Bitcoin Average Coin Age Increases During Current Bull Run

An analyst has noted that the age of the average Bitcoin token is increasing during the current bull run, which may positively impact its price.

Bitcoin Average Coin Age Trends Upward

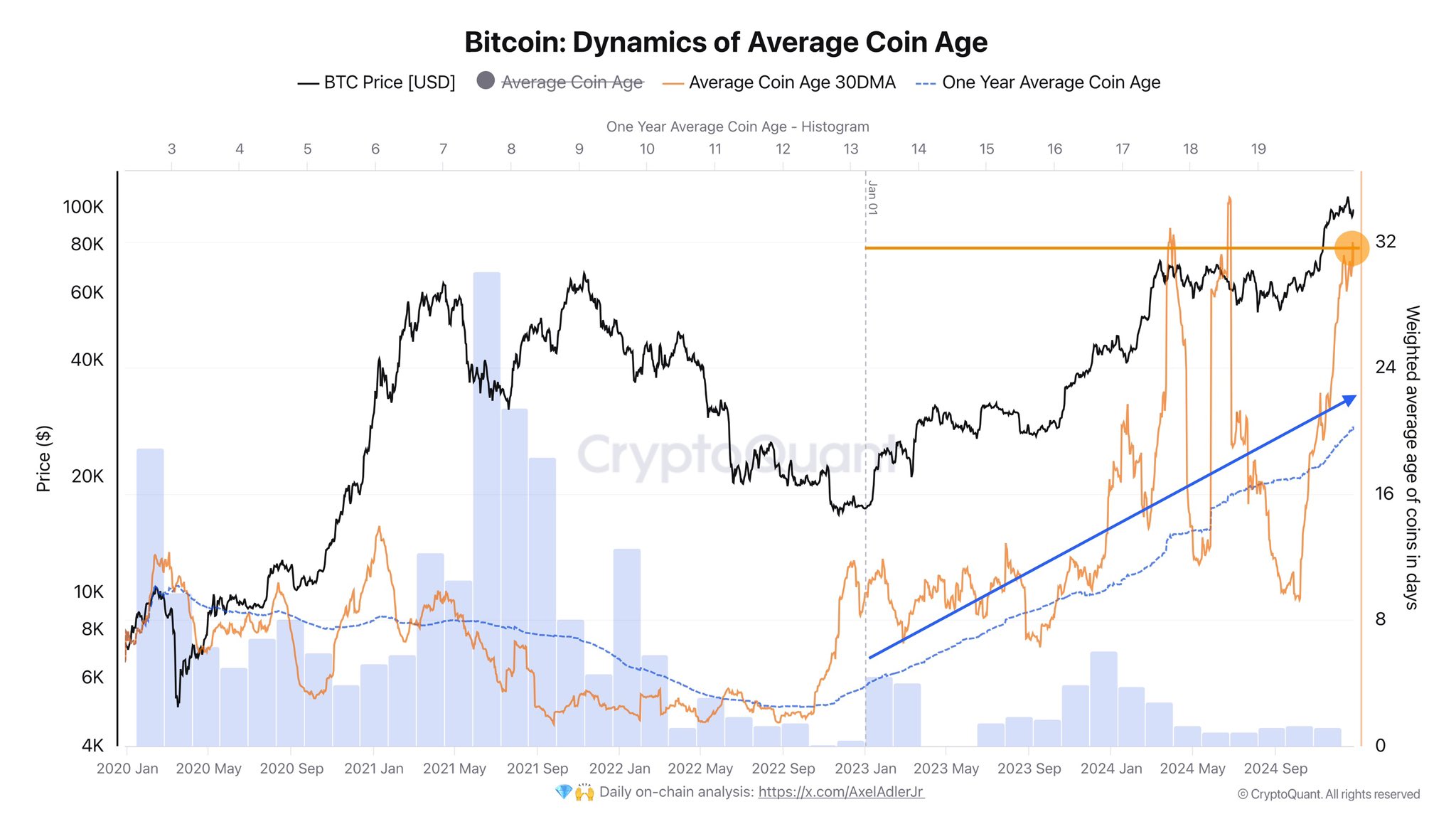

CryptoQuant author Axel Adler Jr discussed the rising trend in Bitcoin's Average Coin Age, an on-chain metric tracking how long BTC tokens remain dormant without transaction activity. A coin is considered dormant when it stays in an address without being used. The longer it remains inactive, the older it becomes.

