6 0

Bitcoin Holds Above $116K as Analysts Predict Possible Uptober Rally

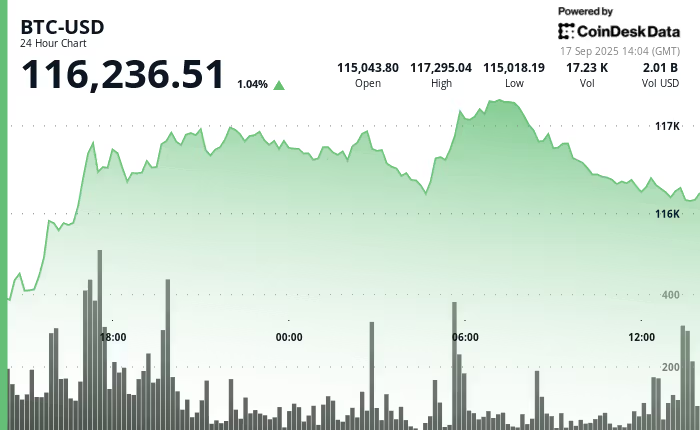

Bitcoin traded at $116,236 on Sept. 17, up about 1% in the past 24 hours, maintaining a key level ahead of the Federal Reserve’s policy announcement.

Market Analysis

- Dean Crypto Trades highlighted that Bitcoin is only about 7% above its post-election local peak, while the S&P 500 rose 9% and gold surged 36% in the same period. Bitcoin may lead the next larger move but could form a "lower high" initially. Ether might join if it breaks $5,000.

- Lark Davis noted Bitcoin's history around September FOMC meetings, where every decision since 2020, except in 2022, preceded a strong rally. He suggested this pattern is due to seasonal dynamics rather than rate choices, with potential growth in October.

Technical Analysis

- CoinDesk Research observed Bitcoin rose from $115,461 to $116,520 during Sept. 16–17, reaching a session high of $117,317 before consolidating.

- The $116,400–$116,600 range was tested multiple times, confirming short-term support. A breakout attempt saw prices spike to $116,551 on higher volume.

- Overall, Bitcoin remains firm above $116,000, with support around $116,400 and resistance near $117,300.

Chart Analysis

- In the last 24 hours, Bitcoin consolidated between $116,000–$116,500, highlighting short-term support.

- Over one month, Bitcoin climbed from lows near $108,000 in late August to recent highs above $117,000, showing an upward trend with current consolidation.