Bitcoin Approaches $123K All-Time High Amid Low Reversal Risk

Bitcoin is trading near critical levels after a 9% rise since August, approaching its all-time high of $123,000. Analysts are divided on the future trajectory:

- Some anticipate a breakout leading to new highs.

- Others warn of potential corrections if buying pressure decreases.

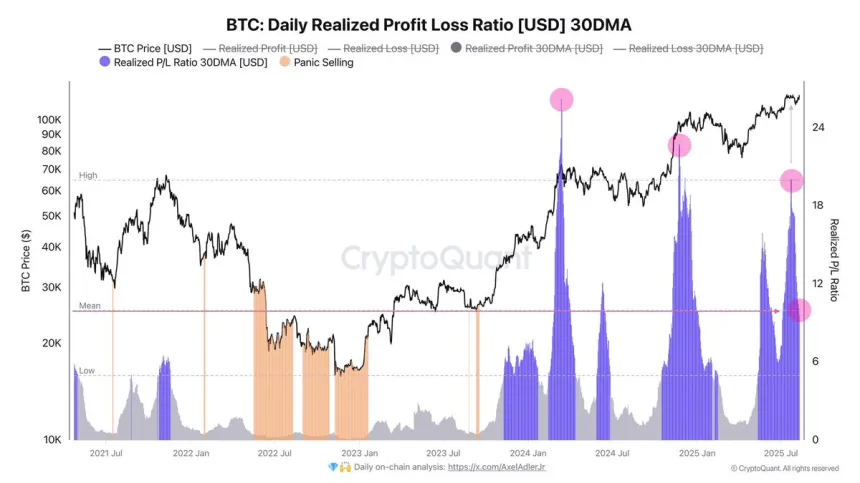

Key data from CryptoQuant indicates the Realized Profit and Loss (P&L) Ratio is close to its historical average, suggesting no overheating in the market yet. This could imply:

- Room for further upside with manageable risk of downturns.

- Long-term trends remain intact but sensitive to sentiment shifts.

Market Analysis

Analyst Axel Adler notes that current market conditions present lower risks for sharp reversals compared to previous cycles. The P&L Ratio's alignment with averages hints at market balance despite volatility.

Bitcoin is at a pivotal price range where a breakout above the all-time high is crucial for momentum continuation. Failure to do so may lead to corrections or sideways consolidation.

On-chain data reflects strong fundamentals, with:

- Healthy accumulation trends.

- Steady network activity.

- Contained leverage in derivatives markets.

However, uncertainties in macroeconomic conditions and regulatory developments continue to impact sentiment.

Current Price Action

Bitcoin has rallied nearly 9% since early August, facing resistance near $123,217.39. After a pullback to around $118,500, this level remains critical for prospective breakout attempts. BTC is currently above key moving averages:

- 50 SMA ($116,605)

- 100 SMA ($117,340)

- 200 SMA ($112,019)

A failure to surpass $123K may trigger renewed selling, while a confirmed breakout could initiate price discovery towards fresh highs.