4 0

Analyst Reports Surge in Bitcoin Accumulation by Retail and Institutions

Bitcoin is currently priced at $108,716. Despite this stability, there are indicators of potential price movement as both retail and institutional investors increase their accumulation.

Key developments include:

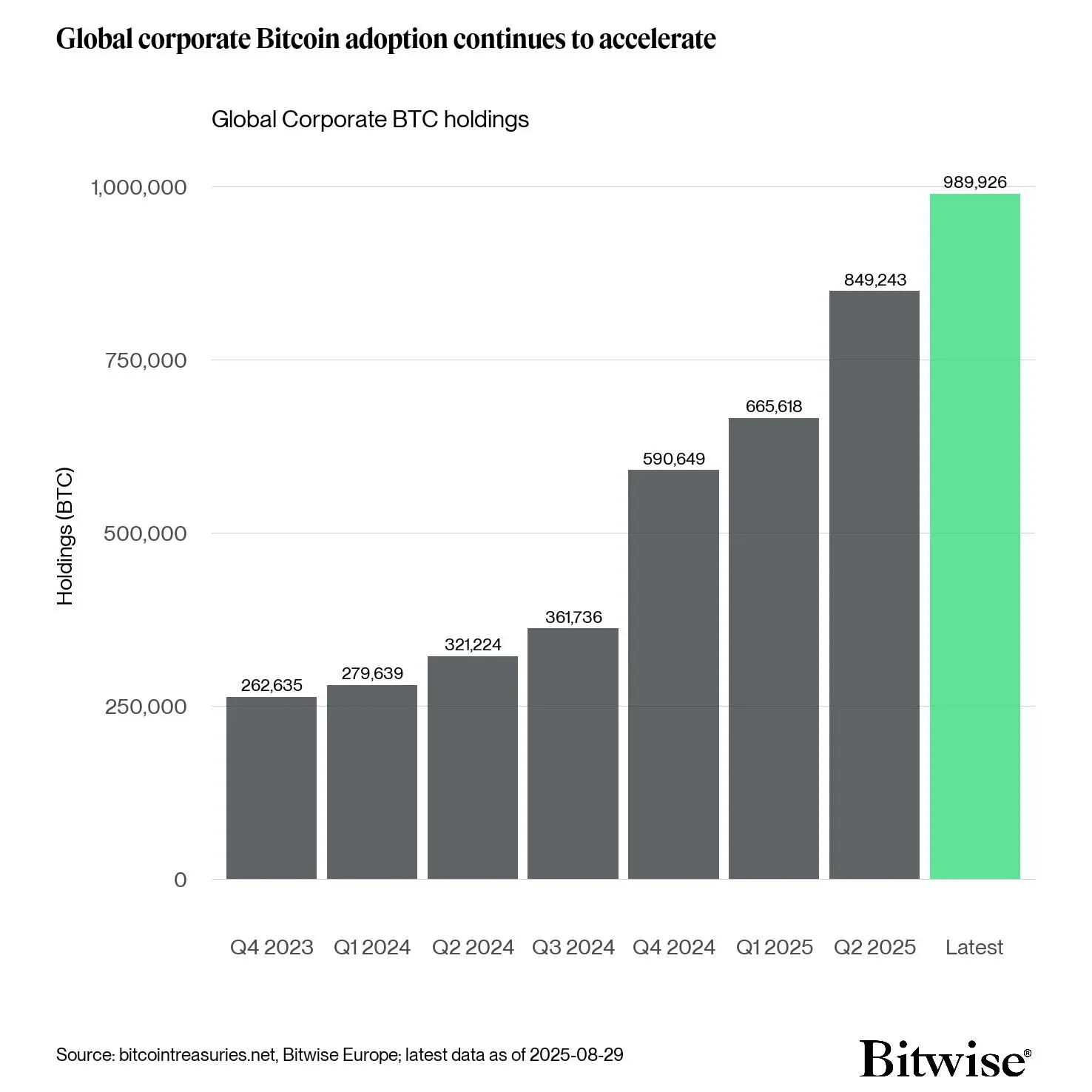

- 28 new bitcoin treasury companies were established in July and August, increasing corporate holdings by over 140,000 BTC.

- This accumulation nearly matches the annual production of new bitcoin, which is approximately 164,000 BTC.

