Bitcoin Reaches $76,800 All-Time High Following Fed Rate Cuts

Bitcoin (BTC), the leading cryptocurrency by market capitalization, reached a new all-time high of $76,800 following the recent US presidential election, where Donald Trump secured another term and the US Federal Reserve (Fed) signaled a more favorable monetary policy.

Fed's Second Consecutive Rate Cut

On Thursday, the Federal Reserve announced a 25 basis point cut to its benchmark overnight lending rate, now at a target range of 4.50%-4.75%. This follows a half-percentage point reduction in September, reflecting a shift towards balancing inflation control with labor market support.

The Federal Open Market Committee (FOMC) noted a revised assessment of economic risks, indicating a balanced outlook for achieving employment and inflation goals, contrasting with the previous month's optimism.

Crypto analyst Doctor Profit suggested that the price increases in both stock and crypto markets were due to anticipation of the Fed's rate cut. He predicts that further rate cuts could continue to drive up prices in these markets.

Positive Trends For Bitcoin And Ethereum Post-Election

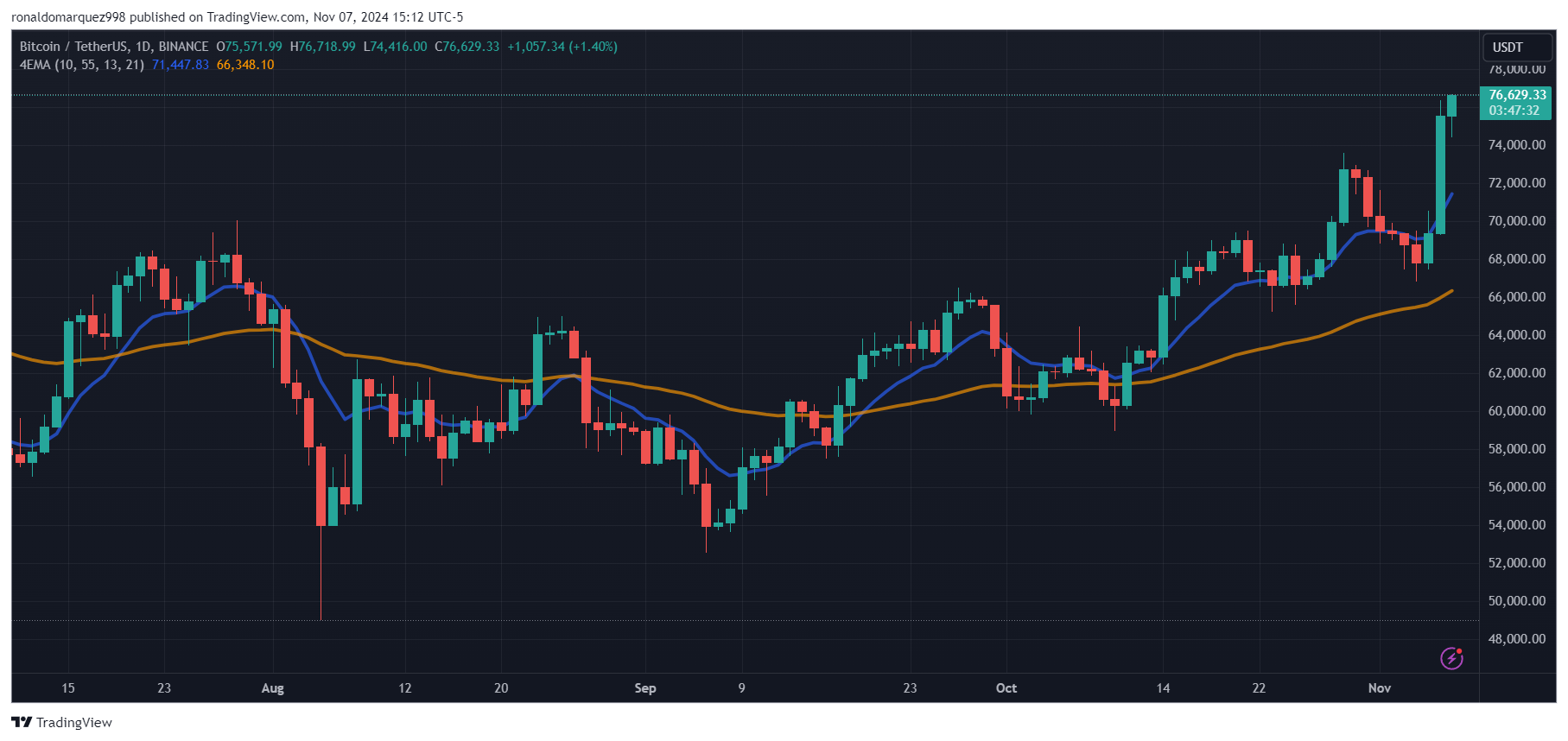

Aurelie Barthere, Principal Research Analyst at Nansen, highlighted that Bitcoin's rise above its previous all-time high, combined with high trading volumes, indicates strong market momentum.

Barthere observed a period of "de-risking" before the election due to unfavorable polls for Trump, followed by a rush to "re-risk" as confidence returned post-election, evidenced by rising prices. She noted that the Republican victory in the House of Representatives could further amplify this rally but warned of potential profit-taking as new policies are tested, especially regarding pressure on the US SEC chair to resign.

Ethereum is also gaining traction, with rising expectations for a resurgence in decentralized finance (DeFi). Barthere noted an uptick in the ETH/BTC price ratio and significant net inflows into Ethereum exchange-traded funds (ETFs), totaling $52 million on the day of the election results. These inflows indicate broader retail interest in Ethereum, which has yet to see significant adoption.

At the time of writing, Bitcoin was trading at $76,629, up nearly 10% over the past week. Similarly, ETH rose 14% during the same period, reaching a current price of $2,885.

Featured image from DALL-E, chart from TradingView.com.