Bitcoin Analyst Highlights Key Metrics for Assessing Market Sentiment

As Bitcoin approaches its all-time high (ATH) of six figures, analyst aytekin from CryptoQuant offers an analysis on metrics for assessing Bitcoin's market temperature, focusing on distinguishing reliable indicators from misleading ones.

Challenges With BTC Key Metrics

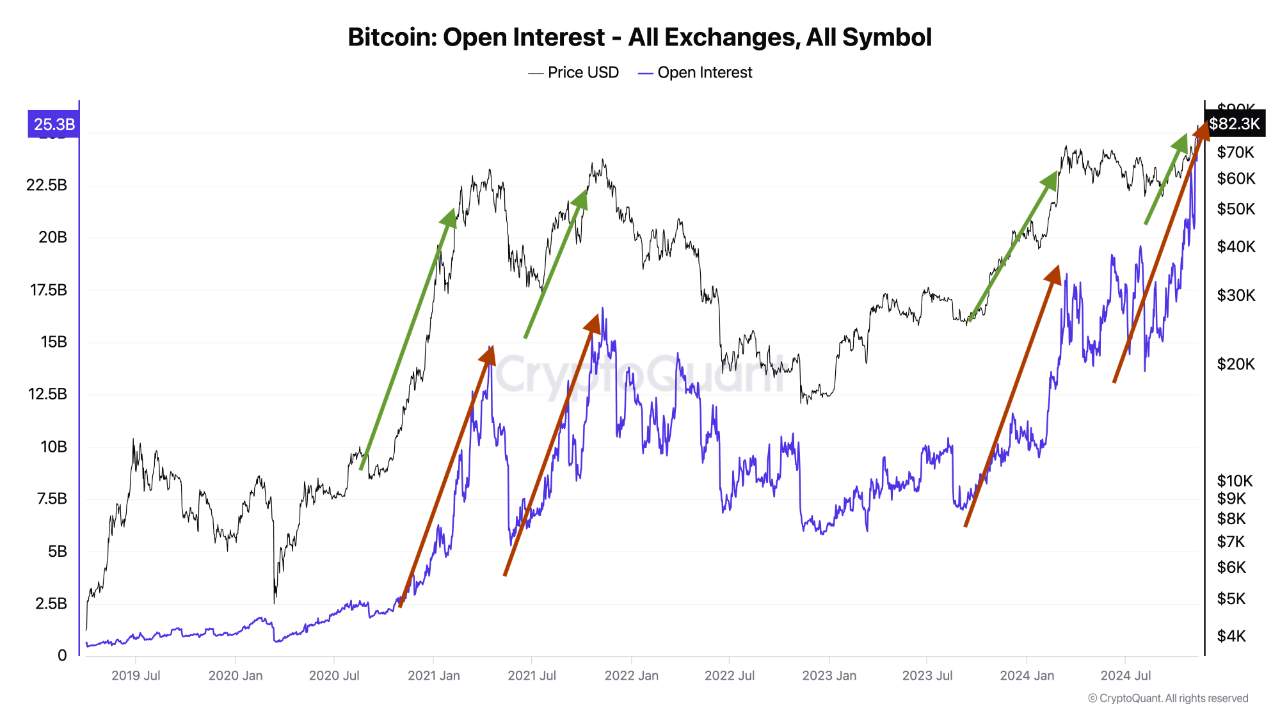

Aytekin notes that establishing a causal relationship between price and open interest is complex. Historical trends show that price fluctuations generally influence changes in open interest rather than the other way around. With the expansion of futures markets and increased Bitcoin adoption, higher open interest levels are expected in the future.

