Bitcoin Analyst Indicates Potential for Upcoming Bull Run

An analyst has indicated a potential new Bitcoin bull run based on recent developments in an on-chain metric.

Bitcoin US To The Rest Reserve Ratio Sees Recent Reversal

A CryptoQuant Quicktake post discusses the trend in the BTC US to The Rest Reserve Ratio. This metric compares the total Bitcoin reserves of US-based centralized platforms with those of global platforms, including exchanges, banks, and funds.

A rising value indicates a shift of Bitcoin from offshore platforms to American ones, reflecting increased demand from US investors. Conversely, a declining value suggests higher demand for Bitcoin on foreign platforms, indicating a loss of dominance by American exchanges.

The chart below illustrates the trend in the 100-day Exponential Moving Average (EMA) of the Bitcoin US to The Rest Reserve Ratio over the past year and a half:

The graph shows that the 100-day EMA had been declining earlier this year but has recently reversed upwards. This indicates a transfer of Bitcoin from global platforms back to US-based ones. The previous similar trend occurred in late 2023, coinciding with a Bitcoin rally that led to a new all-time high (ATH). The most significant increase in this indicator happened in early 2024, driven by the introduction of spot exchange-traded funds (ETFs) in the US, which gained rapid popularity.

However, after reaching the ATH, the metric peaked and subsequently declined, indicating decreased interest in spot ETFs.

The analyst attributes the ongoing consolidation of Bitcoin this year to a reduction in reserves on US-based platforms. With the recent reversal in the metric, there is potential for renewed bullish momentum if historical patterns hold.

BTC Price

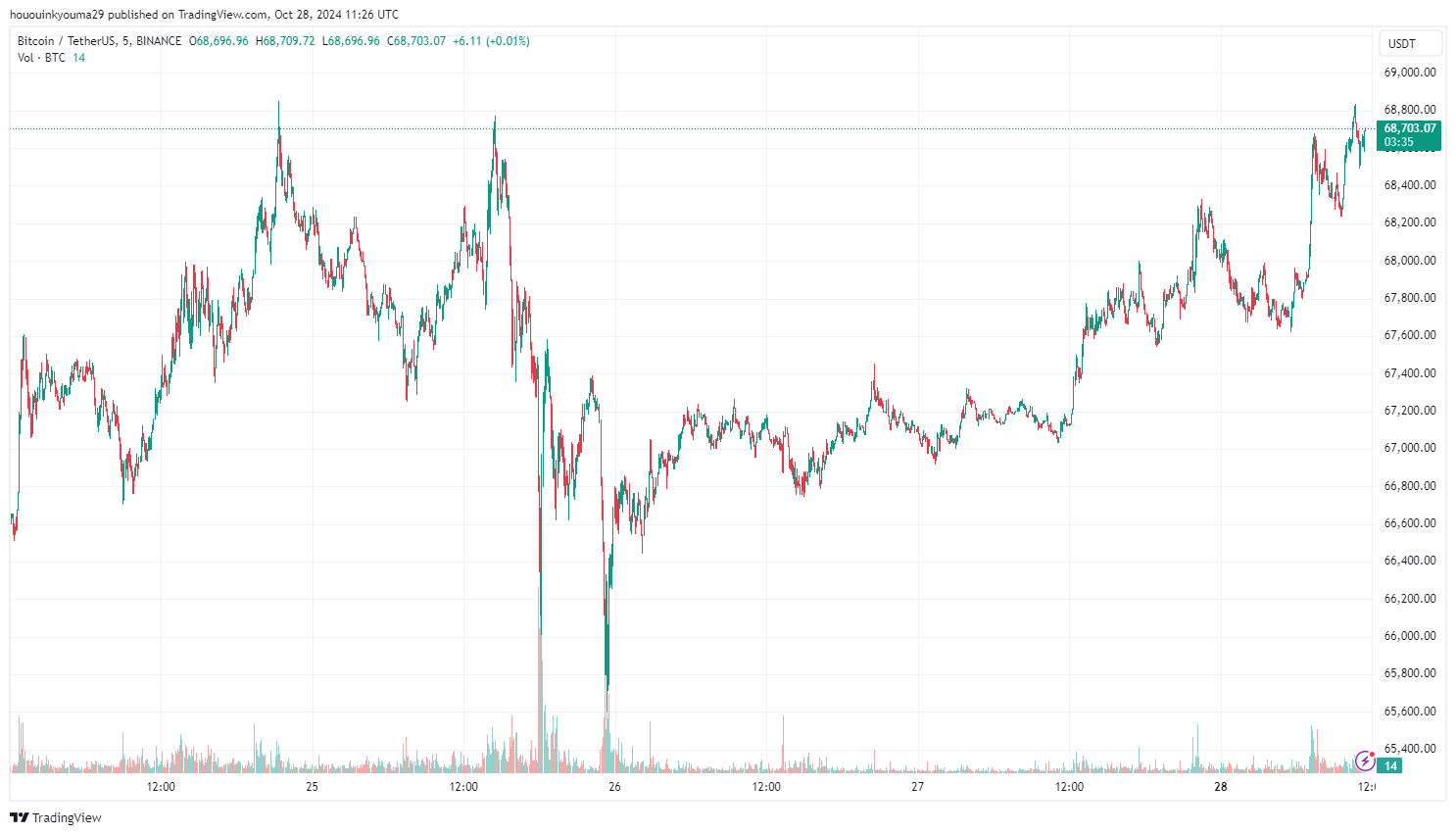

Bitcoin experienced a 2% increase in the last 24 hours, returning to the $68,700 level.