7 1

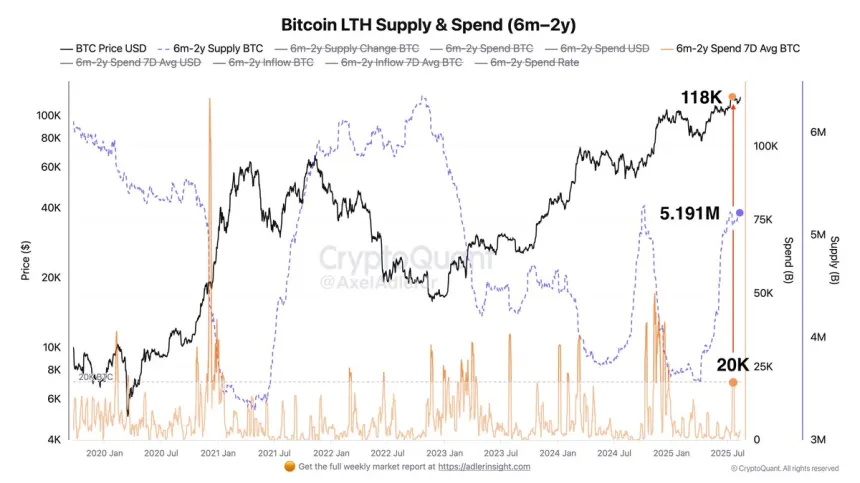

Bitcoin Accumulation Increases as Long-Term Holder Selling Pressure Decreases

Bitcoin is currently at a critical point after reaching new all-time highs. Key highlights include:

- BTC briefly surpassed $120,000 but could not maintain these levels.

- This failure has raised bearish concerns about potential short-term downside risks.

- Long-Term Holders (LTHs) have increased their holdings from 3.551 million BTC to 5.191 million BTC since April, indicating strong investor conviction.

- LTHs' average spending recently climbed to 20,000 BTC, below typical spikes seen in past cycles.

- A decisive push above $125,000 is needed to confirm bullish momentum and validate LTH strength.

- Current support is identified between $116,900 and $117,600; a breakdown could lead to further declines toward $115,000.

The market remains in consolidation as traders monitor whether support holds at the $117K level while aiming for a breakout above recent resistance near $124,000.