Updated 18 December

Bitcoin Reaches All-Time High of $108,264 Amid Rising Institutional Interest

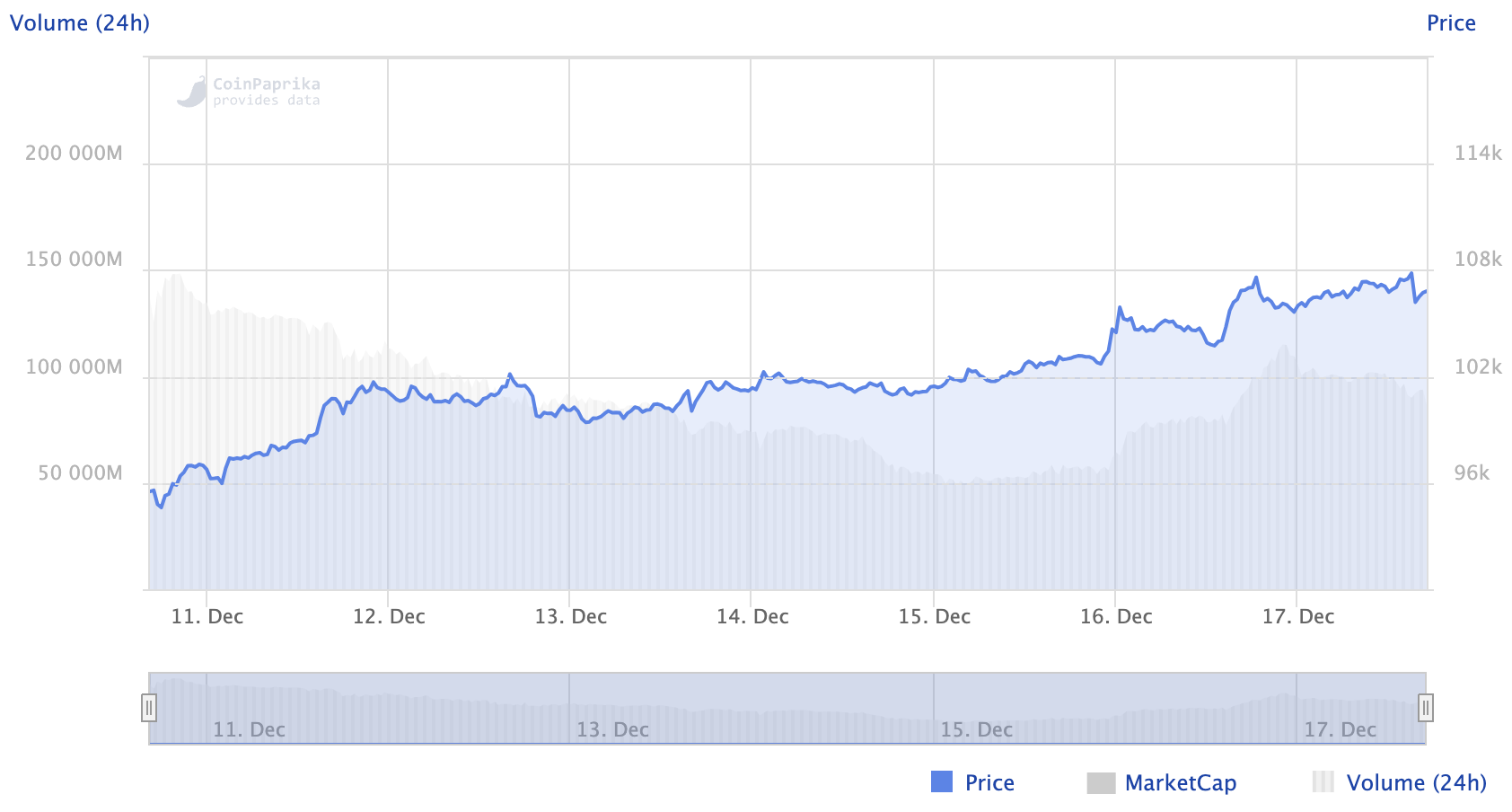

Bitcoin has reached an all-time high of $108,264 and is currently trading at $108,223, reflecting a 2% increase in the last 24 hours. The price surge of nearly 60% since the U.S. elections is attributed to growing confidence in President-elect Donald Trump's pro-crypto policies, including plans for a strategic Bitcoin reserve and the nomination of crypto supporter Paul Atkins as SEC Chair.

Institutional interest significantly contributes to Bitcoin's rise, with over 70 public companies now holding Bitcoin as part of their financial strategy. Michael Saylor, chairman of MicroStrategy, referred to Bitcoin as the “Cyber Manhattan” of the digital age. MicroStrategy holds 439,000 BTC, valued at approximately $46 billion.

Corporate rules are evolving to favor Bitcoin, as the Financial Accounting Standards Board (FASB) has updated regulations allowing companies to include Bitcoin on balance sheets without adverse accounting effects. James Lavish from the Bitcoin Opportunity Fund emphasized that this change legitimizes Bitcoin as a corporate asset.

Investor confidence surged following Trump’s election win, with a notable increase in “whales”—large Bitcoin holders. On-chain analyst Ali Martinez reported that Bitcoin whales acquired over 70,000 BTC, worth $7.28 billion, within 48 hours, contributing to the recent price rally. Optimism is bolstered by MicroStrategy's inclusion in the Nasdaq 100 index on December 23. Analysts predict Bitcoin prices could reach between $150,000 and $200,000 by the end of 2025.

As corporate adoption increases and regulatory support strengthens, Bitcoin continues to achieve new milestones, positioning itself as a critical long-term asset for many investors.