9 1

Bitcoin Reaches All-Time High of $111,875 Amid Rising Institutional Demand

Bitcoin (BTC) reached an all-time high of $111,875 early Thursday, surpassing its previous record as institutional demand rises amidst concerns about U.S. debt and rising bond yields. Key points include:

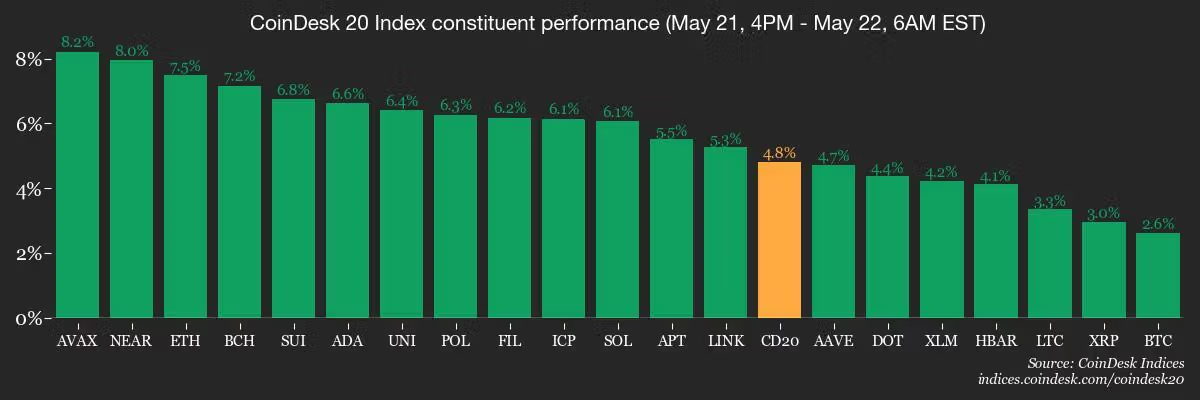

- BTC gained approximately 3.8% in 24 hours; broader CoinDesk 20 index rose 4.74%.

- U.S. 10-year Treasury yield increased to 4.6%; 30-year topped 5%, raising concerns over a potential $5 trillion debt increase due to President Trump's tax bill.

- Japan's bond yields hit record highs amidst scrutiny over its 234% debt-to-GDP ratio.

- Traders are building long positions in BTC options, with significant open interest at $110,000 and $120,000 strikes for contracts expiring in late June.

- Spot Bitcoin ETFs saw $1.6 billion in inflows last week, totaling $4.24 billion in May, reaching $129 billion in net assets.

Despite bullish activity, some bearish signs exist. Traders are positioning for consolidation rather than declines. Additionally, recent credit downgrades may be too pessimistic.

Market Overview

- BTC is currently priced at $110,690.36 (+4.05% in 24hrs).

- ETH rose 6.19% to $2,662.72.

- CoinDesk 20 index increased by 4.88% to 3,348.63.

- Funding rates on Binance for BTC stand at 0.03%.

Technical Insights

- BTC closed above the previous peak of $109,000, suggesting continued upward momentum.

- Resistance expected around $112,000-$113,000; support at $100,000 following recent consolidation.

Investors should monitor upcoming economic data releases and ongoing market dynamics as they influence cryptocurrency valuations.