2 0

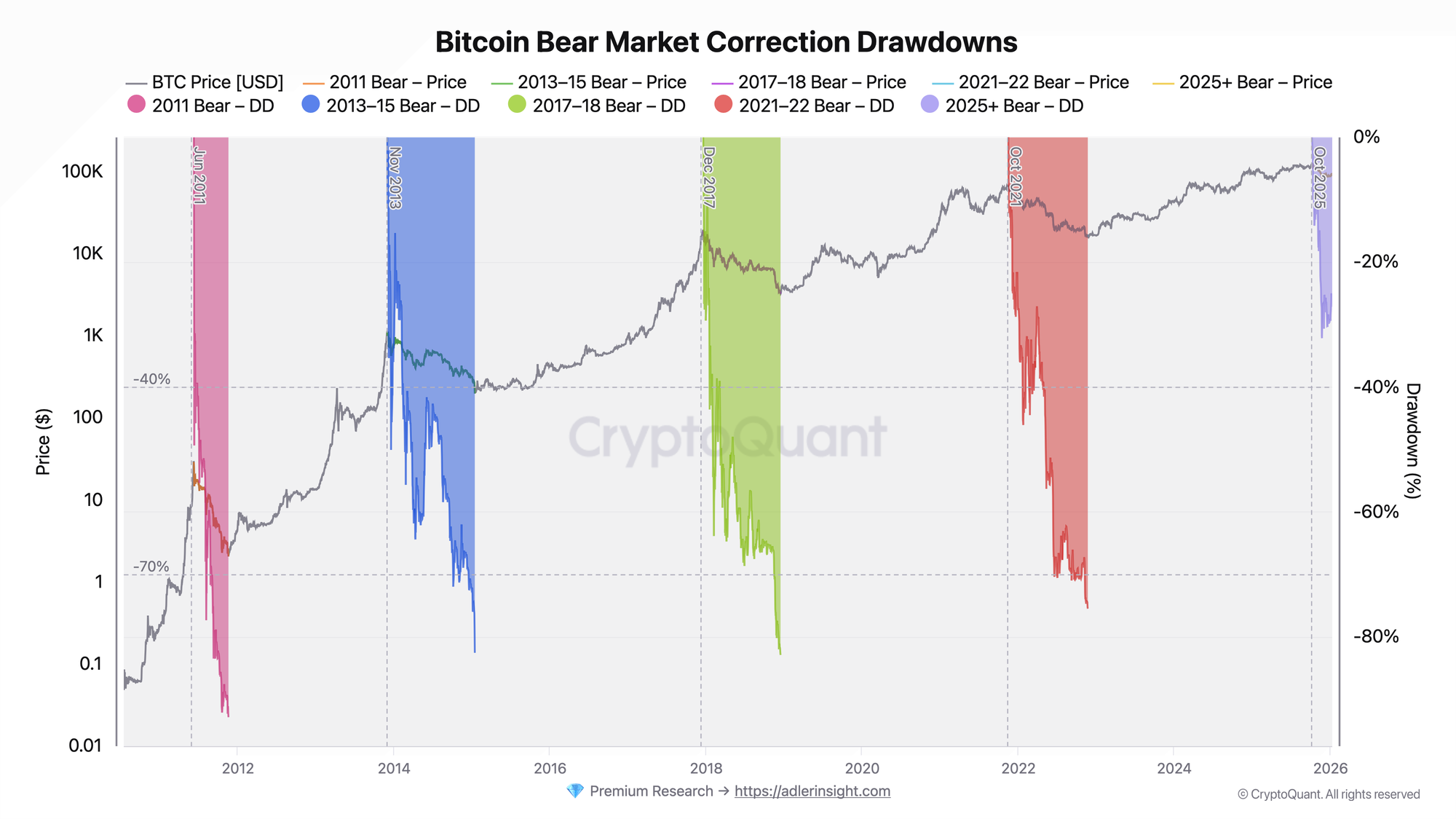

Bitcoin Trades Above CVDD as Bear Market Drawdown Remains Shallow

Bitcoin's price is consolidating, showing uncertainty among investors as it remains in a range since late November. The failure to maintain momentum above October highs has kept BTC within this broad range.

- Current drawdown from the October peak is about −27%, with maximum correction at −33%.

- Historical bear markets saw more severe declines: 2011 (-92%), 2013–2015 and 2017–2018 (-82%), and 2021–2022 (-75%).

- The presence of spot ETFs and institutional capital may reduce volatility and correction magnitude.

