Bitcoin Trades Above $115,000 Ahead of US Fed Rate Decision

Bitcoin is currently trading above $115,000 as the market awaits a critical decision from the US Federal Reserve. Investors anticipate an interest rate cut, though the extent and pace remain uncertain. A 25-basis-point cut may indicate controlled economic adjustments, while aggressive actions could imply deeper economic issues, potentially increasing market volatility.

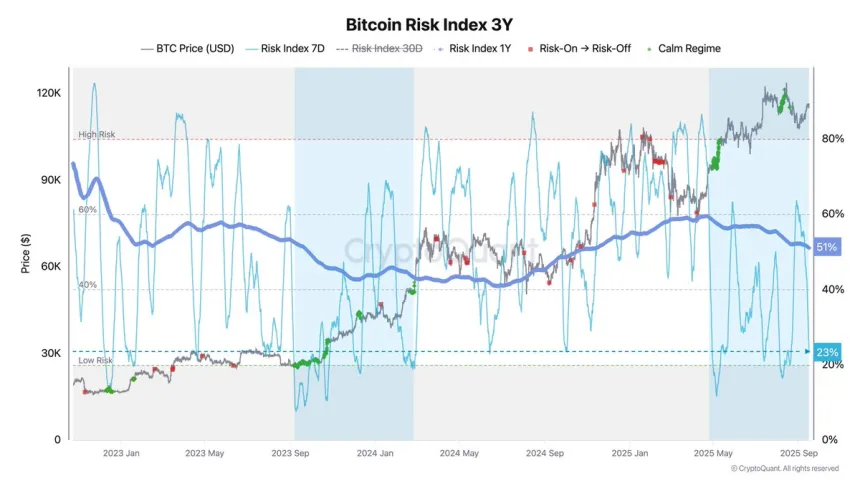

- The Bitcoin Risk Index, according to analyst Axel Adler, is at a low 23%, suggesting a stable market with minimal risk of sharp declines.

- This calm environment might favor sustained growth if external shocks are avoided.

- Bitcoin has shown resilience, holding key levels due to structural demand and institutional interest.

Bitcoin Risk Index Signals Calm Before Fed Decision

The current low level of the Bitcoin Risk Index indicates a stable market environment. This situation resembles past periods where Bitcoin gradually gained strength amid limited volatility. However, macroeconomic uncertainty remains a concern, with potential surprises from the Fed's decision that could disrupt this calm.

Analysts suggest that if the Fed's decision provides clarity, Bitcoin might surge, supported by low risk indicators, tightening exchange supply, and robust institutional demand.

Price Action Details: Holding Key Demand

Bitcoin trades at $115,739, showing resilience after recovering from early September lows. It remains above crucial moving averages, indicating a pivotal area for both bulls and bears.

- BTC maintains support above the $114,500–$115,000 zone, showcasing buyer demand during price dips.

- Key resistance is near $123,217, a psychological barrier for confirmation of further breakout towards $125,000.

- Momentum is cautious but promising, with higher lows forming since early September.

A dovish Fed outcome might boost Bitcoin, whereas a hawkish stance could see it drop toward $112,000.