6 0

Bitcoin Holds Above $90K Amid Rising Unrealized Losses and Market Tension

Bitcoin is currently stabilizing around the $90K mark as the market enters an uncertain phase. Opinions differ: some analysts see a potential bear market, while others expect a rally breaking the usual four-year cycle. This reflects a market grappling with fear, macroeconomic pressures, and liquidity changes.

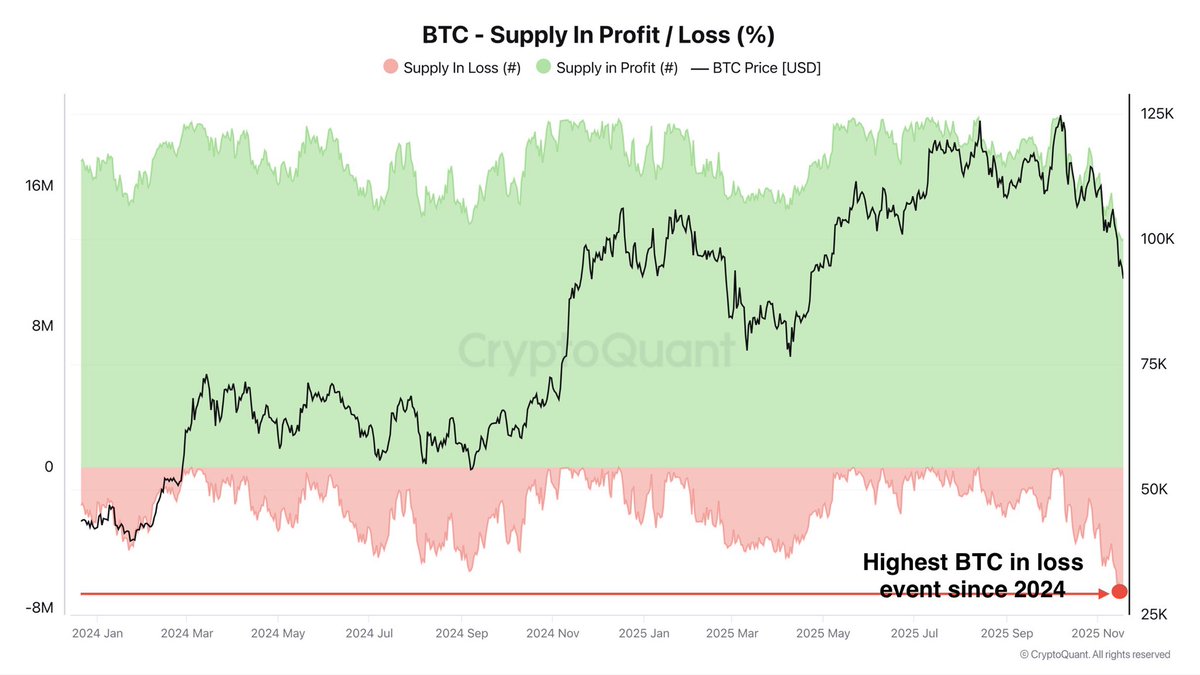

- Data from analyst Darkfost indicates over 6.96 million BTC are at an unrealized loss, the highest since January 2024.

- This suggests significant Bitcoin accumulation near previous all-time highs, leading to emotional selling pressures.

Despite challenges, Bitcoin defends the $90K level, indicating demand absorption. The key question remains whether this signals a bear market onset or a pre-rebound phase.

Unrealized Losses Indicate "Change of Hands" Phase

- Darkfost notes that many short-term holders (STHs) bought near peak prices, making them prone to sell amid volatility.

- Such selling increases short-term volatility but historically presents strong buying opportunities during bullish trends.

- This phase represents a shift from emotional sellers to strategic buyers.

BTC Price Analysis: Testing Major Support

- Bitcoin faces pressure at just above $90K, breaching the 50-day and 100-day moving averages.

- The price hovers on the 200-day MA, often a key support during corrections in bullish cycles.

- Long lower wicks on recent candles suggest buyer attempts to hold this zone, though rebound strength is limited.

- Sustained break below the 200-day MA could increase downside momentum, targeting $85K–$88K levels.

- If bulls stabilize above $90K and reclaim the 100-day MA, it may indicate seller exhaustion and potential recovery.

Currently, Bitcoin is at a critical junction, with its future direction dependent on how the $90K support zone holds.