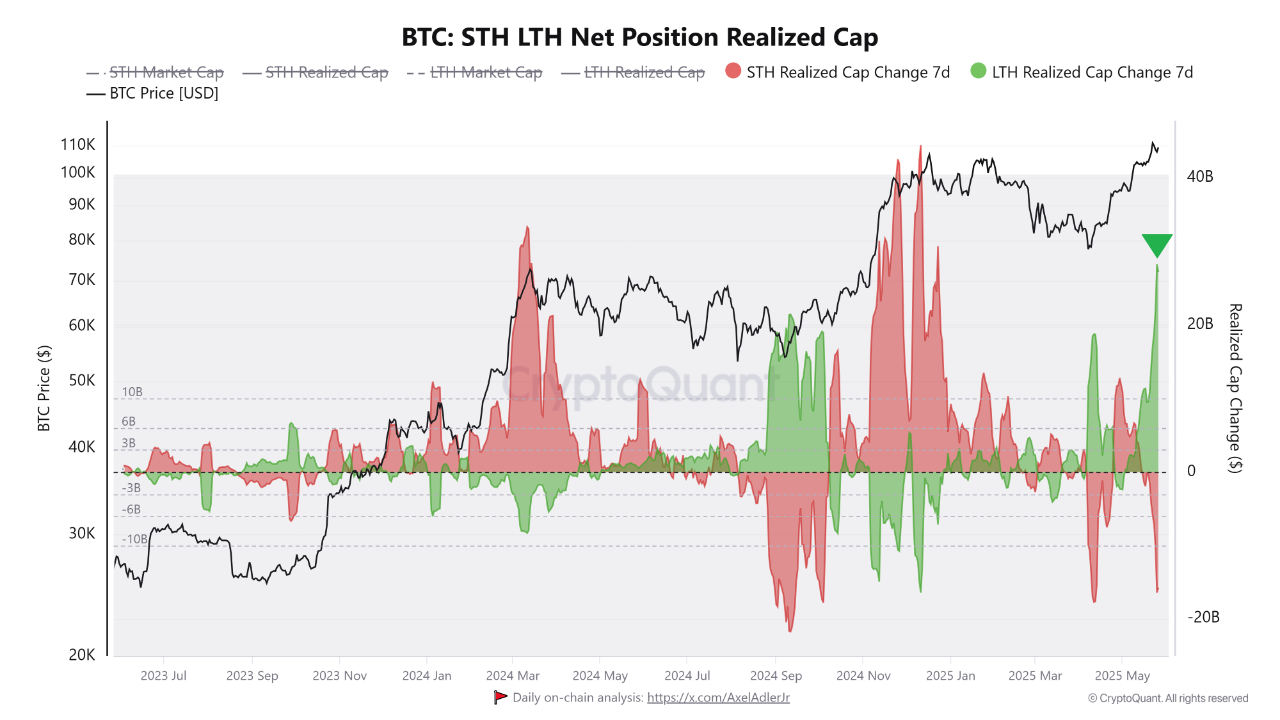

Long-term holders (LTHs) remained active and seized the opportunity to accumulate Bitcoin during this volatility.

Long-Term Holders Accumulate

- LTH realized cap surged past $28 billion, not seen since April.

- Accumulation by LTHs during liquidations suggests confidence in Bitcoin's long-term value.

- This behavior historically precedes upward price expansions as selling pressure decreases.

- The reset of leveraged positions may set the stage for another breakout attempt beyond previous highs.