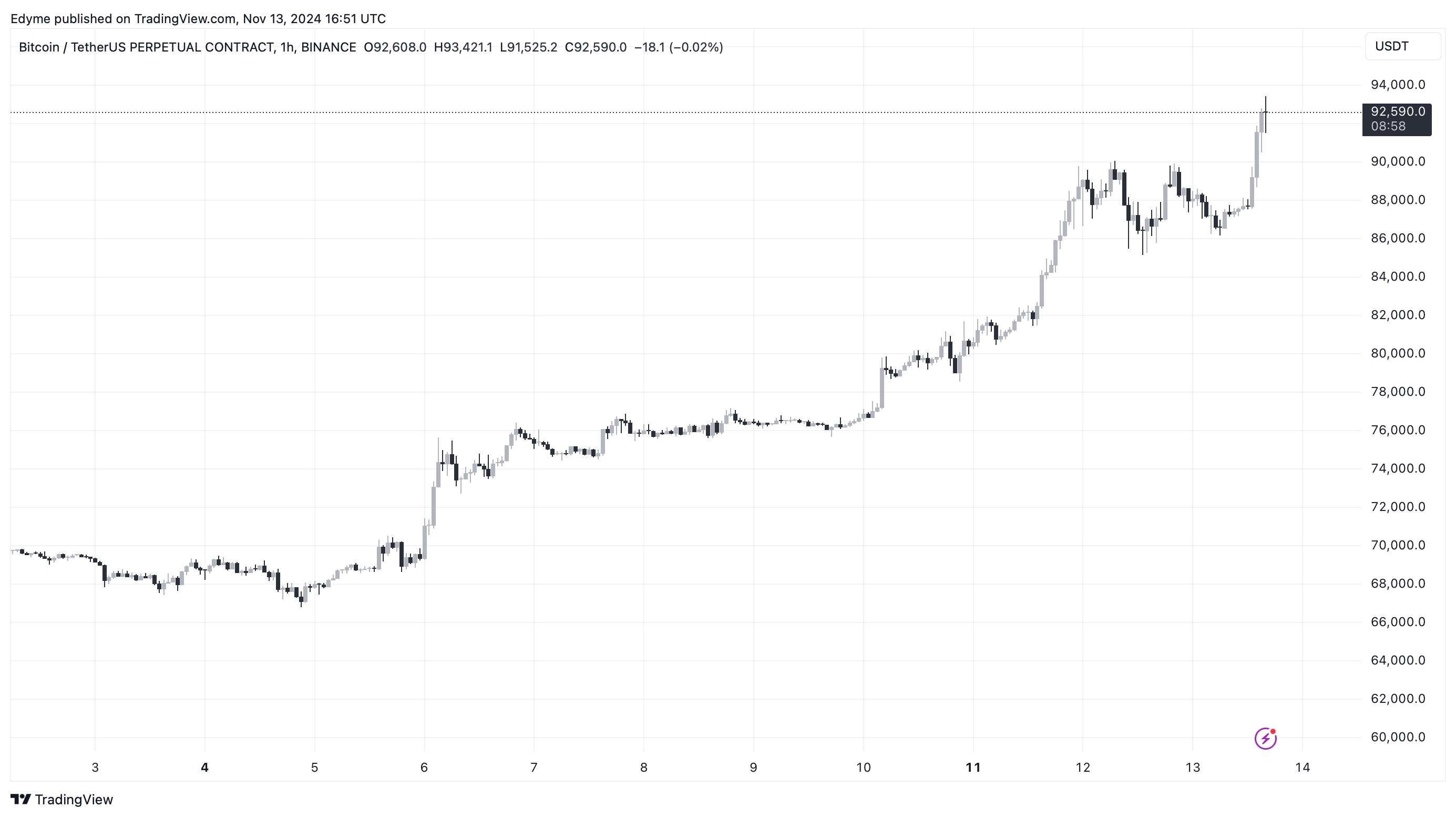

Bitcoin Reaches New All-Time High of Approximately $93,477

Bitcoin is experiencing significant bullish momentum, currently trading at an all-time high of approximately $93,477. This peak follows a dip earlier today to $85,000. At present, BTC has slightly retraced, down 0.5% from its peak, trading at $92,544, while still reflecting a 5.6% increase over the past day.

Bitcoin Finally At Its Peak?

Market analysts are evaluating Bitcoin’s potential trajectory amidst its price surge. Crazzyblockk, a CryptoQuant analyst, analyzed whether Bitcoin has reached its peak by examining market profitability indicators.

