Updated 19 December

Bitcoin Reaches New All-Time High of $107,756.83 on December 17

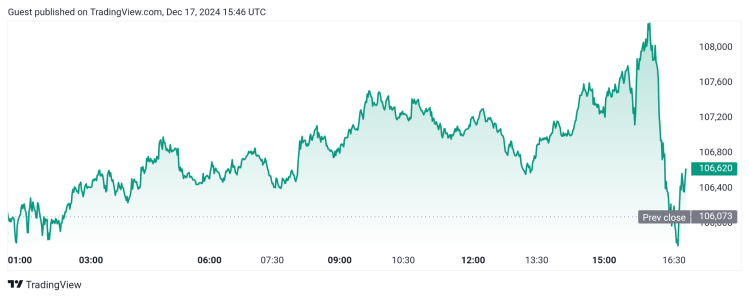

On December 17, Bitcoin (BTC) reached a new all-time high (ATH) of $107,756.83 before decreasing to $106,657.32 at the time of reporting. Its strong bullish momentum leads market observers to speculate on the possibility of surpassing this record again.

Reasons Behind the Rise

- Institutional investment has significantly influenced Bitcoin's price surge, particularly through large purchases by companies like MicroStrategy and Riot Platforms, enhancing market confidence. MicroStrategy's inclusion in the Nasdaq 100 Index has further fueled optimism.

- Investors are seeking protection against inflation and economic uncertainty. Speculation regarding potential federal Bitcoin reserves and inflationary pressures has led to increased investments as a safeguard against economic instability.

- Technological advancements and network improvements have contributed to Bitcoin's bullish trend. Analysts expect continued growth due to higher lows and the formation of bullish patterns.

Bitcoin Price Prediction

Following its peak of $107,756.83 on December 17, Bitcoin has shown a daily increase of 1.74% and a weekly rise of 10.83%. Earlier in December, it achieved a record high of $100,000, marking an 18.41% increase over the past 30 days.

Analysts attribute BTC’s recent surge to a series of short liquidations, with increasing investor sentiment contributing to rising prices. There is speculation whether BTC can achieve another record high soon. Market analysts suggest that favorable conditions, including a potential bull run and political shifts following President-elect Donald Trump's anticipated return to office in 2025, could positively impact Bitcoin's price trajectory.

Can Bitcoin Record A New ATH With Growing Interest?

Bitcoin's recent ATH of $107,756.83 has prompted speculation regarding its ability to set new records. Analysts indicate that upcoming market dynamics and political changes could support Bitcoin in achieving new price milestones.

Featured image from Pixabay, Chart from TradingView