The following chart illustrates the 30-day and 365-day moving averages (MAs) of Bitcoin's Average Coin Age over recent years:

The graph shows significant spikes in the 30-day MA this year, alongside sharp declines. This indicates investor behavior fluctuating between holding (HODLing) and realizing profits. Notably, the 365-day MA has consistently increased since the end of the 2022 bear market.

Statistically, longer holding periods reduce the likelihood of selling. Therefore, a growing preference for keeping coins dormant suggests a bullish outlook for Bitcoin's price.

This trend contrasts with the 2021 bull market, where the 30-day MA increased while the 365-day MA declined, suggesting improved investor strategies in the current cycle.

Currently, the rapid rise in the 30-day MA indicates active accumulation within the Bitcoin market.

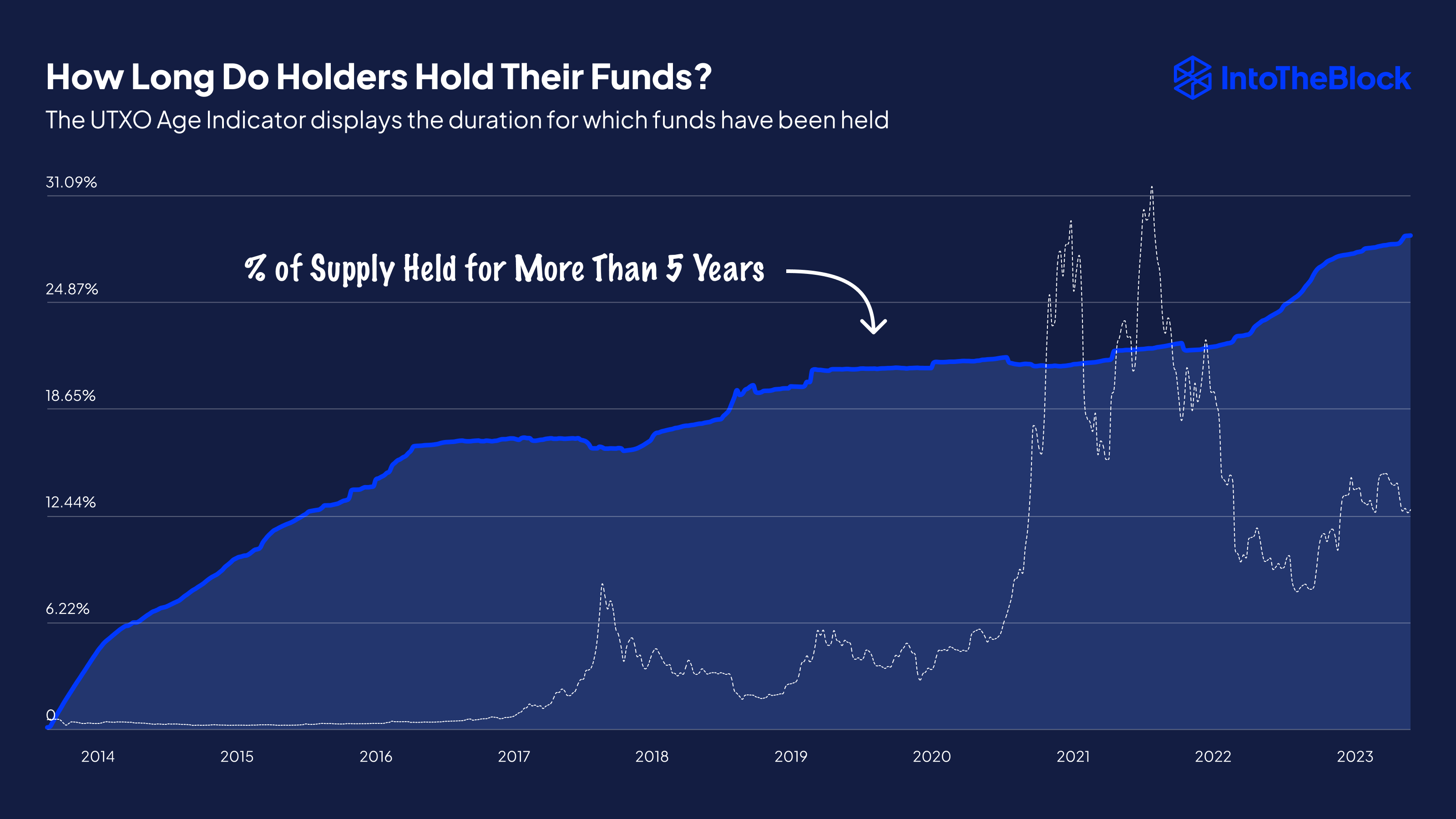

Additionally, market intelligence platform IntoTheBlock reported on the supply of Bitcoin held for over five years:

The data reveals that nearly one-third of circulating Bitcoin tokens have not been transacted in over five years.

