Bitcoin Reaches New All-Time High of $93,483 Amid Bullish Momentum

Bitcoin reached a new all-time high of $93,483, maintaining an upward trajectory with minimal dips over the past nine days. The price has not dropped more than 5% during this bullish phase, attracting significant attention as it continues to defy expectations.

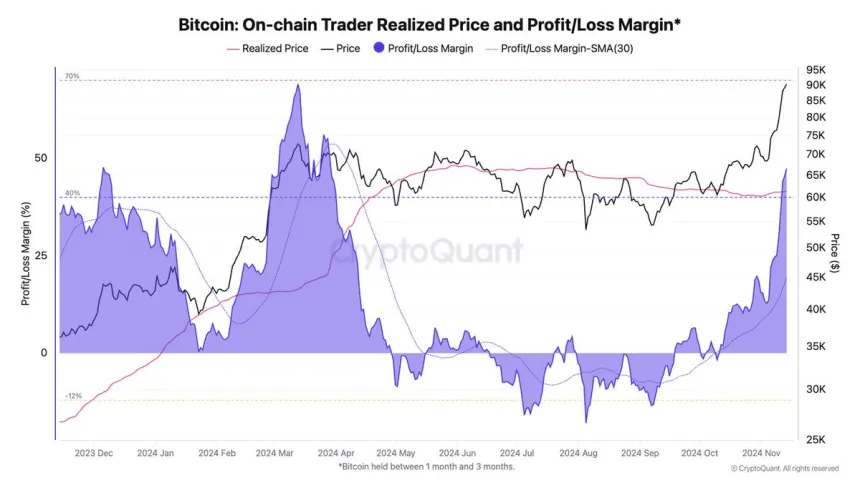

Data from CryptoQuant indicates rising unrealized profit margins among traders, suggesting a potential short-term peak. High unrealized profits often precede corrections as investors look to secure gains. Despite this, the strength of Bitcoin's current price action makes the timing and extent of any correction uncertain.

Bitcoin Strong Move About To Pause?

Since the U.S. election, Bitcoin has surged 38%, but signs point to a possible temporary pause in this aggressive rally. Julio Moreno from CryptoQuant presented a chart showing unrealized profit margins at 47%, a level that historically precedes pullbacks.

High unrealized profit margins indicate significant trader gains, increasing the likelihood of profit-taking that could cool the market. Previous peaks have shown that levels exceeding certain thresholds correlate with heightened correction risks. For instance, March saw unrealized profits at 69%, and December 2023 at 48%, both leading to notable corrections shortly after.

The current 47% level suggests caution is warranted, yet Bitcoin may still have room for growth. Historical trends show the market can sustain higher unrealized profits before reversing. Although a pullback may be imminent, Bitcoin could continue its upward trend for a while longer.

Investors will monitor for consolidation or retracement signs in the coming days. If Bitcoin holds strong support levels, the bull run could persist. Conversely, intensified profit-taking might trigger a correction, allowing Bitcoin to reset for future gains.

BTC Breaking ATH Almost Every Day

Bitcoin has broken its all-time high seven times in eight days, creating a bullish sentiment in the market. Currently priced at $90,620 after peaking at $93,483, Bitcoin's price action remains robust, indicating sustained buying momentum despite the potential for a brief correction.

Given the strong buying pressure, a short-term pullback could establish a new market equilibrium, allowing Bitcoin to test lower demand levels and strengthen support areas for its next upward movement. If profit-taking escalates, Bitcoin might revisit the $85,000 mark as it seeks stability.

In the upcoming days, investors will likely observe this potential consolidation phase to assess Bitcoin’s resilience. A successful retest of support around $85,000 would bolster confidence in the ongoing bull market, laying a stronger foundation for future gains. Overall, while the trend remains bullish, a balanced correction may be necessary to sustain long-term momentum.

Featured image from Dall-E, chart from TradingView