Updated 17 December

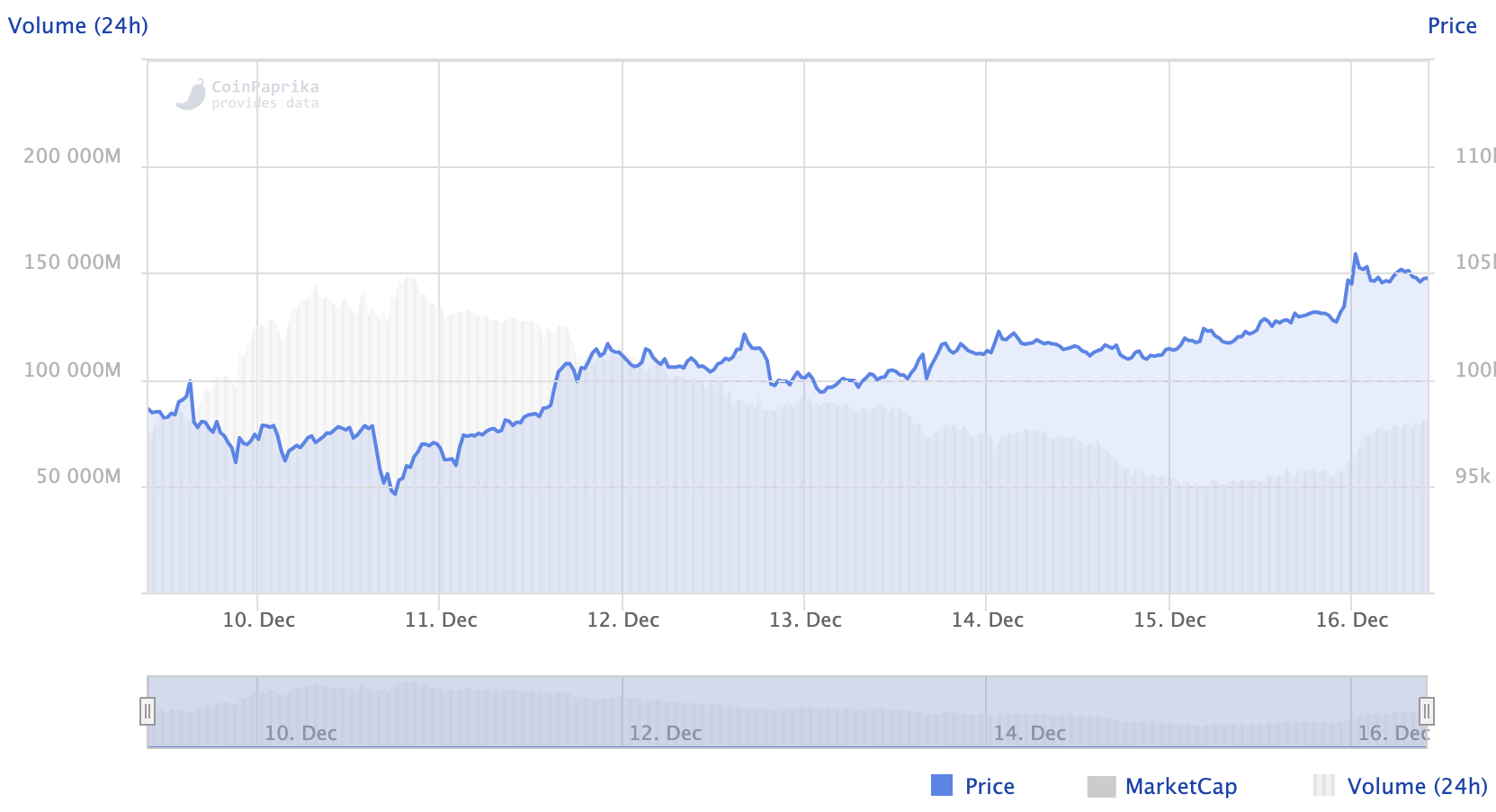

Bitcoin Reaches All-Time High of $106,368 Driven by Institutional Interest

Bitcoin has reached a new all-time high, exceeding $106,368. This milestone reflects increased institutional interest, broader adoption, and favorable market conditions.

Crypto analyst Rachael Lucas from BTC Markets stated that this record indicates a turning point for Bitcoin. She noted that the achievement showcases Bitcoin's transition from a retail-dominated asset to one increasingly influenced by institutional investors, ETFs, and corporate adoption, solidifying its status as a mainstream financial asset.

Key events have driven Bitcoin’s recent surge. US President-elect Donald Trump announced plans for a strategic cryptocurrency reserve, generating optimism in the market. His commitment to enhance the crypto landscape has increased confidence in Bitcoin’s long-term prospects.

Additionally, MicroStrategy, a major corporate holder of Bitcoin, contributed to the excitement. On December 23, the company was included in the Nasdaq 100 index, marking a significant achievement for both MicroStrategy and Bitcoin. Co-founder Michael Saylor hinted at potential further Bitcoin purchases, highlighting institutional support.

Riot Platforms, a leading Bitcoin mining company, also revealed its acquisition of thousands of Bitcoins. This action strengthens its market position and reflects growing confidence in Bitcoin’s price trajectory, fueling positive sentiment and increasing demand.

Macroeconomic factors are influential as well. Investors are closely watching the upcoming Federal Reserve FOMC meeting, with expectations of a rate cut seen as beneficial for Bitcoin, typically boosting risk assets. Market participants remain optimistic that these developments will sustain Bitcoin’s growth.

As Bitcoin sets new records, the market is attentive to its next steps. Its ability to maintain upward momentum or face a correction will depend on market sentiment and broader economic conditions. Bitcoin’s latest milestone underscores its maturation and expanding role in the global financial landscape.