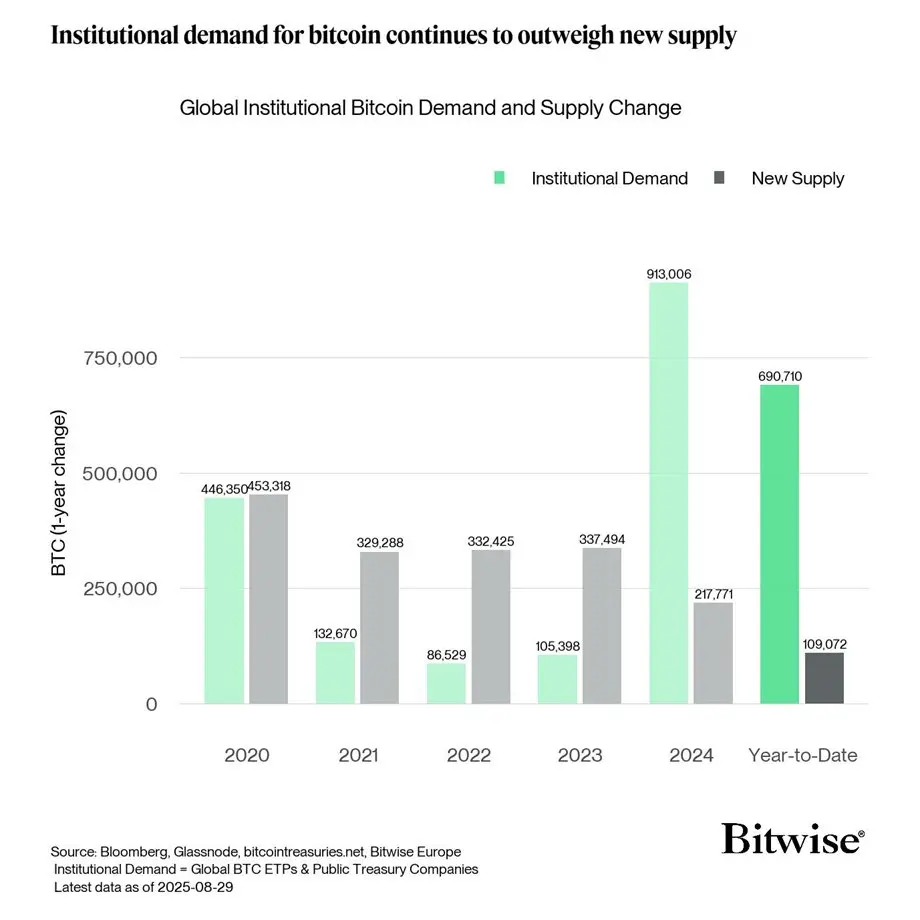

- Institutional demand has exceeded new supply significantly, with over 690,000 BTC absorbed compared to a supply of just over 109,000 BTC as of August 29, creating a demand-supply ratio of about 6.3 times.

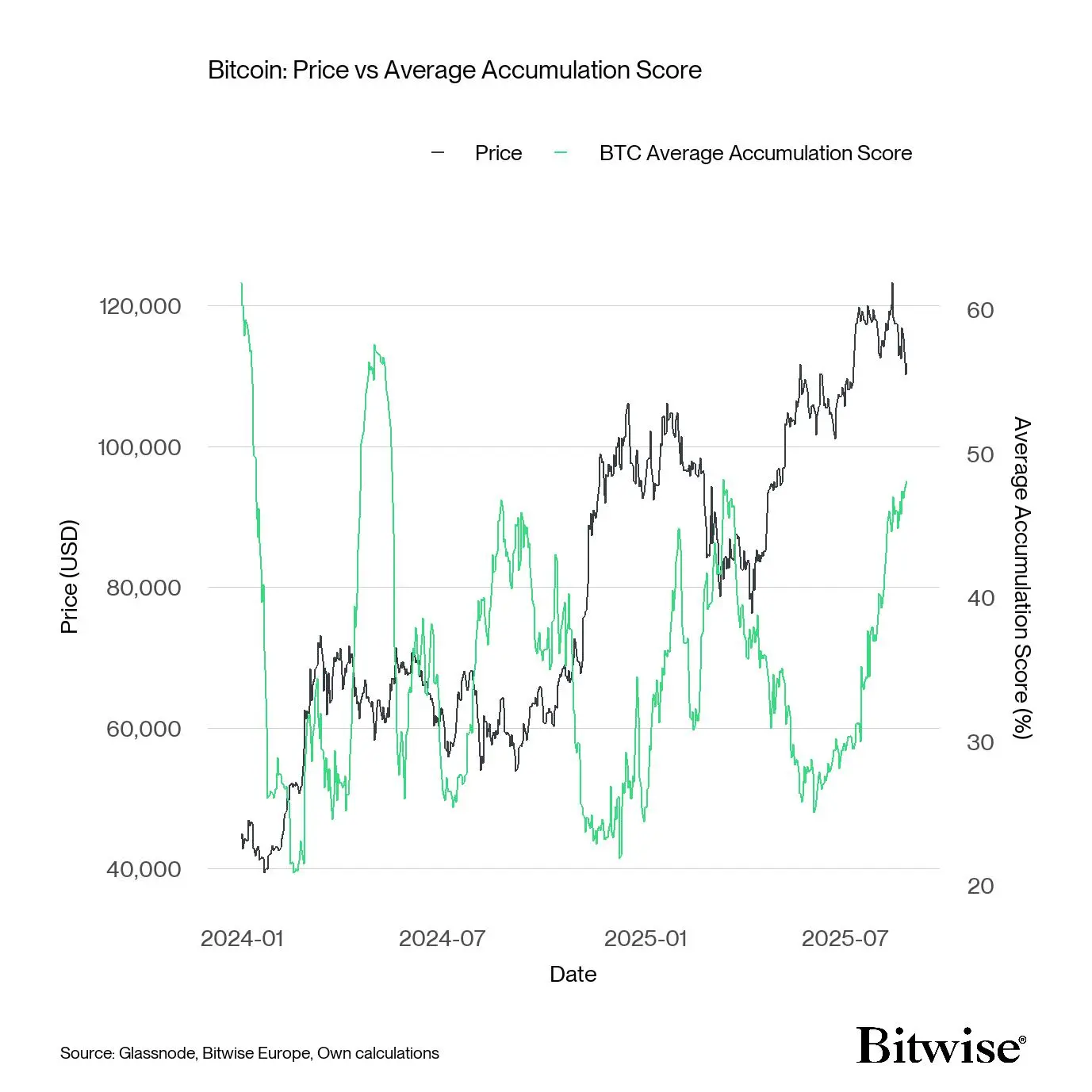

- Retail buying activity across all wallet sizes has reached its highest levels since April, indicating robust demand from individual investors.

Price analysis shows:

- BTC traded within a range of $2,150 between August 30 and 31, fluctuating between $107,490 and $109,640.

- Support was noted around $107,800, where trading volumes surpassed daily averages.

- Resistance formed near $109,600, with profit-taking evident at this level.

- In the last hour of the analysis, BTC moved from $109,250 to $108,700, closing close to $108,900.