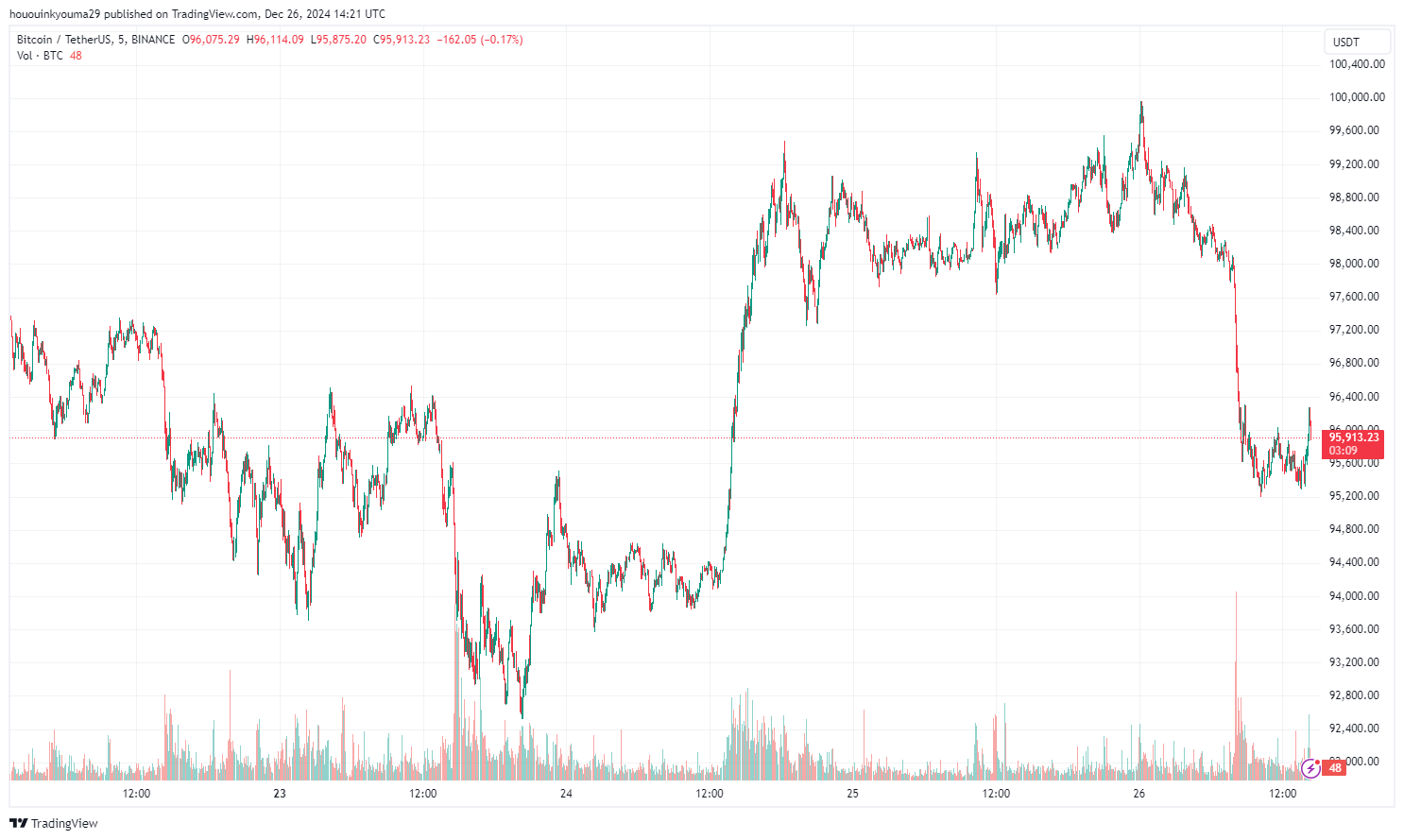

BTC Price Update

Bitcoin experienced a 3% decline in the last 24 hours, bringing its price to $95,900.