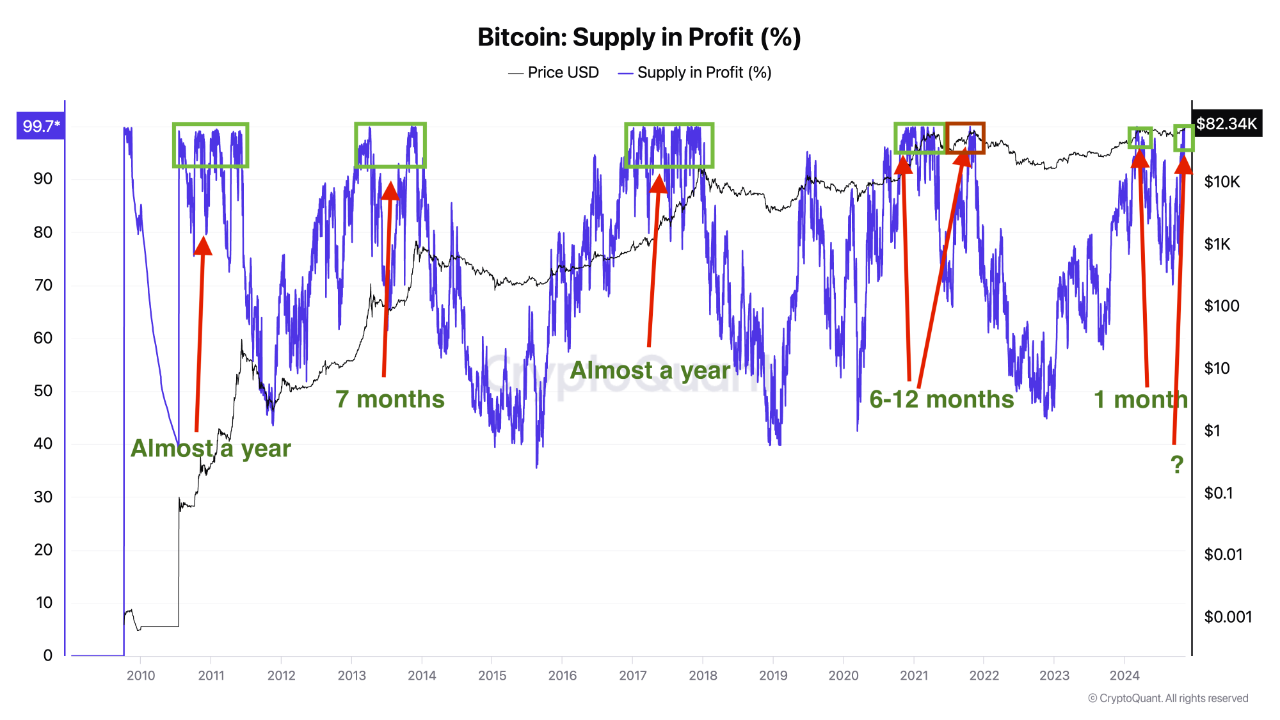

Another metric aytekin considers potentially misleading is the “supply in profit,” which reflects overall network profitability. This metric often spikes above 95% during ATH periods, correlating closely with Bitcoin’s nominal price.

He emphasizes that if extreme profitability consistently leads to significant sell-offs, reaching new highs could be challenging. He advises monitoring the duration of these high-profitability levels, as historically, they have persisted up to a year within broader market cycles.

Credible Metric Suggests Overheating Bitcoin?