Two key metrics are crucial for assessing Bitcoin’s profitability: the number of profitable Bitcoin addresses and the overall profitability rate for these addresses. The analysis indicates that nearly all Bitcoin addresses are in profit, suggesting heightened market risk. However, current profit margins across various holding periods remain below those seen during previous bull markets, where margins reached 800-900%.

Despite concerns regarding potential short-term price corrections due to elevated risks, Crazzyblockk remains confident in Bitcoin's long-term upward potential. He advocates for strategies like Dollar-Cost Averaging (DCA) and a long-term investment approach for capital growth.

More Room For Gains?

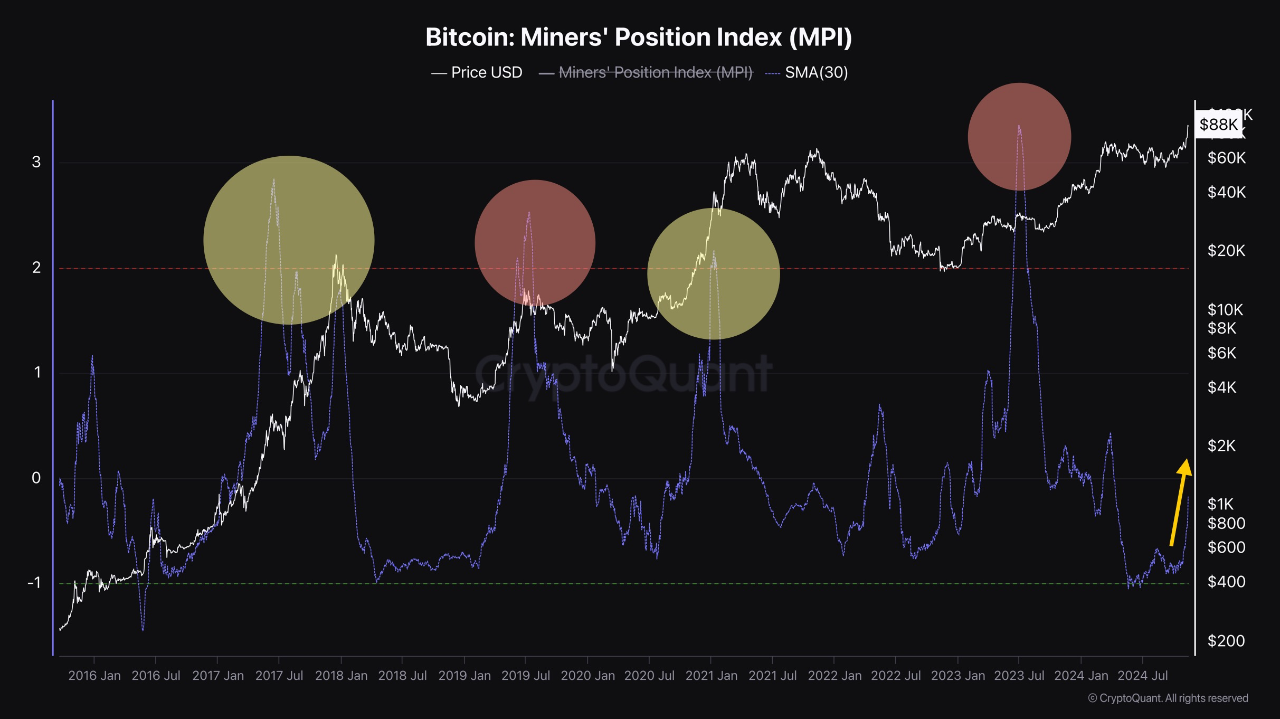

In another analysis, CryptoQuant analyst Avocado Onchain discussed miner activity and its implications for Bitcoin’s price movement. Some miners have begun taking profits, but this does not necessarily indicate a weakening of Bitcoin’s overall upward potential.

The Miner Position Index (MPI), which tracks Bitcoin outflows from miners' wallets relative to the annual average, shows a slight increase as Bitcoin reaches new highs. A high MPI indicates increased selling activity, which can signal that Bitcoin’s price may be nearing a cycle peak. However, this could also represent early positioning for the next market cycle when converted to a 30-day moving average.

Patterns of profit-taking by miners near cycle tops often precede subsequent price increases followed by longer-term downtrends. Additionally, the hashrate and mining difficulty have reached new highs, indicating strong miner participation and overall network health. These factors, combined with continued market interest and growing liquidity, suggest further upside potential for Bitcoin's price.

Featured image created with DALL-E, Chart from TradingView