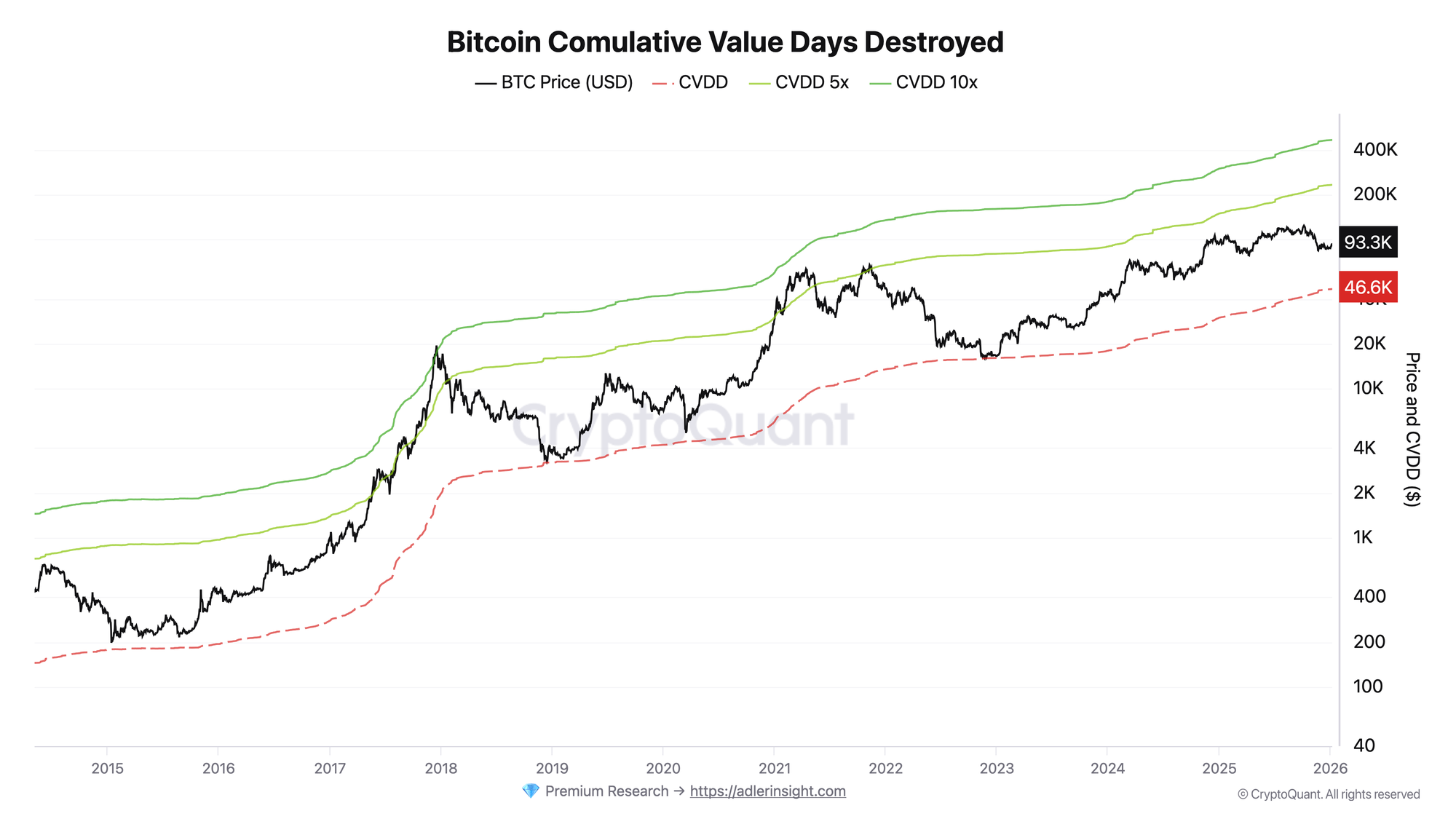

Bitcoin Cumulative Value Days Destroyed (CVDD)

- CVDD model indicates Bitcoin is trading near $91,000, about 2x above the base CVDD level (~$46,600).

- This positioning suggests the market hasn't entered a true capitulation phase.

- The base CVDD continues to act as a long-term structural floor for Bitcoin.

Technical Analysis

- BTC trades around $90,000–$91,000, below the 100-day and 200-day moving averages, indicating a shift from bullish to corrective trend.

- Short-term demand remains cautious; upside attempts capped by descending moving averages.

- Volume decline during consolidation suggests lack of conviction from both bulls and bears.

- A sustained recovery requires reclaiming the $95,000–$98,000 region.