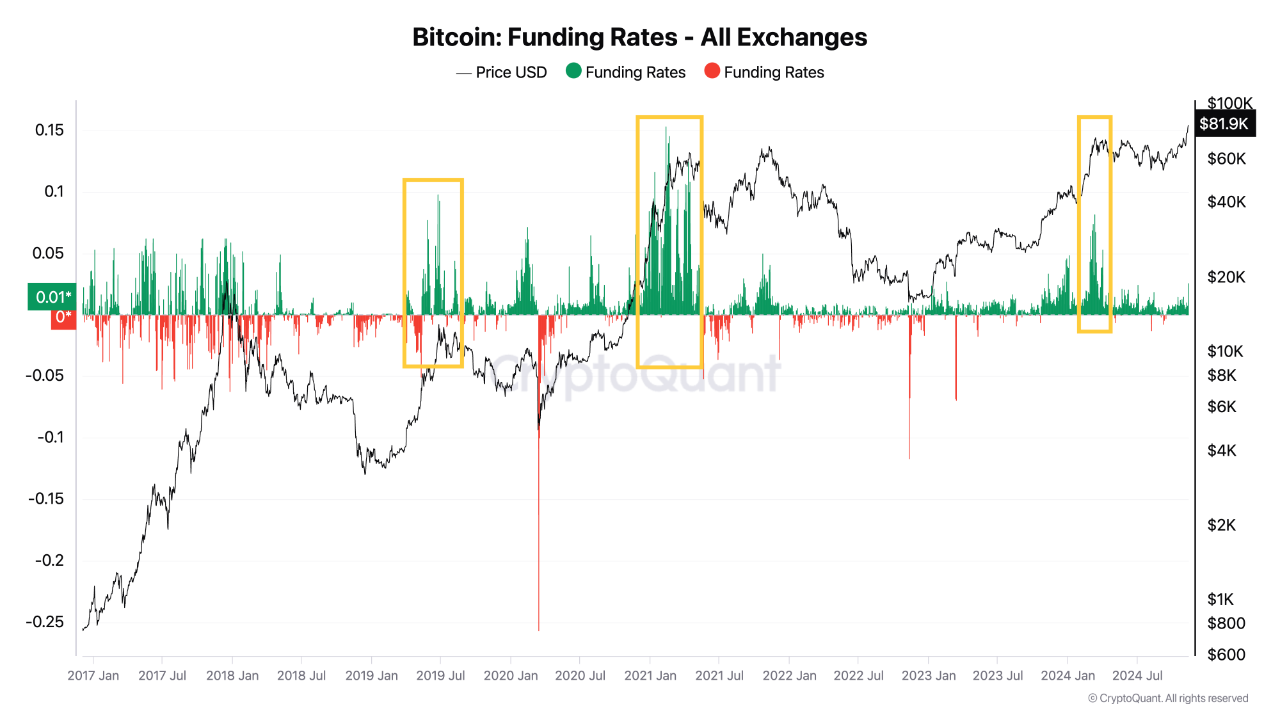

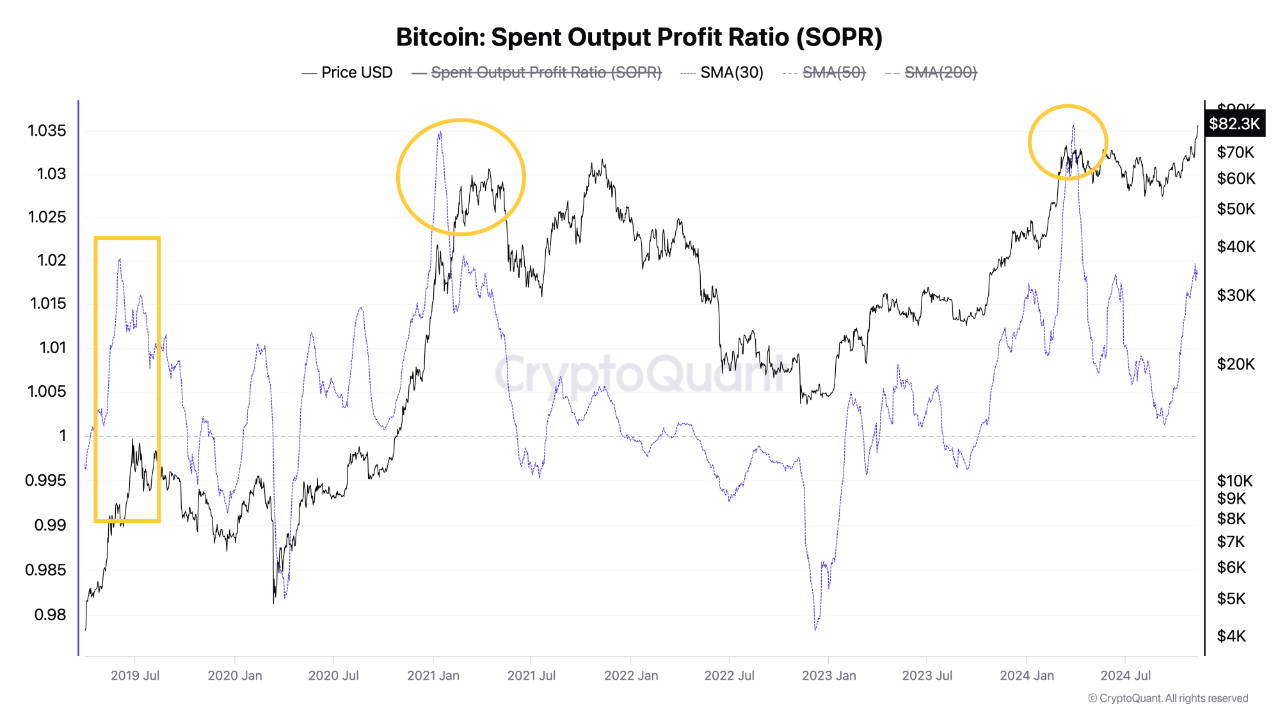

Aytekin identifies two valuable metrics for tracking Bitcoin's market sentiment: the funding rate and the Spent Output Profit Ratio (SOPR). The funding rate, which measures costs between long and short positions in futures, helps identify excessive market optimism.

