11 2

Bitcoin Faces Bear Market as Analysts Predict $40,000 Target by 2026

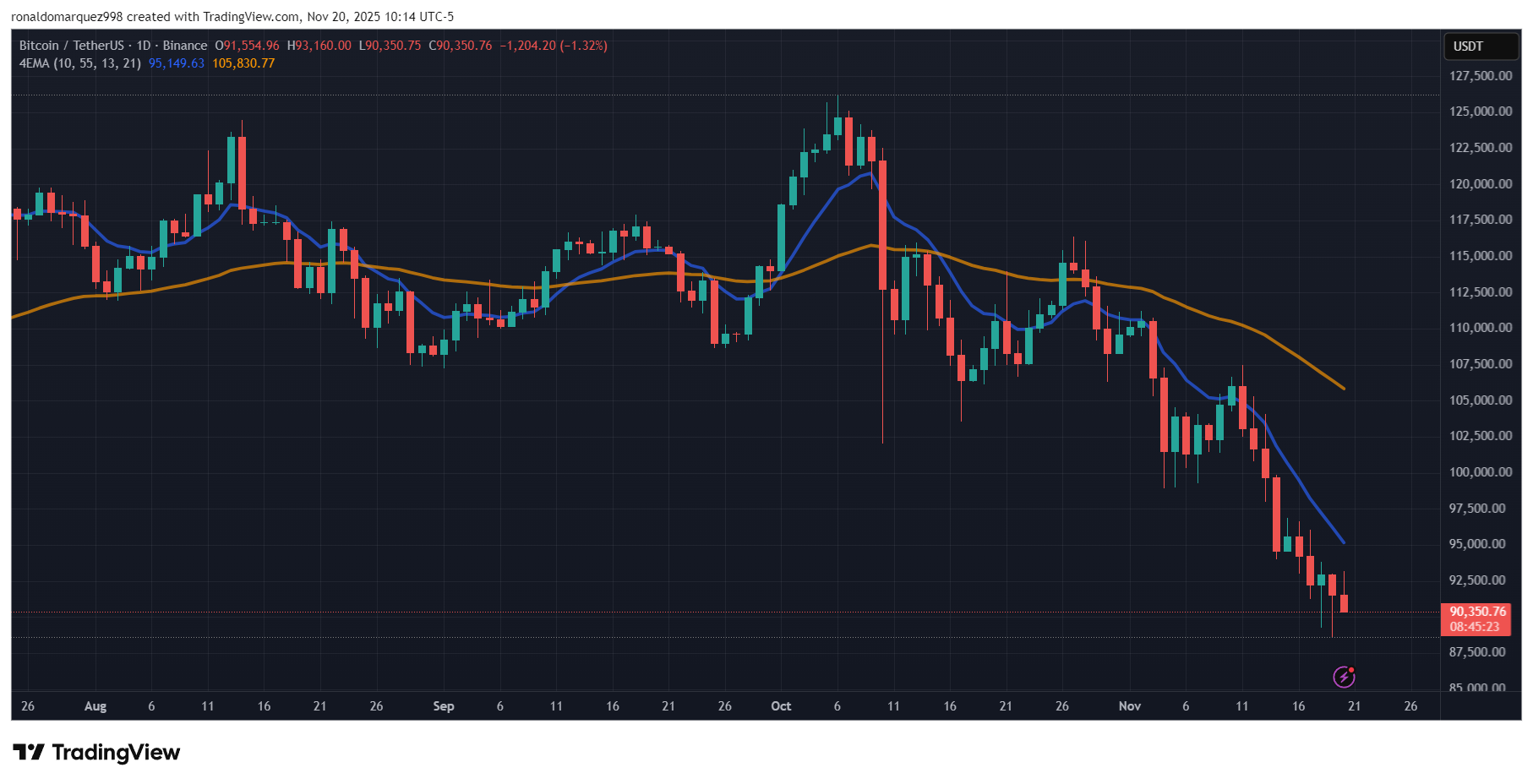

Bitcoin experienced a rebound after hitting an eight-month low of $87,500, reaching nearly $90,000. However, market expert Leshka warns that this increase may mark the start of a new distribution phase due to ongoing selling pressure.

Potential Bottom and Long-Term Outlook

- Leshka identifies demand zones between $40,700 and $47,500 on Bitcoin's weekly chart, which could serve as a bottom during a bear market by 2026.

- This implies potential price drops of 47% to 54% from current levels.

- Despite short-term lows, Leshka remains optimistic about Bitcoin's long-term trajectory, predicting new all-time highs of around $150,000 by 2027.

Market Indicators and Temporary Rally

- Analyst Ali Martinez notes a sell signal for Bitcoin via the TD Sequential indicator, historically a predictor of 78% and 32% drops.

- This aligns with Leshka’s forecast of a possible price target around $40,000.

- Crypto Feras highlights Bitcoin's breach of its 50-day moving average (MA50) above $102,000, suggesting a temporary rally.

- Exponential moving averages (EMA89-99) could provide support at $88,500, leading to a brief “bearish retest” of MA50.

- Support is noted at $84,000, potentially signaling a final bear trap before a prolonged downturn.

- Bitcoin will remain bearish until it surpasses its weekly MA50, indicating a shift back into a bull market.

The current phase remains bearish until Bitcoin reclaims critical moving averages signifying a potential bull trend.