Bitcoin Active Addresses Indicate Potential Golden Cross Formation

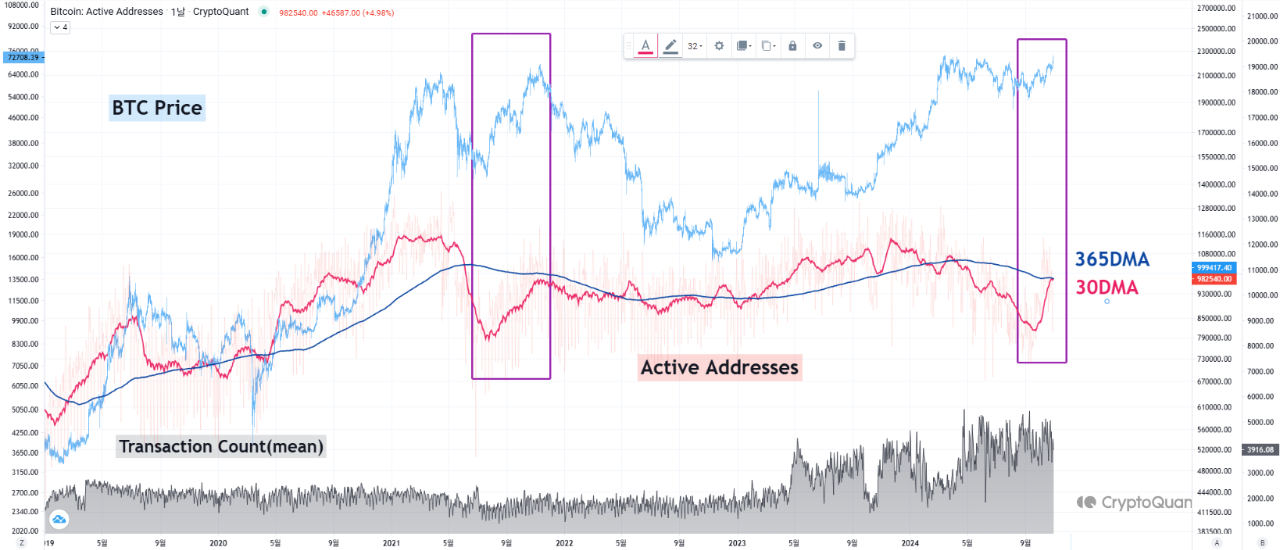

Bitcoin's on-chain activity is increasing as analyst ‘Yonsei Dent’ from CryptoQuant identifies a potential golden cross in the active addresses metric. This indicator measures unique addresses interacting with the Bitcoin network, reflecting overall activity, investor engagement, and market trends.

Golden Cross On Bitcoin Active Addresses

Dent's analysis suggests that applying monthly and annual moving averages to active addresses may indicate bullish momentum shifts. A high count of active addresses signifies strong participation, while a decline can signal reduced interest. The crossing of the 30-day moving average above the 365-day average—termed a "golden cross"—often correlates with upward price movements in Bitcoin.

This pattern indicates renewed interest from retail and institutional investors, potentially supporting or boosting Bitcoin’s value. Dent highlights the significance of the golden cross in relation to past market cycles, noting that a previous shift led to a “dead cross,” which typically indicates bearish sentiment. Current transaction volumes are nearly double those during Bitcoin's 2021 price cycle, suggesting increased market engagement.

A weak or inconclusive golden cross could mirror mid-2021 trends, where price increases encountered resistance without sustaining upward movement.

BTC On Track For $100k Rally?

Recently, Bitcoin has experienced a notable price rebound, regaining levels it previously faced resistance at. Over the past month, BTC has risen by 13% and nearly 10% in the last week, trading above $72,000. This price represents a 2.3% decrease from its all-time high (ATH) in March 2024, positioning it closer to a potential increase beyond $100,000.

Analyst Javon Marks indicated that Bitcoin's stability above $67,559 suggests a target of $116,652, representing an upside potential of 61.2% from current levels.

#Bitcoin (BTC) has just recently marked its highest 3 Day close EVER, and is currently holding above a vital level at $67,559.

Being above this level means the target at $116,652 is, according to technicals, in play, implying room for another +61.2% upside from here! https://t.co/R483X5gC5J pic.twitter.com/rBKjwXdPft— JAVON MARKS (@JavonTM1) October 30, 2024

Featured image created with DALL-E, Chart from TradingView.