Currently, funding rates do not indicate extreme market behavior. The SOPR metric provides clarity on profitability trends, particularly when smoothed with a 30-day moving average.

Profitability is not inherently risky unless it coincides with significant supply movements in the market. Current SOPR levels indicate a market showing signs of profitability but not overheating.

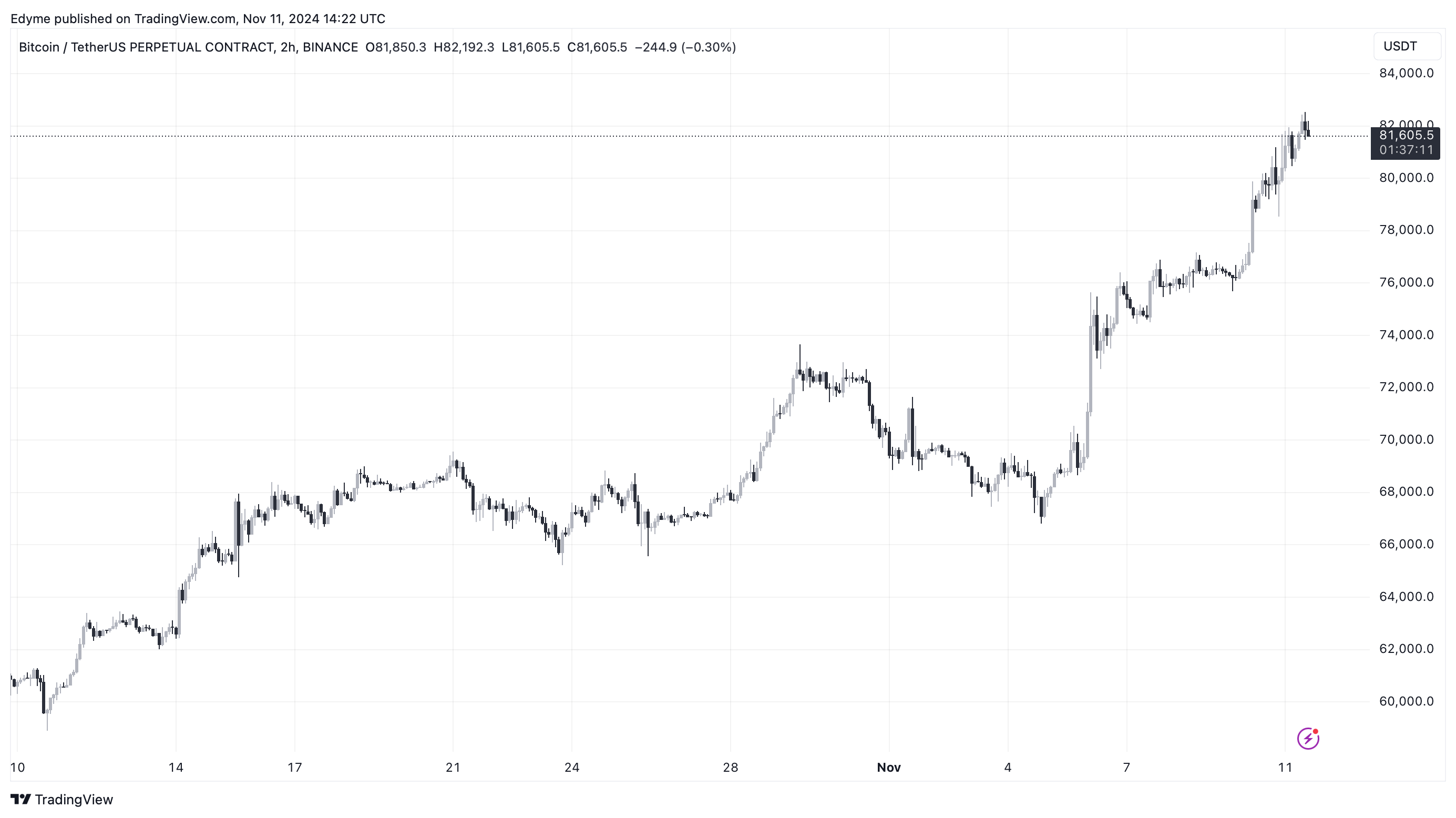

Bitcoin is currently trading at $81,838, reflecting a 2.4% increase over the past day. This price represents a 0.6% drop from its earlier ATH of $82,379.

The asset's market capitalization exceeds $1.6 billion, with a 24-hour trading volume of $90.6 billion.

Featured image created with DALL-E, Chart from TradingView.