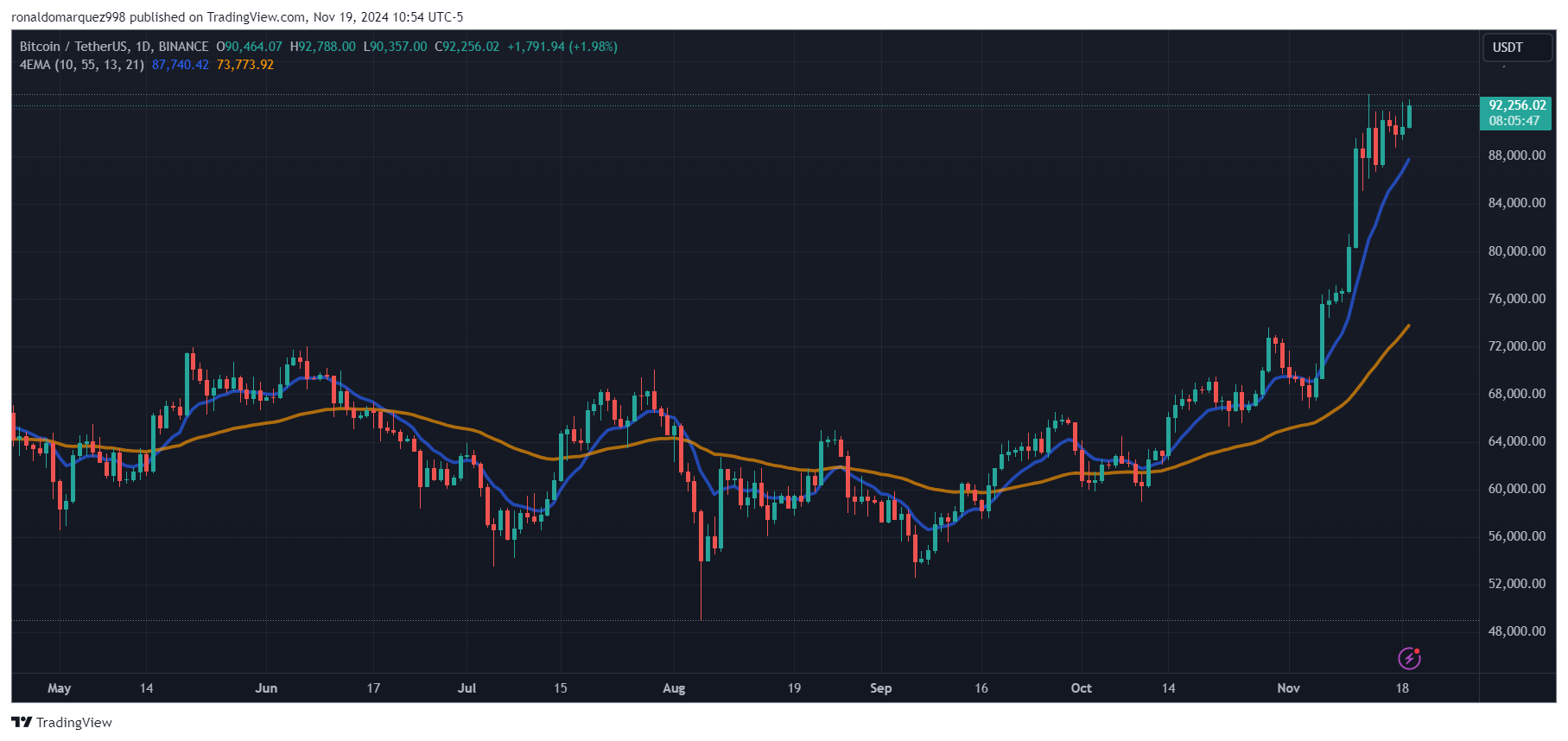

Bitcoin Reaches New All-Time High of $93,300 Amid Uptrend

Since November 5, following President-elect Donald Trump's election victory, Bitcoin has risen significantly, reaching an all-time high of $93,300. Currently, BTC trades between $89,000 and $92,000, potentially moving toward the $100,000 milestone. This raises questions about the feasibility of a price of $1 million per coin over the next decade.

A Long-Term Vision For Investors

Market expert VirtualBacon analyzed the potential for Bitcoin to surge nearly 1,000% from current levels. He forecasts Bitcoin could reach $200,000 in one to two years but highlights that altcoins may yield higher returns at greater risk, often experiencing declines of 80% to 90% during bear markets. Unlike altcoins, which face regulatory scrutiny, Bitcoin is viewed as a safer long-term investment.

VirtualBacon emphasizes Bitcoin's fundamental utility as a store of value, supported by its fixed supply of 21 million coins, global accessibility, and resistance to censorship. He posits that if Bitcoin becomes recognized as the digital gold of the 21st century, achieving a market capitalization comparable to gold's estimated $13 trillion is plausible.

Key growth drivers include increased participation from asset managers, corporate treasuries, central banks, and wealthy individuals. Recent data shows Bitcoin ETFs attracted record inflows, with $1 billion invested last week, indicating growing institutional confidence. Corporations like Microsoft are considering Bitcoin reserves, enhancing its strategic value, while wealthy individuals adopt Bitcoin as a standard portfolio allocation.

What Does Bitcoin Need To Reach $1 Million?

Two critical factors for Bitcoin to hit $1 million are global wealth growth and portfolio allocation. In 2022, total global wealth was approximately $454 trillion, projected to grow to $750 trillion by 2034. Gold currently holds about 3.9% of global wealth, while Bitcoin stands at only 0.35%. A rise in Bitcoin's allocation to just 3%, still below gold's share, could elevate its market cap to $20 trillion, resulting in a price of $1 million per coin.

Historically, gold's market cap expanded significantly post the launch of exchange-traded funds in 2004, increasing from 1.67% to 4.74% over a decade. If Bitcoin follows this trajectory, its allocation could increase from 0.35% to 1.05% or more, leading to a market cap of around $7.92 trillion, equating to about $395,000 per Bitcoin. Thus, reaching $1 million would require Bitcoin to capture approximately 57% of gold's projected market cap by 2034.

With gold representing 4.7% of global portfolios compared to Bitcoin's 0.35%, an increase in Bitcoin’s share to 3%—just 60% of gold's allocation—could result in a $20 trillion market cap and a $1 million price point.

Currently, BTC is trading at $92,240, reflecting a weekly increase of 7%.

Featured image from DALL-E, chart from TradingView.com.